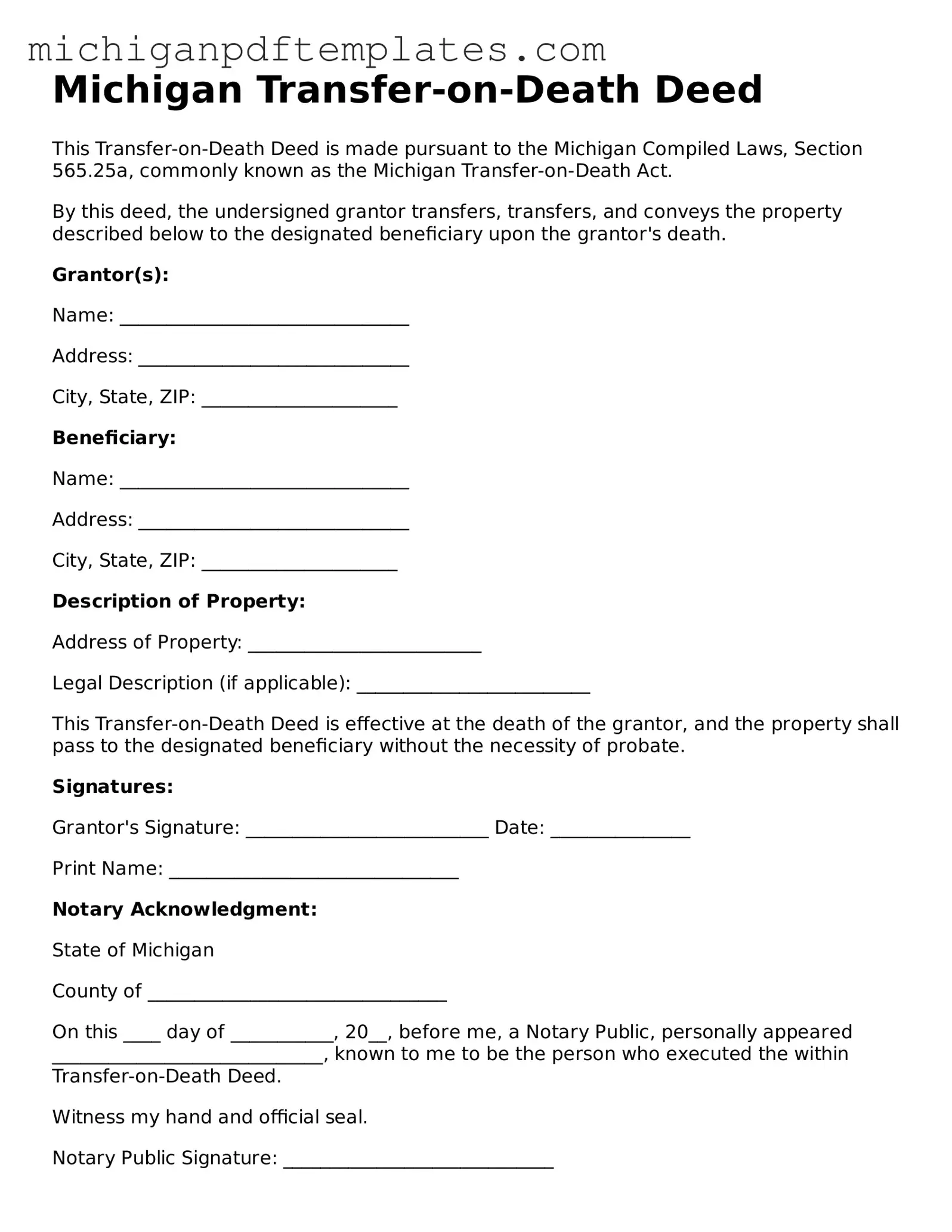

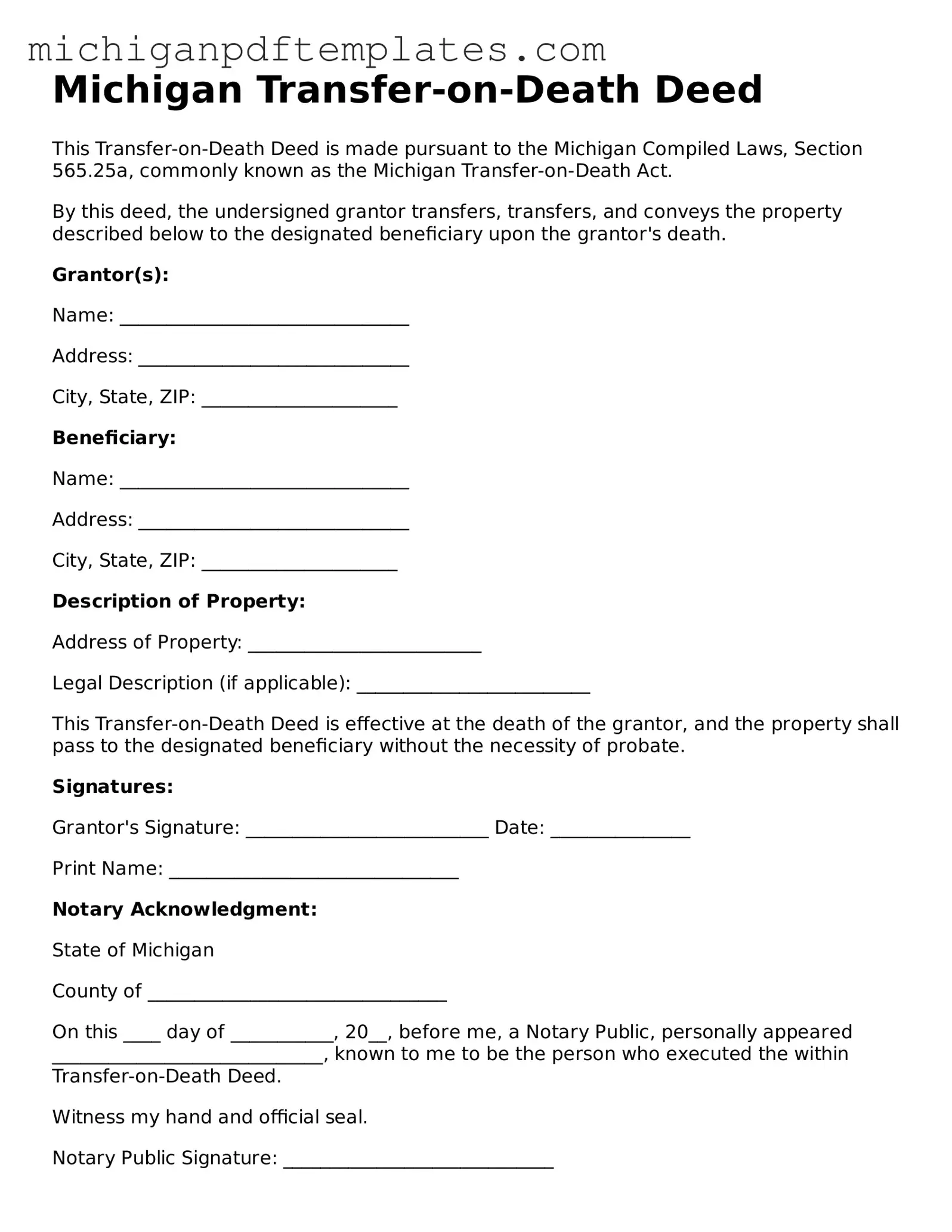

Legal Michigan Transfer-on-Death Deed Template

The Michigan Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This simple yet effective tool can help ensure that your property is transferred smoothly to your loved ones. To learn more and get started, fill out the form by clicking the button below.

Get Your Form Now

Legal Michigan Transfer-on-Death Deed Template

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Transfer-on-Death Deed online quickly.