Fill in Your Michigan Uia 1015 C Form

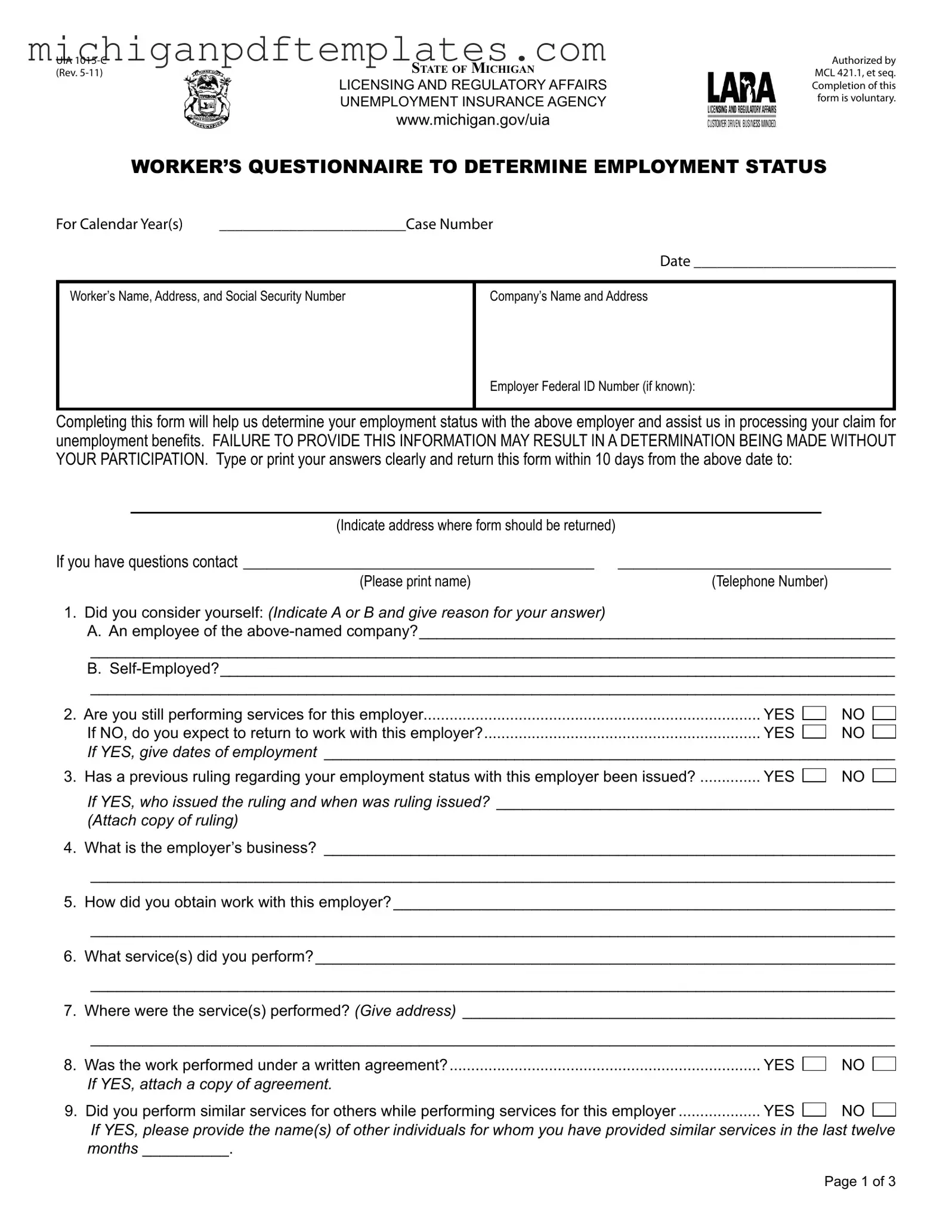

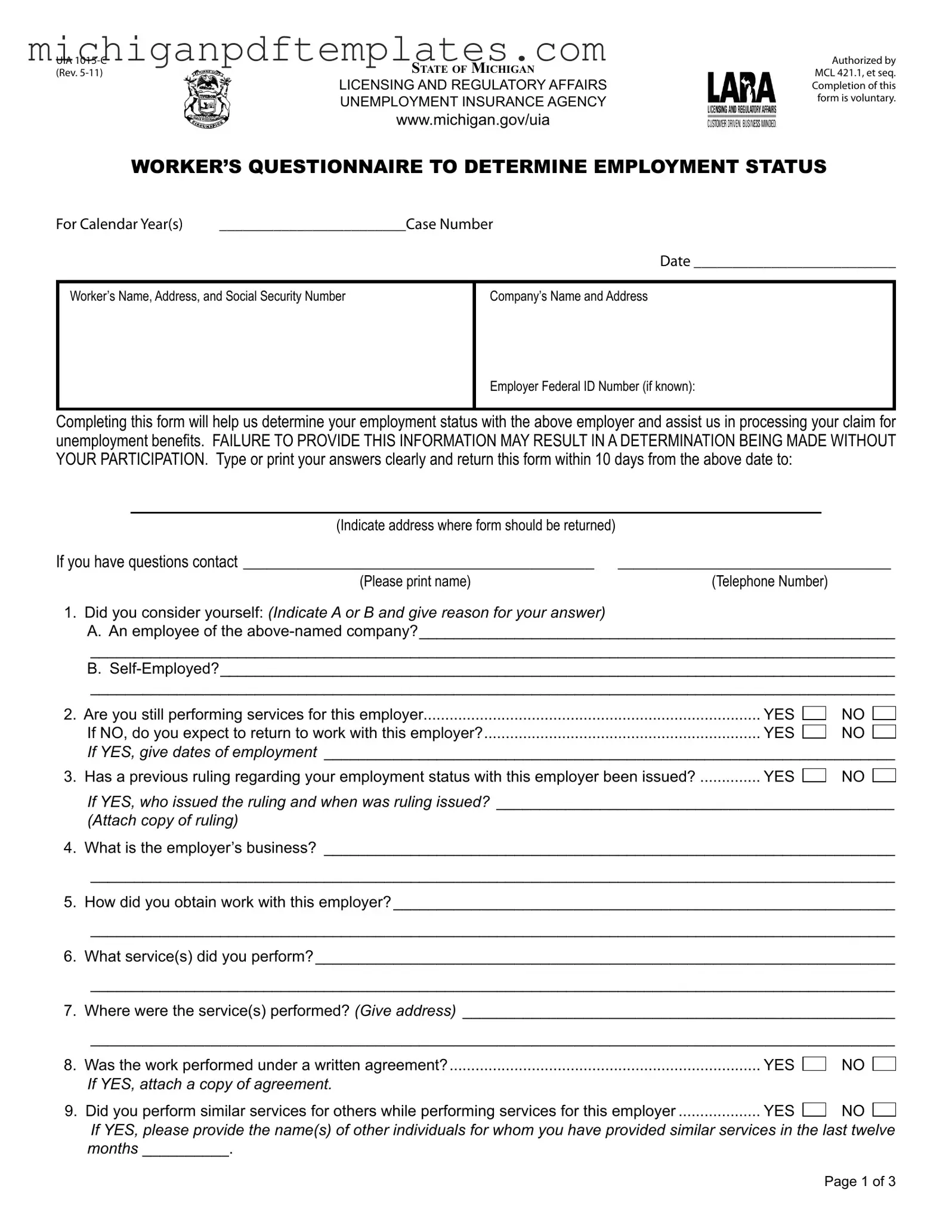

The Michigan UIA 1015 C form is a Worker’s Questionnaire designed to determine an individual’s employment status for the purpose of processing unemployment claims. Completing this form is voluntary, yet it plays a crucial role in ensuring accurate determinations regarding eligibility for benefits. To facilitate your claim, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Uia 1015 C Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Uia 1015 C online quickly.