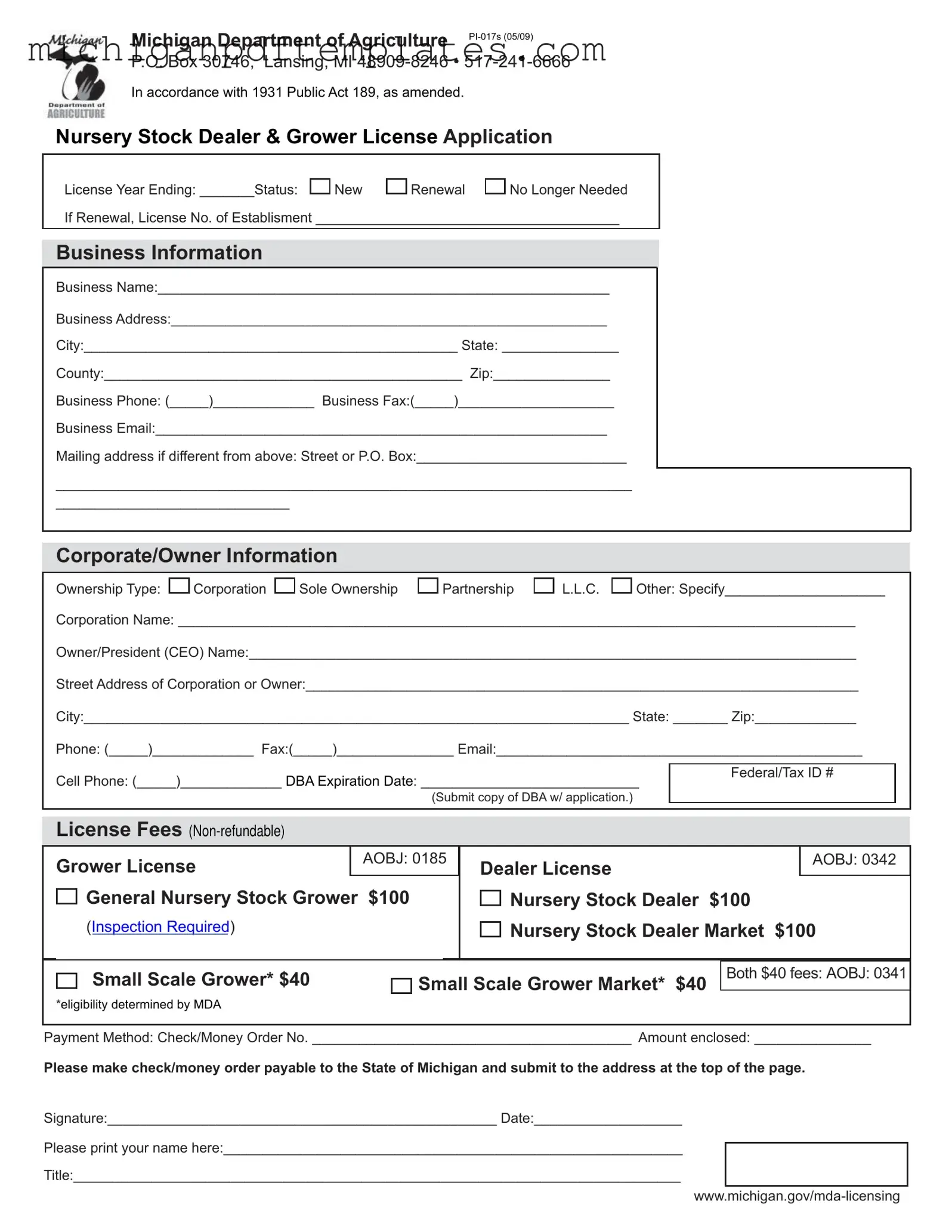

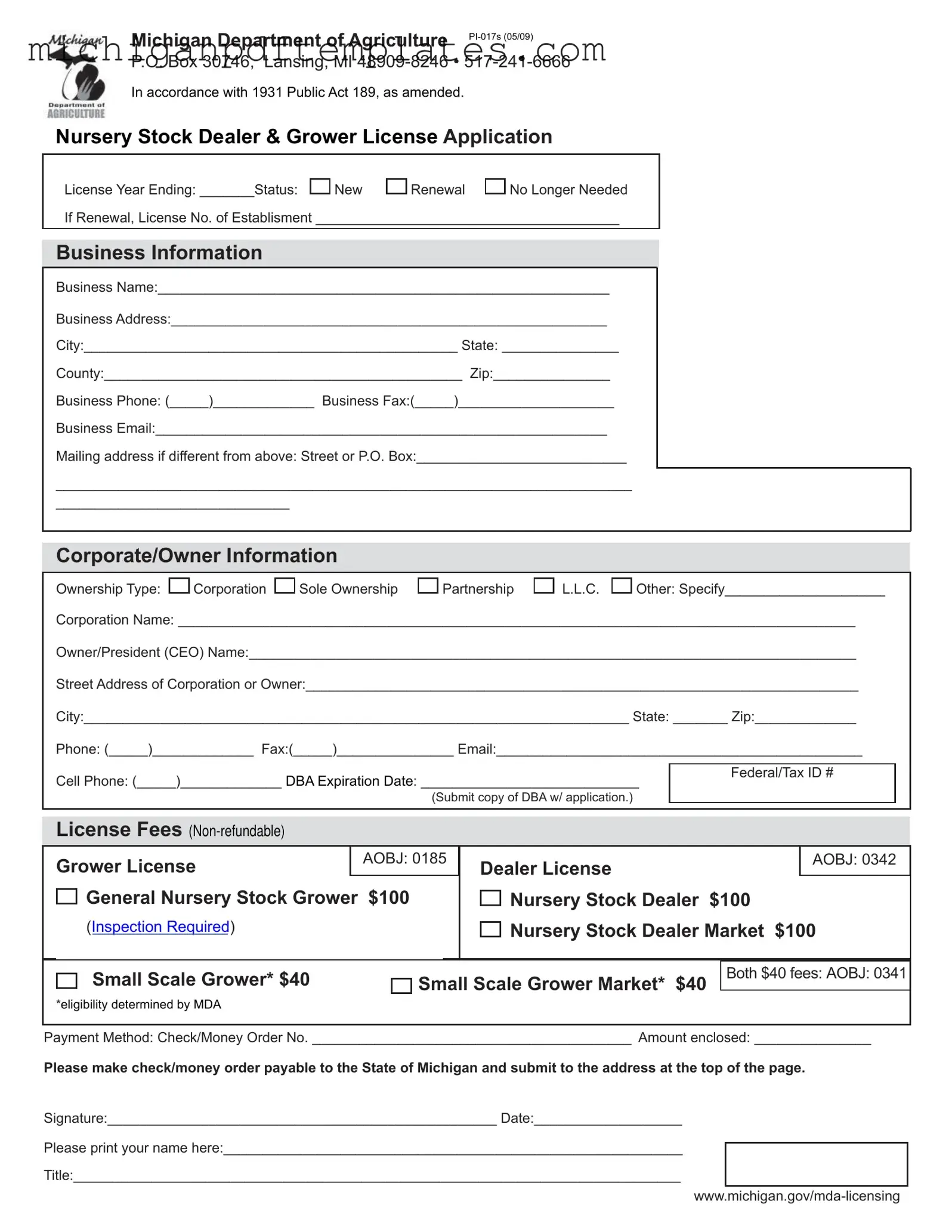

Fill in Your Pi 017S Michigan Form

The Pi 017S Michigan form is an application for the Nursery Stock Dealer and Grower License, regulated by the Michigan Department of Agriculture. This form is essential for businesses engaged in the sale or cultivation of nursery stock, ensuring compliance with state regulations. To begin the licensing process, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Pi 017S Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Pi 017S Michigan online quickly.