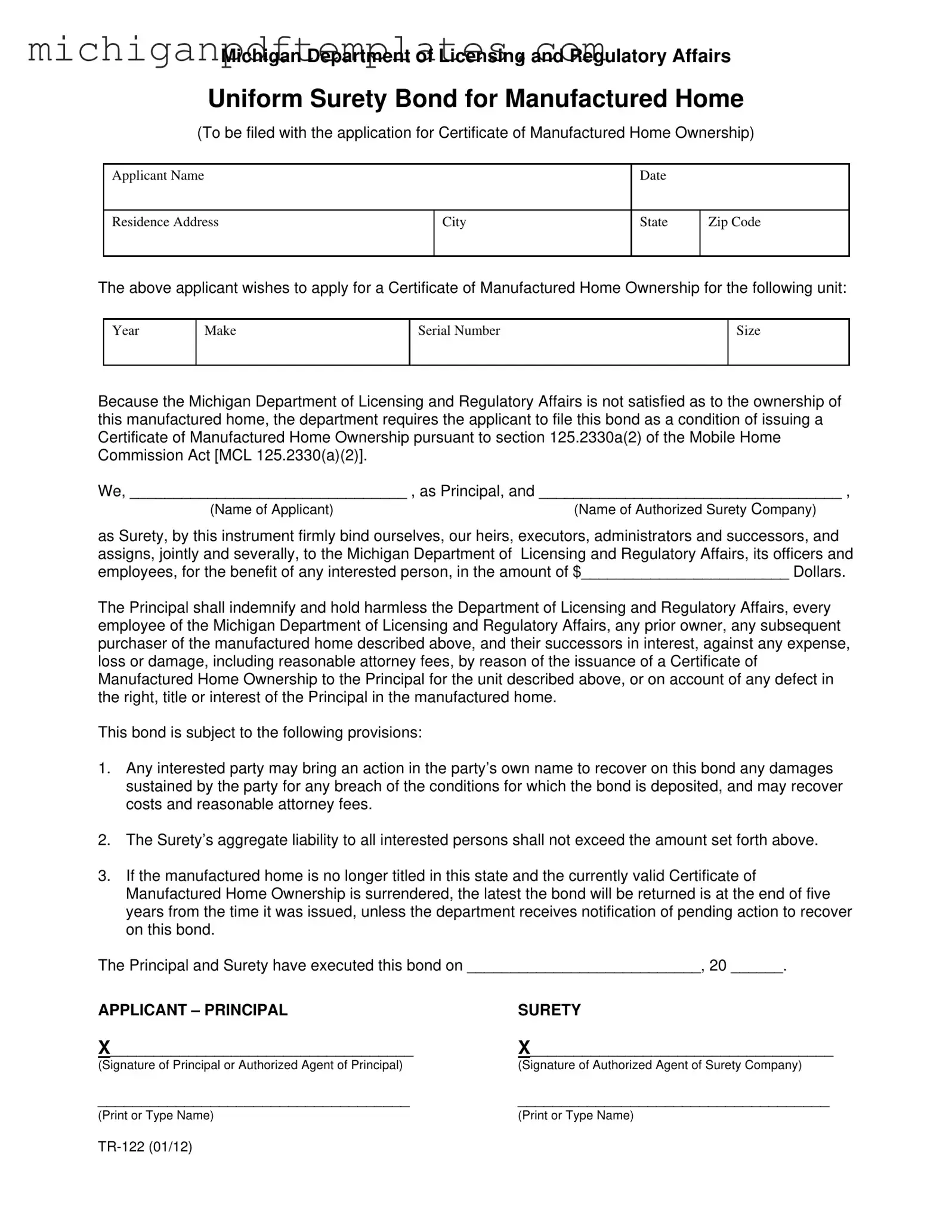

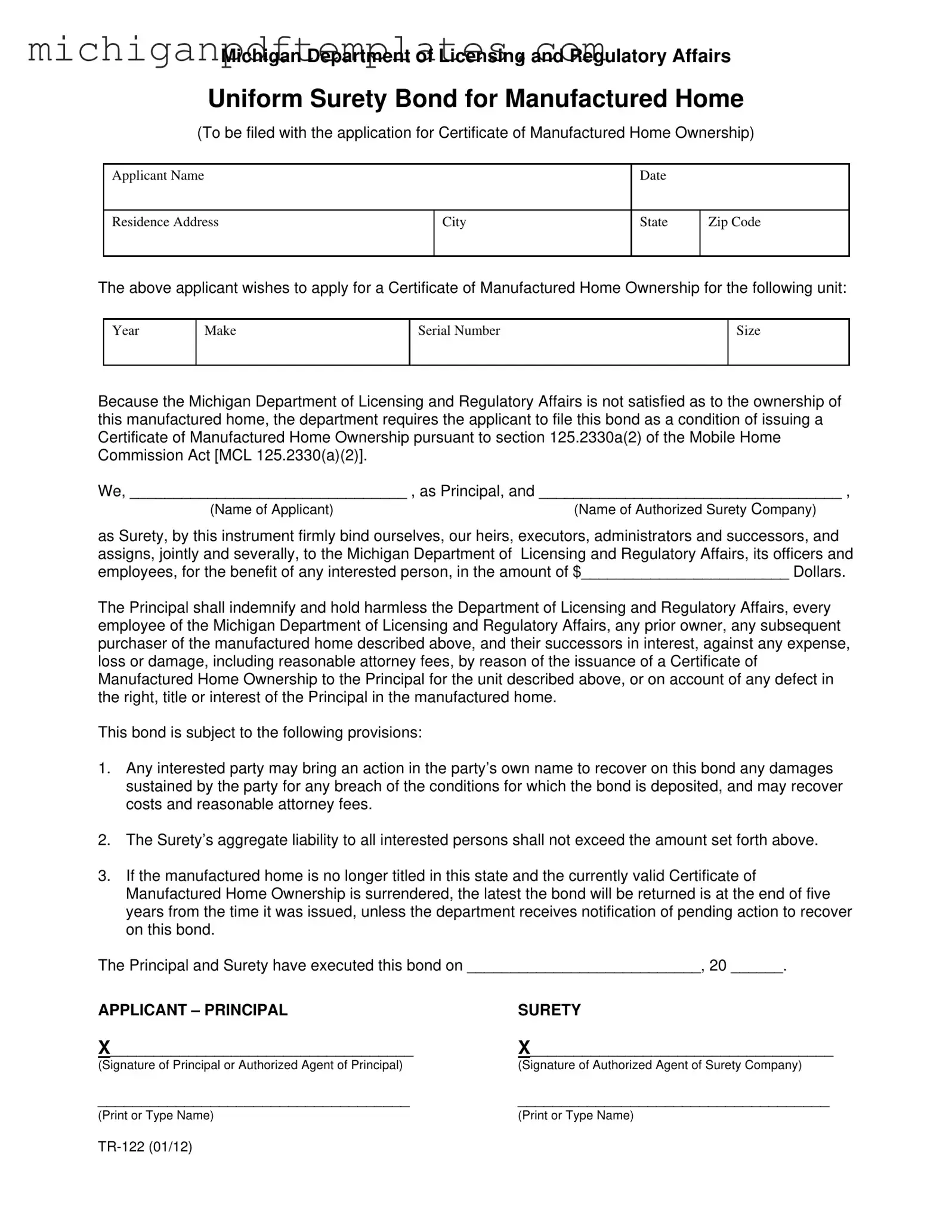

Fill in Your Michigan Tr 122 Form

The Michigan Tr 122 form is a Uniform Surety Bond required for individuals seeking a Certificate of Manufactured Home Ownership. This form ensures that the Michigan Department of Licensing and Regulatory Affairs has a financial guarantee regarding the ownership of the manufactured home. To get started, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Tr 122 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Tr 122 online quickly.