Fill in Your Michigan Tr 205 Form

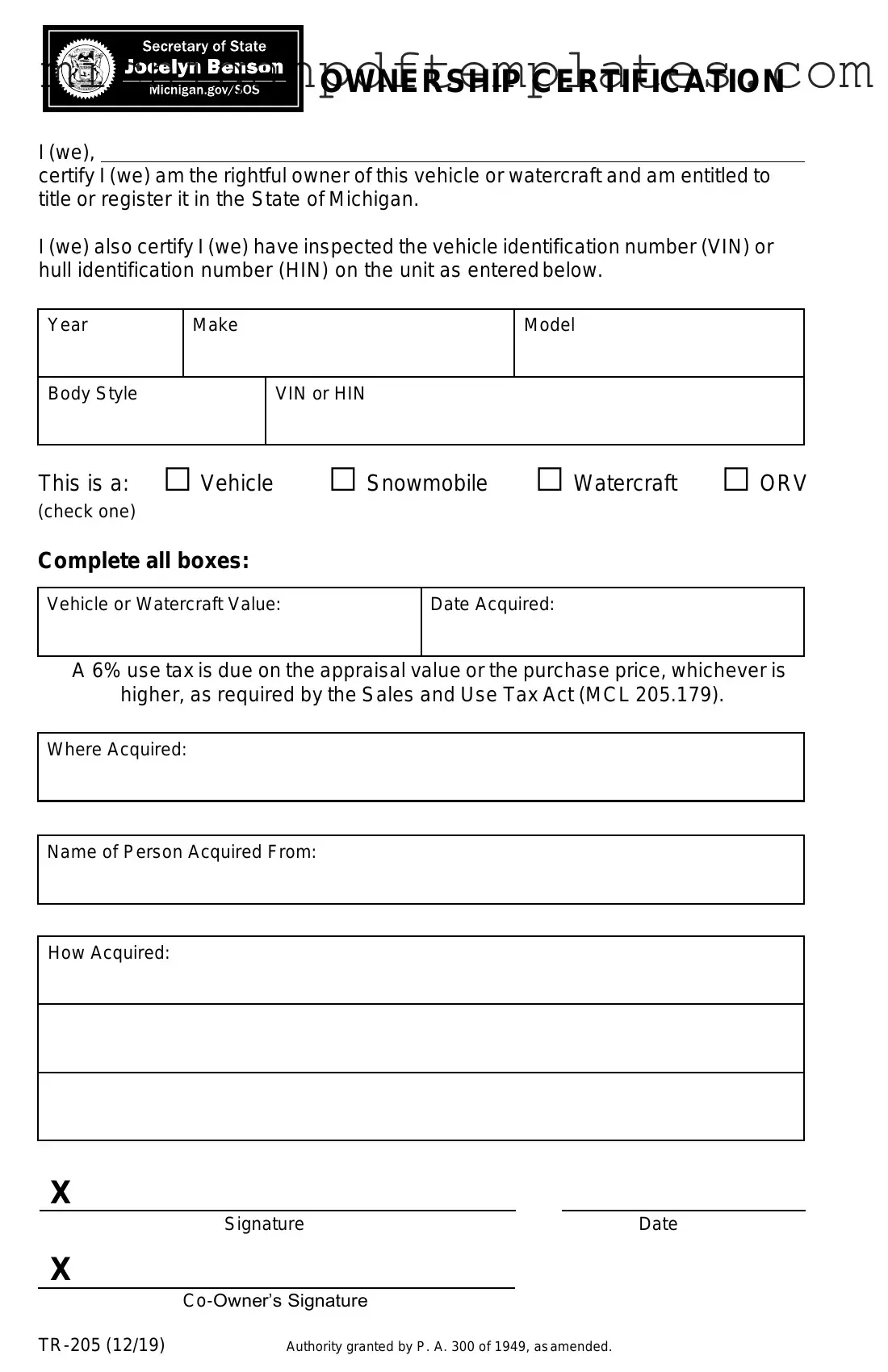

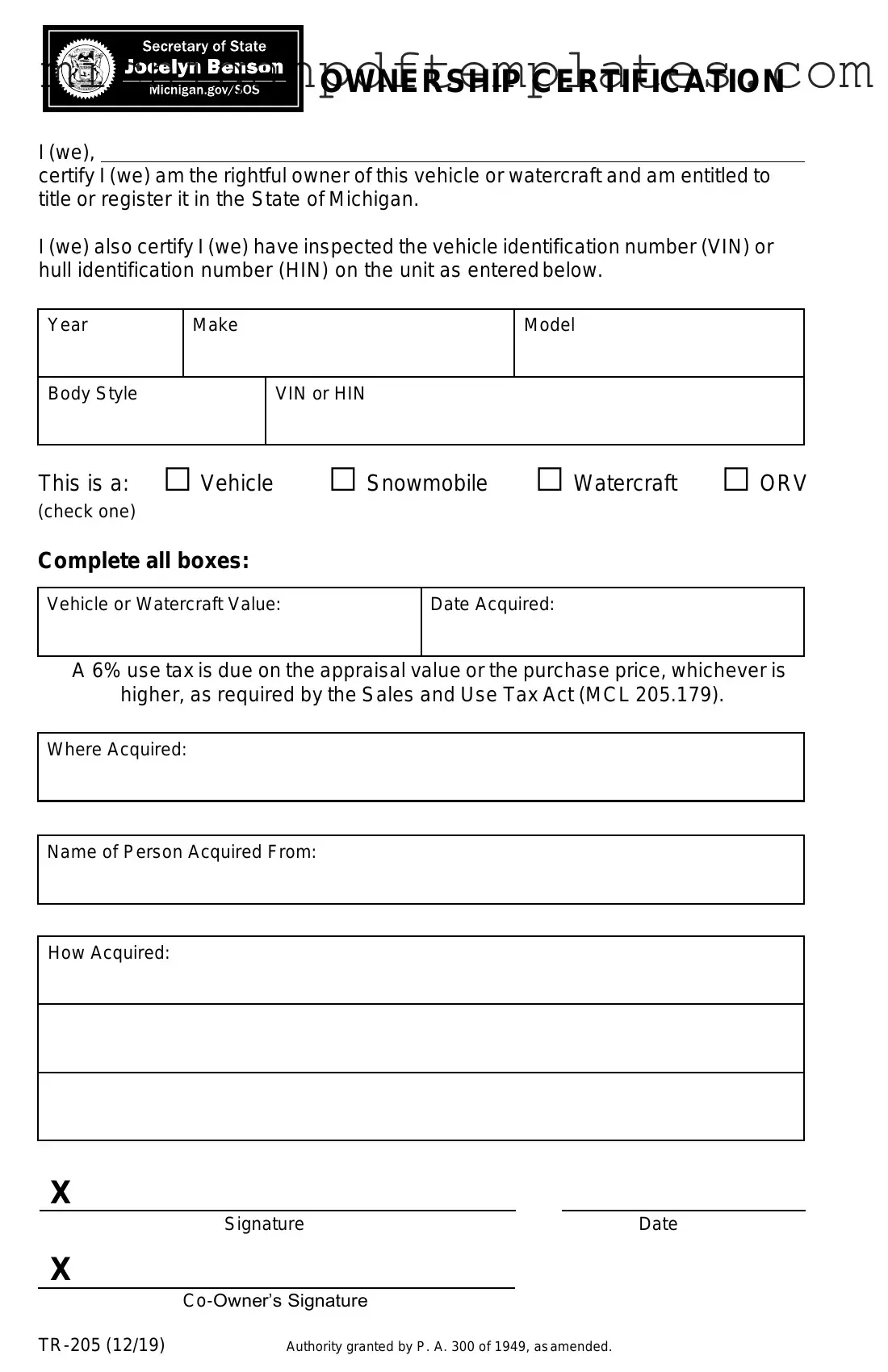

The Michigan TR-205 form is an Ownership Certification that allows individuals to certify their rightful ownership of a vehicle or watercraft when the title has been lost, destroyed, or stolen. This form is essential for those who have exhausted all options to contact the previous owner for a duplicate title. If you need to fill out the TR-205 form, click the button below to get started.

Get Your Form Now

Fill in Your Michigan Tr 205 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Tr 205 online quickly.