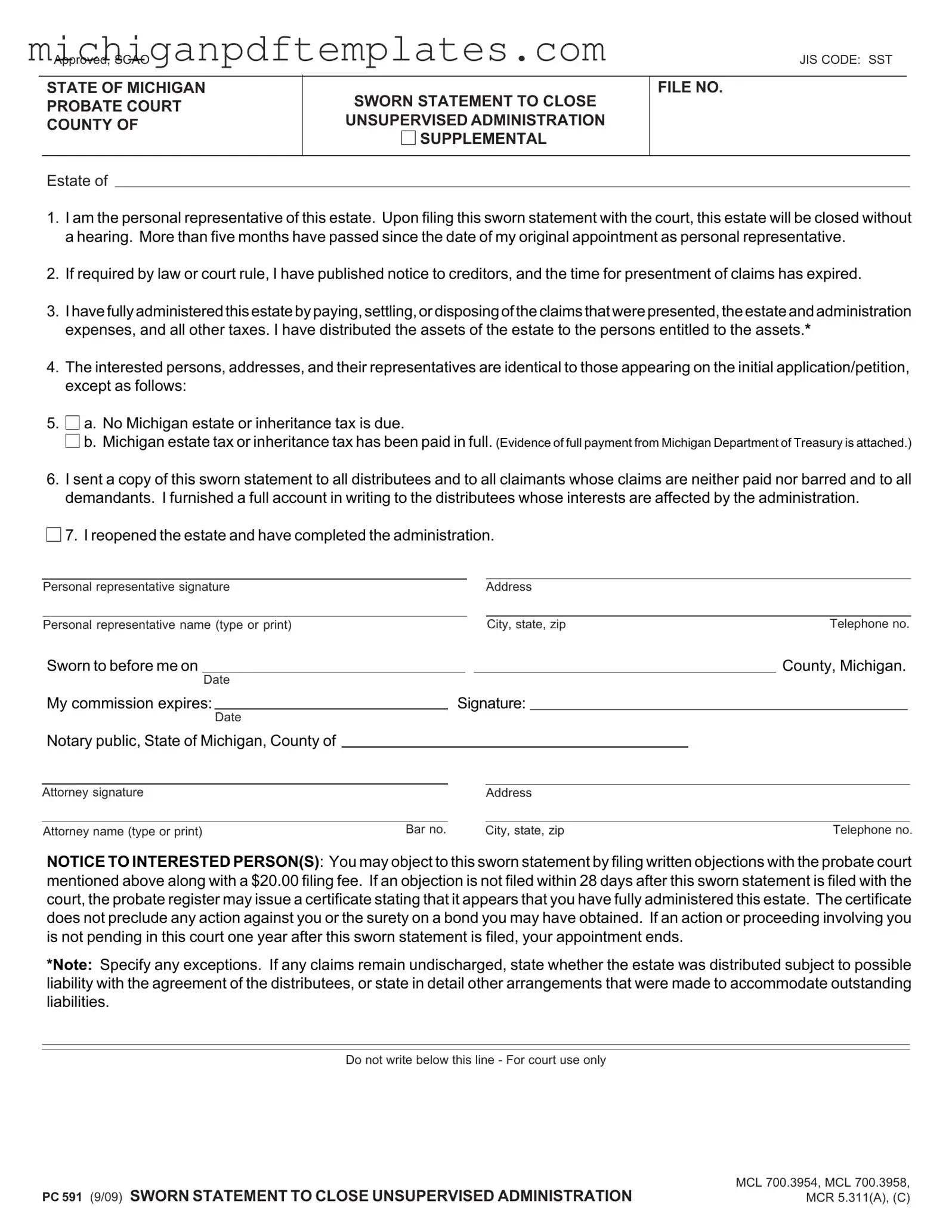

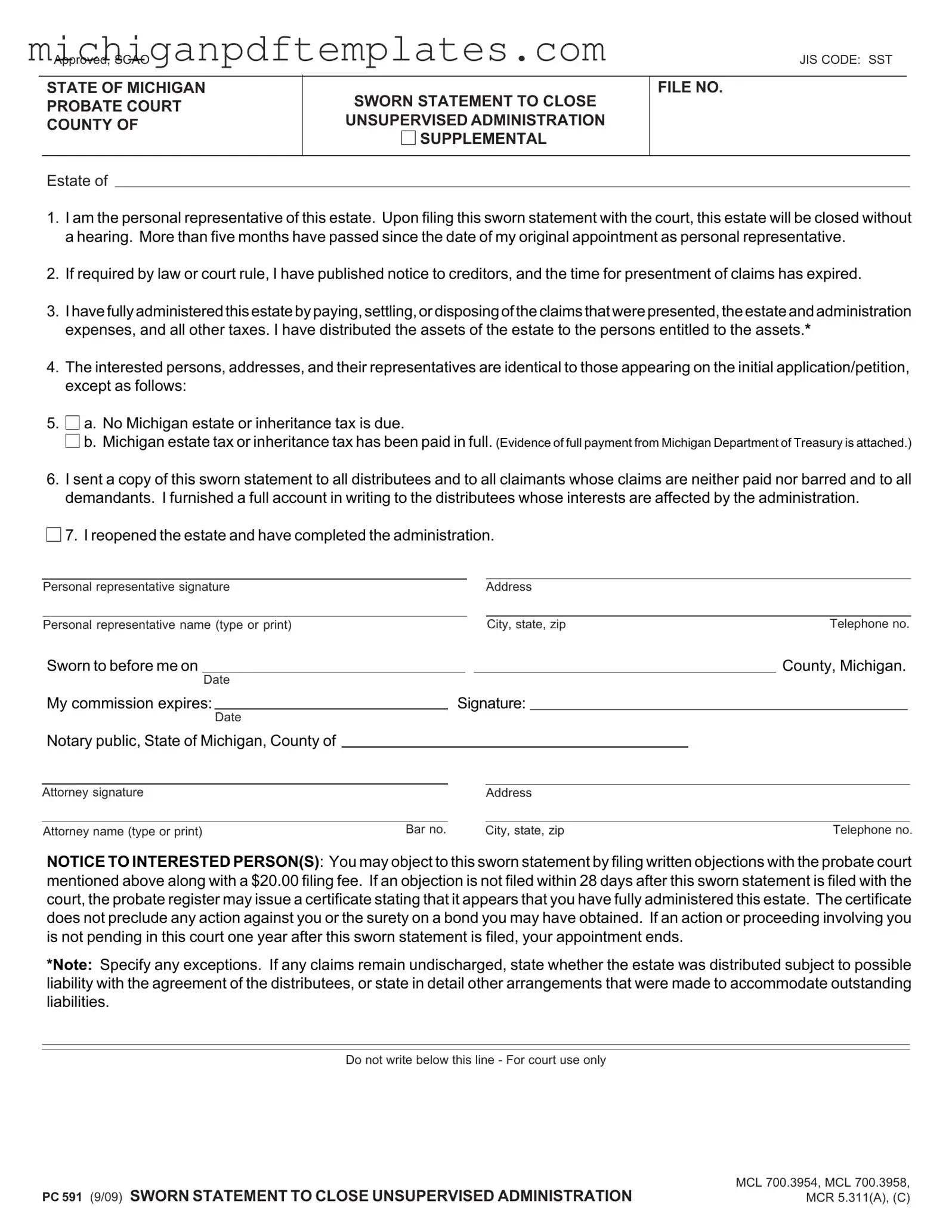

Fill in Your Pc 591 Michigan Form

The PC 591 Michigan form is a sworn statement used to close an unsupervised estate administration without a court hearing. This form confirms that the personal representative has fully administered the estate, settled claims, and distributed assets to the rightful beneficiaries. If you need to complete this process, please fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Pc 591 Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Pc 591 Michigan online quickly.