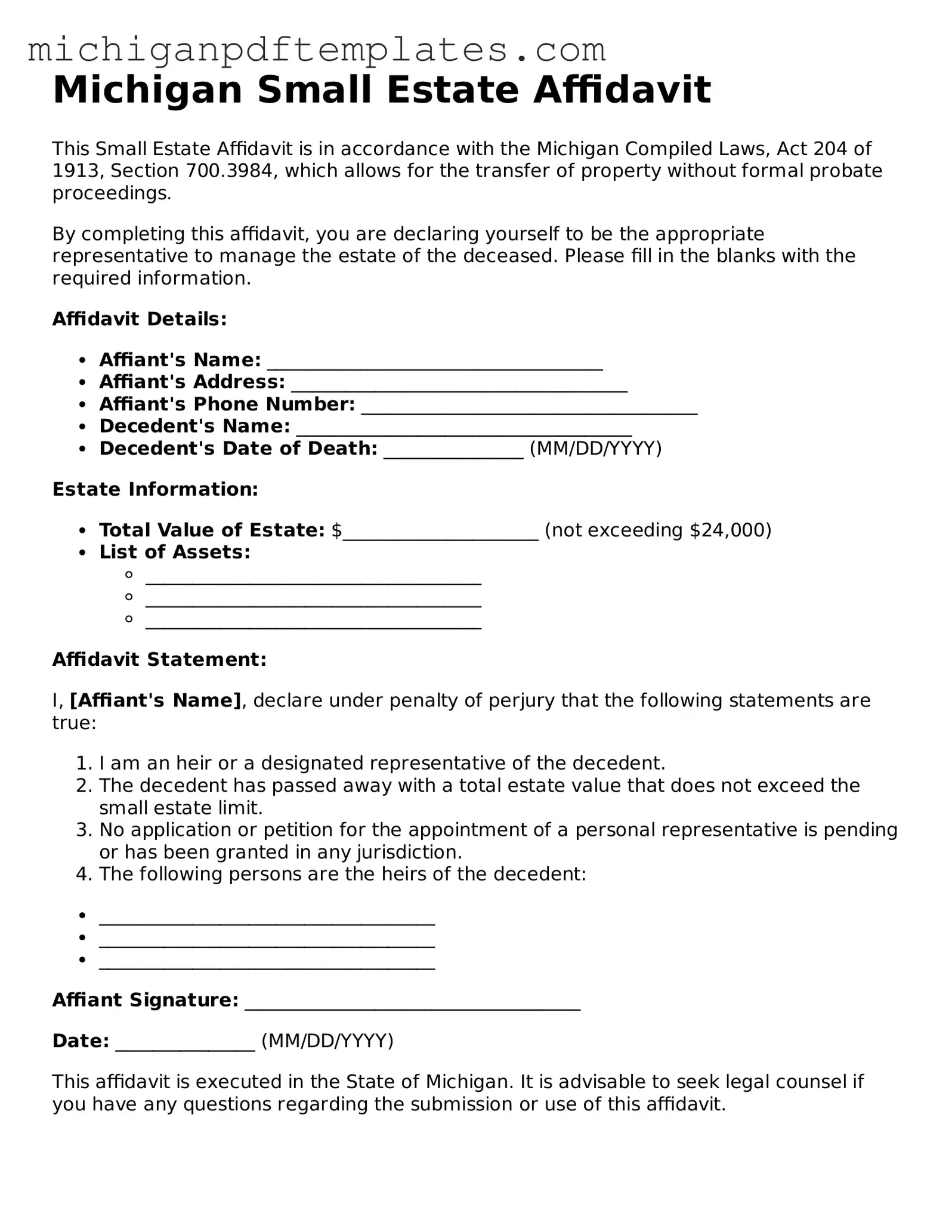

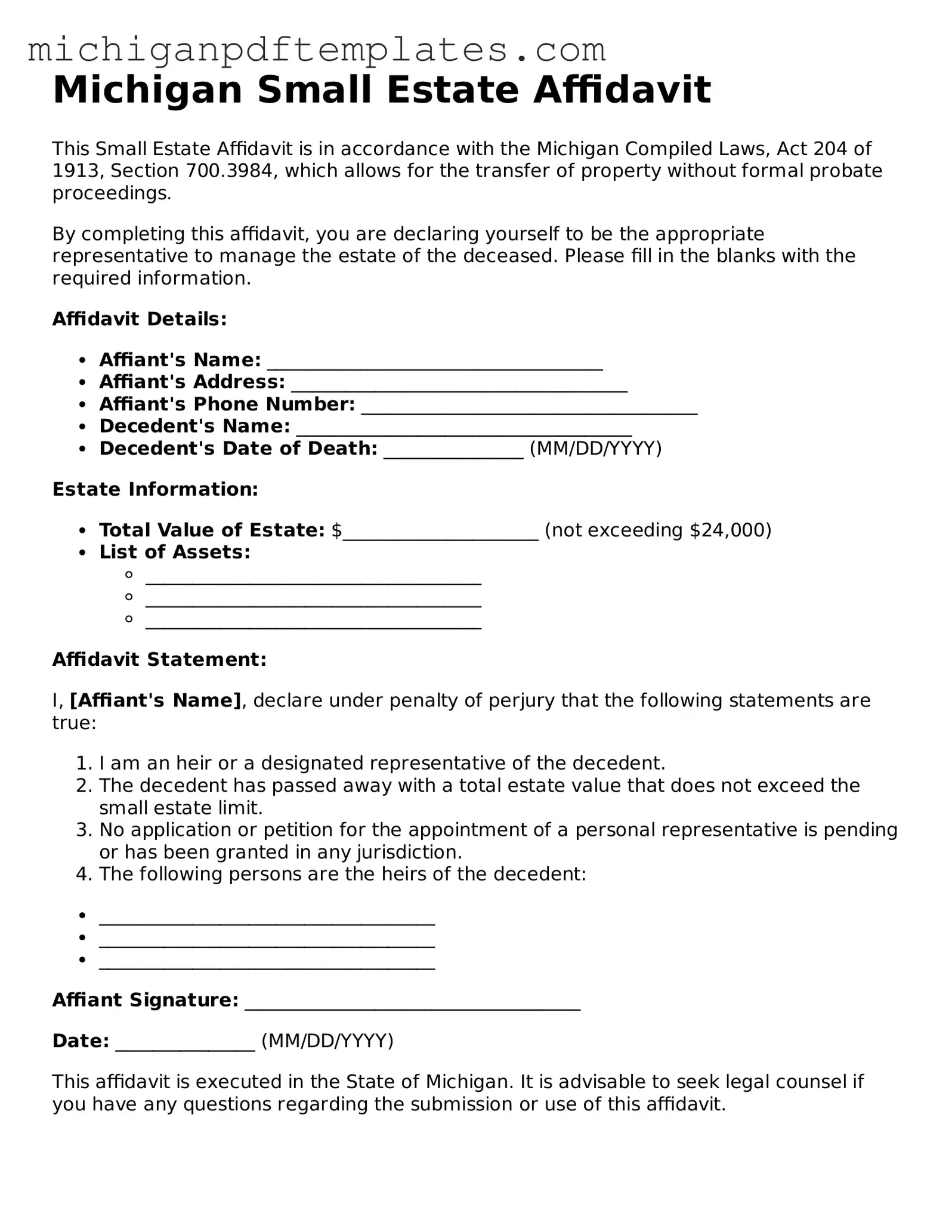

Legal Michigan Small Estate Affidavit Template

The Michigan Small Estate Affidavit is a legal document that simplifies the process of transferring assets from a deceased person's estate when the total value is below a certain threshold. This form allows heirs to claim property without going through the lengthy probate process, making it an efficient option for settling small estates. If you’re ready to take the next step in managing a loved one's estate, fill out the form by clicking the button below.

Get Your Form Now

Legal Michigan Small Estate Affidavit Template

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Small Estate Affidavit online quickly.