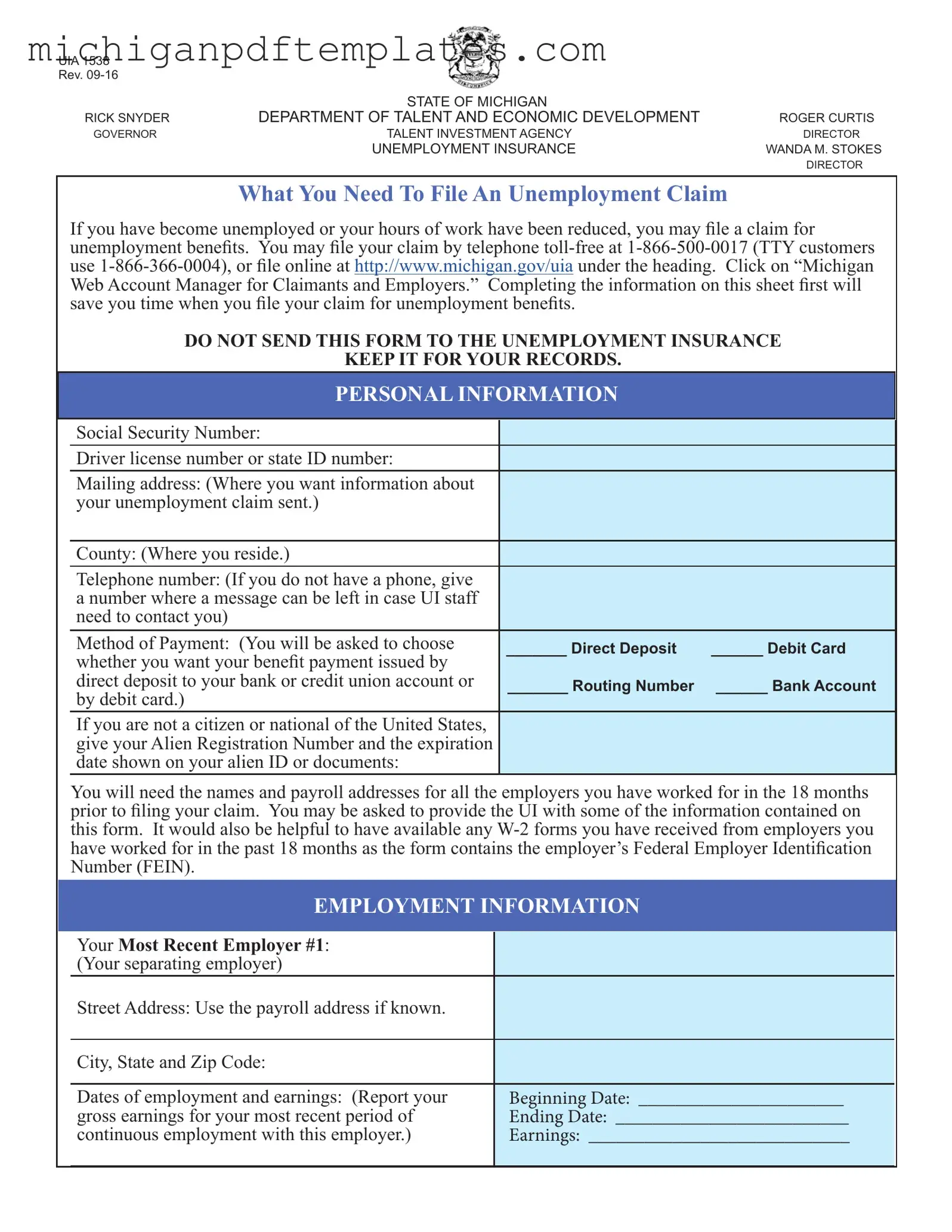

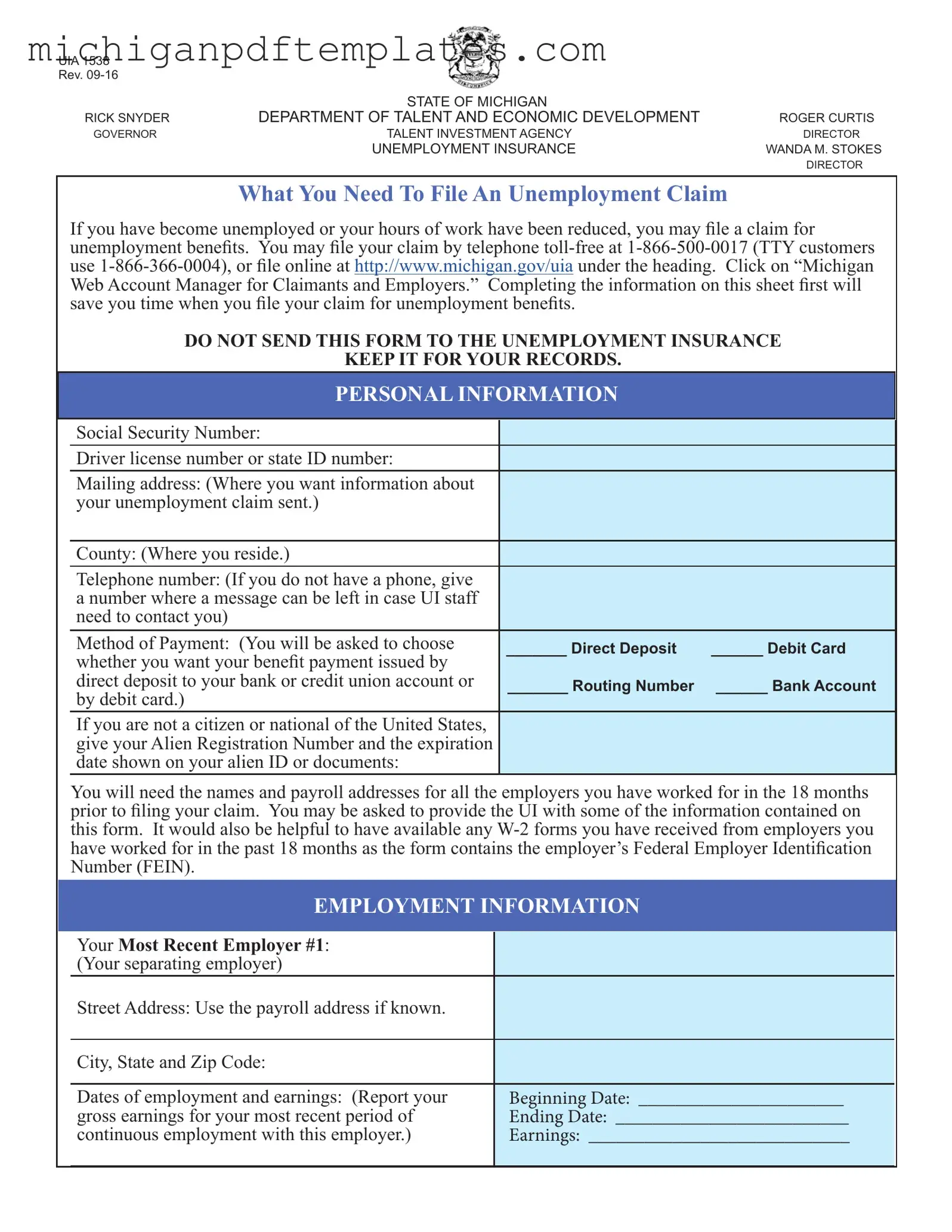

Fill in Your Michigan Uia 1538 Form

The Michigan UIA 1538 form is a crucial document for individuals seeking unemployment benefits in Michigan. It helps gather essential information about your employment history and personal details necessary for filing a claim. Completing this form accurately can streamline the process and ensure you receive the benefits you deserve.

Ready to get started? Fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Uia 1538 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Uia 1538 online quickly.