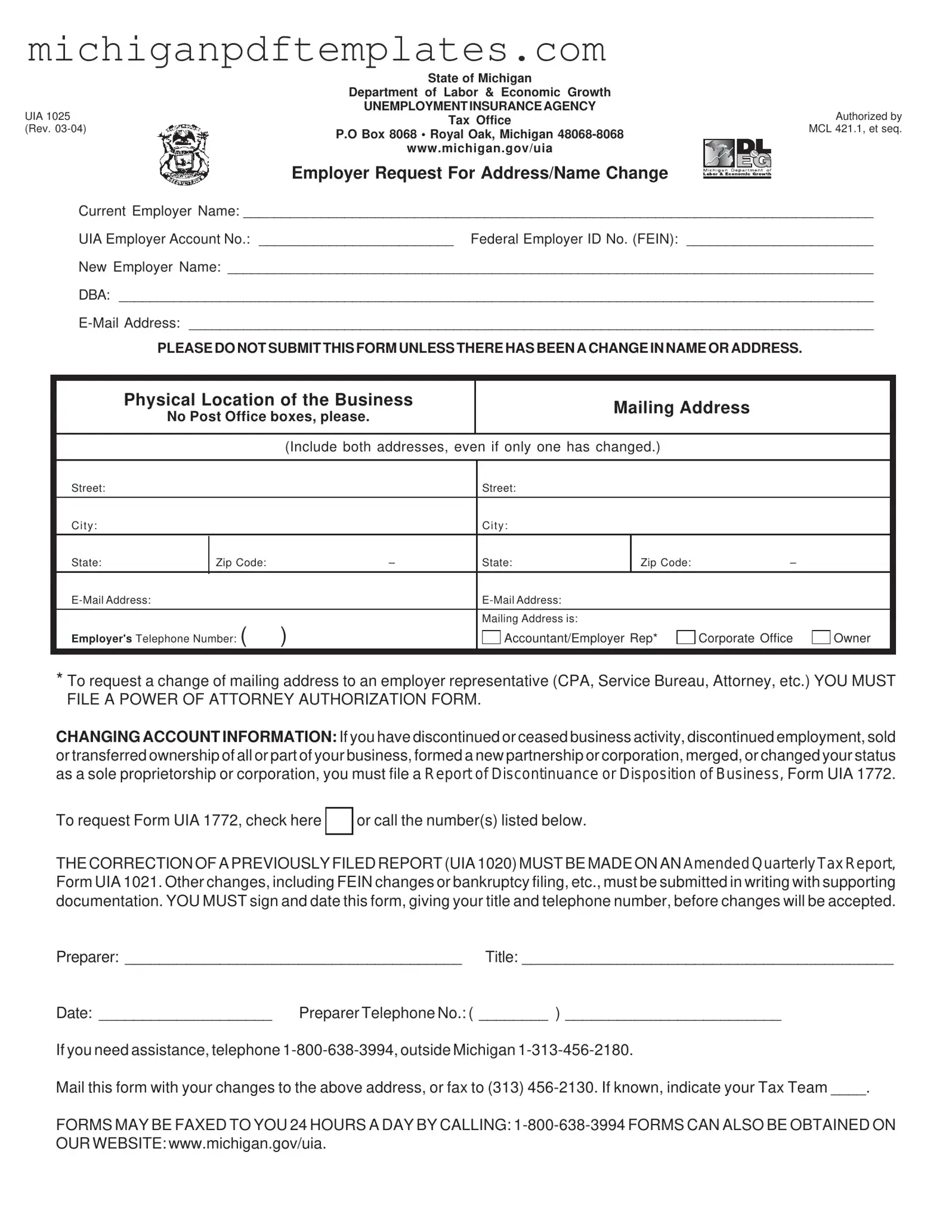

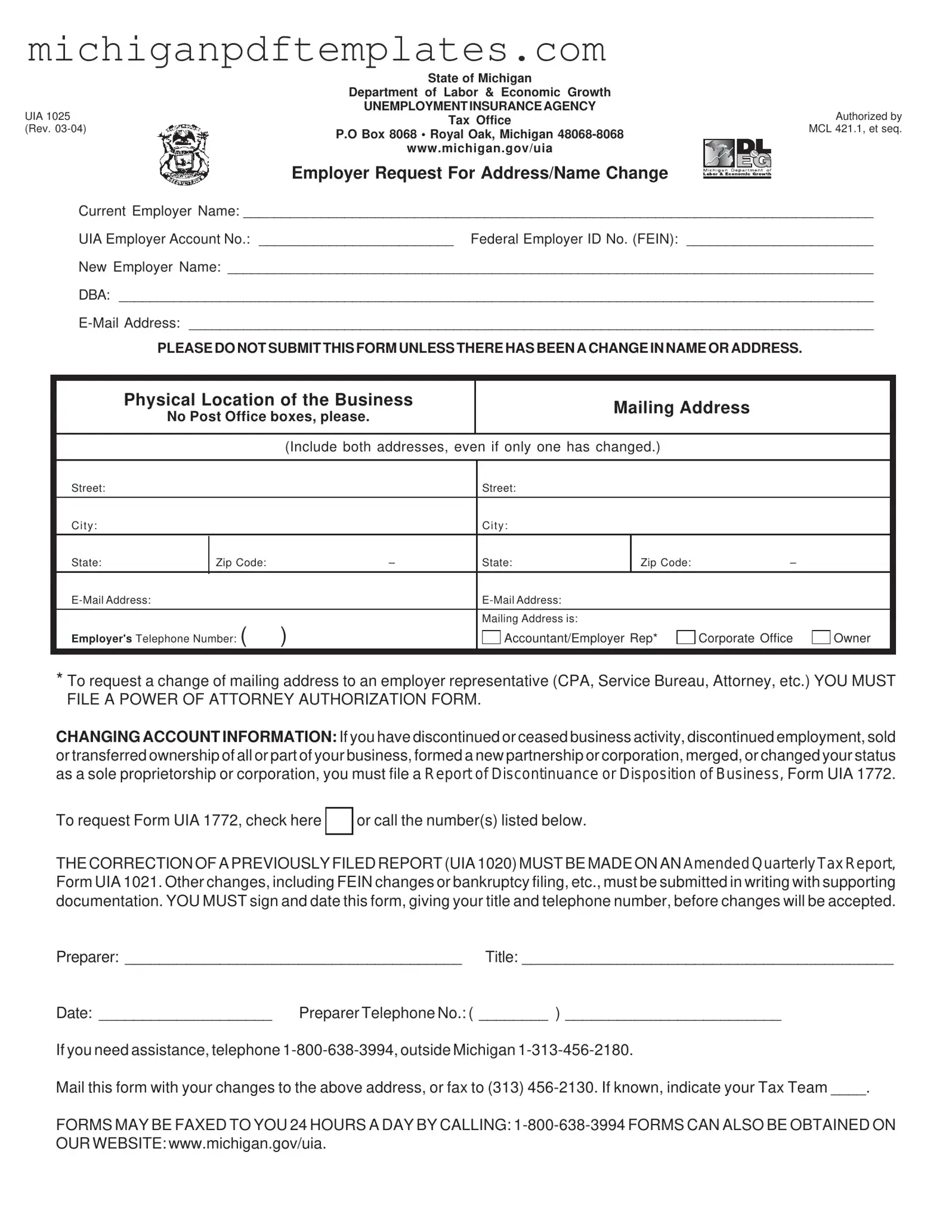

Fill in Your Michigan Uia 1025 Form

The Michigan UIA 1025 form is an essential document used by employers to officially request changes to their business name or address with the Unemployment Insurance Agency. This form ensures that the agency has accurate and up-to-date information, which is crucial for maintaining compliance with state regulations. If you need to make changes, consider filling out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Uia 1025 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Uia 1025 online quickly.