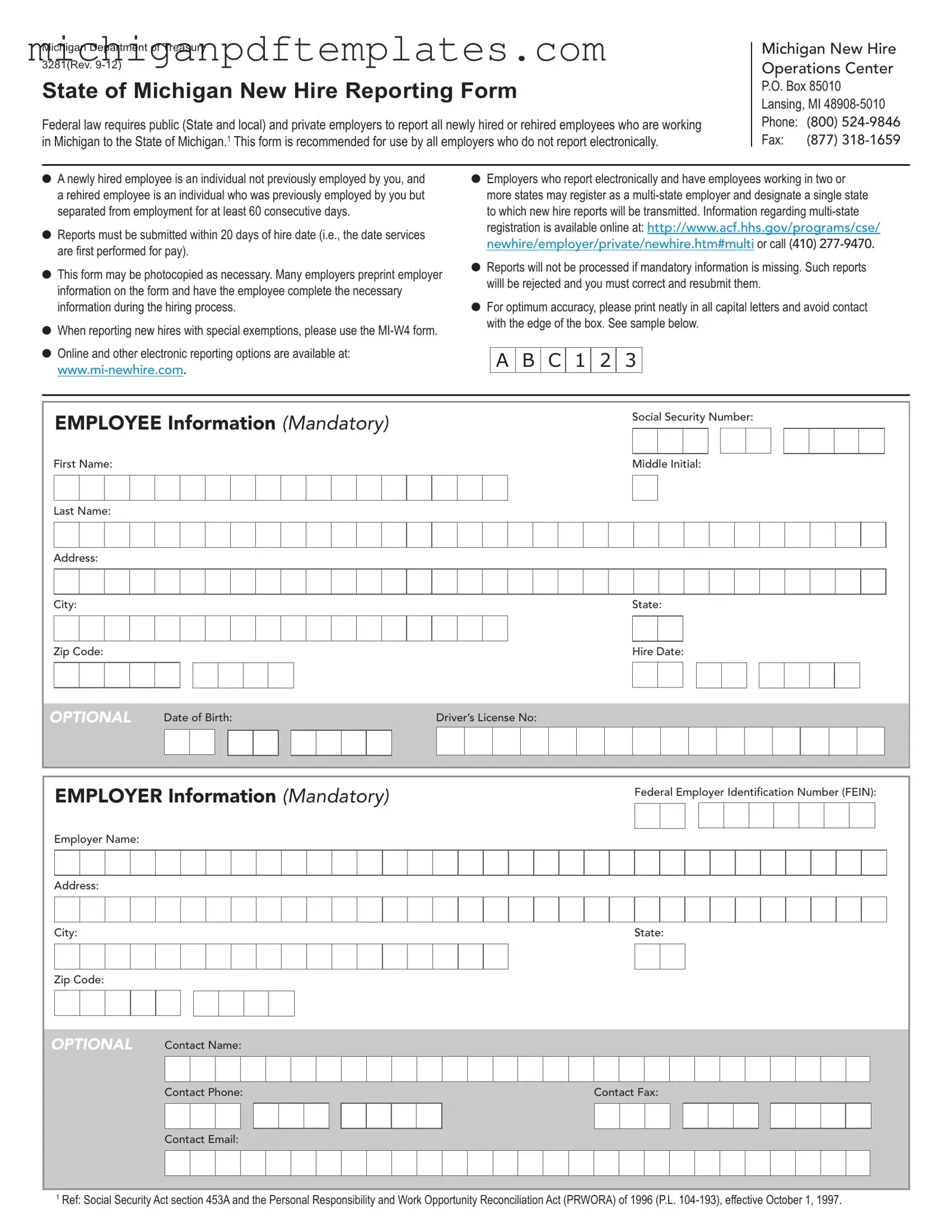

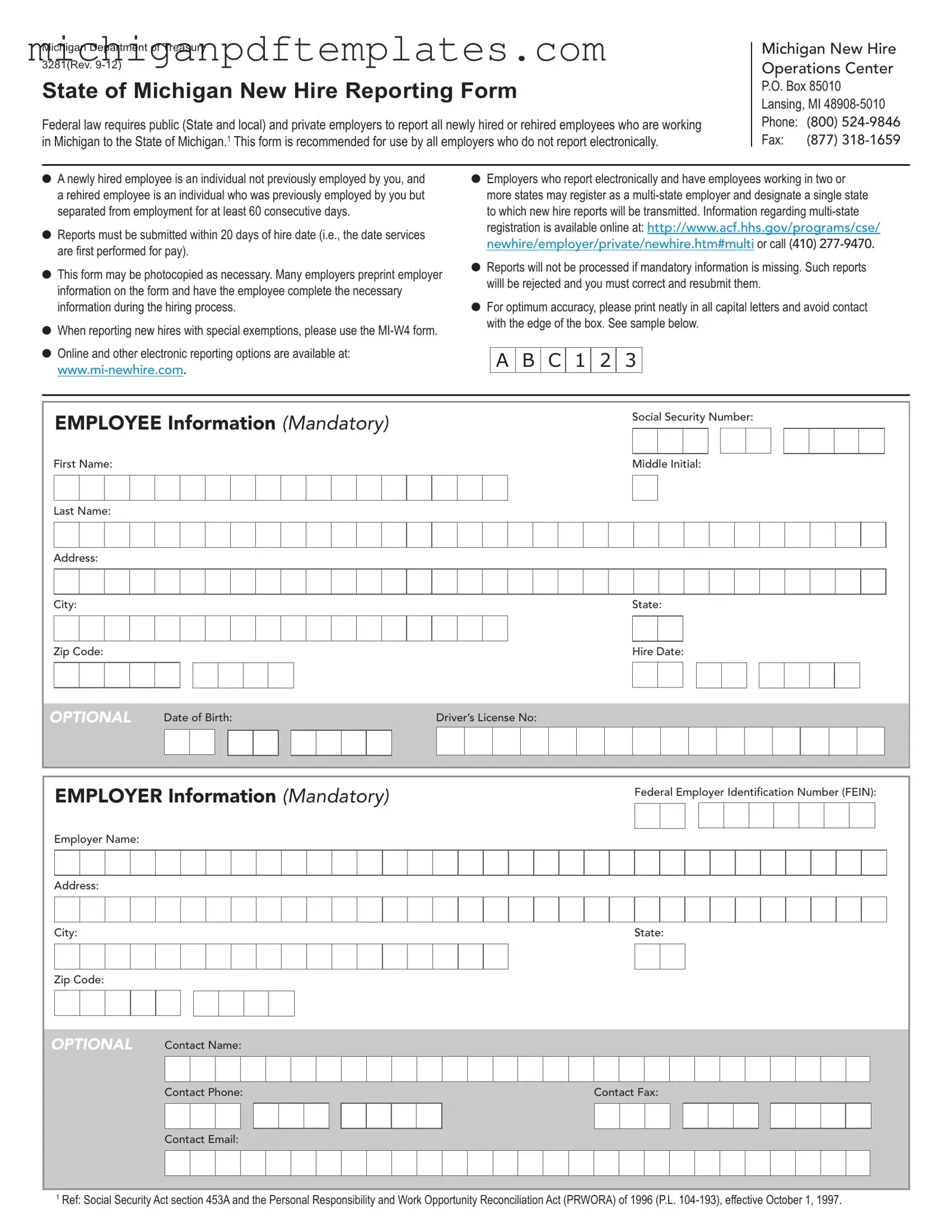

Fill in Your State Of Michigan New Hire Reporting Form

The State of Michigan New Hire Reporting Form is a document that employers must complete to report all newly hired or rehired employees working in Michigan. This requirement is mandated by federal law, which aims to ensure accurate tracking of employment for various administrative purposes. Employers who do not report electronically are encouraged to use this form to comply with reporting obligations.

To fill out the form, please click the button below.

Get Your Form Now

Fill in Your State Of Michigan New Hire Reporting Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete State Of Michigan New Hire Reporting online quickly.