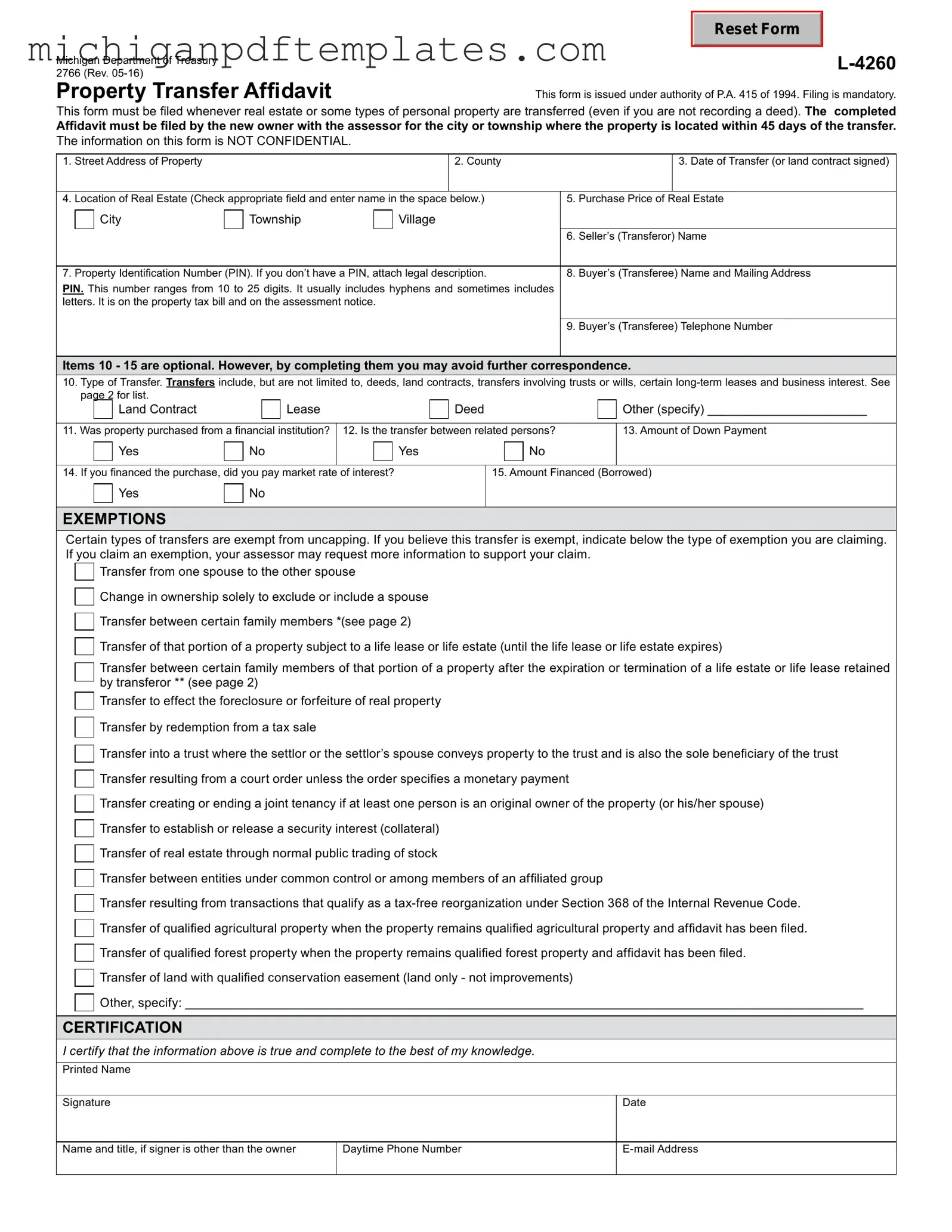

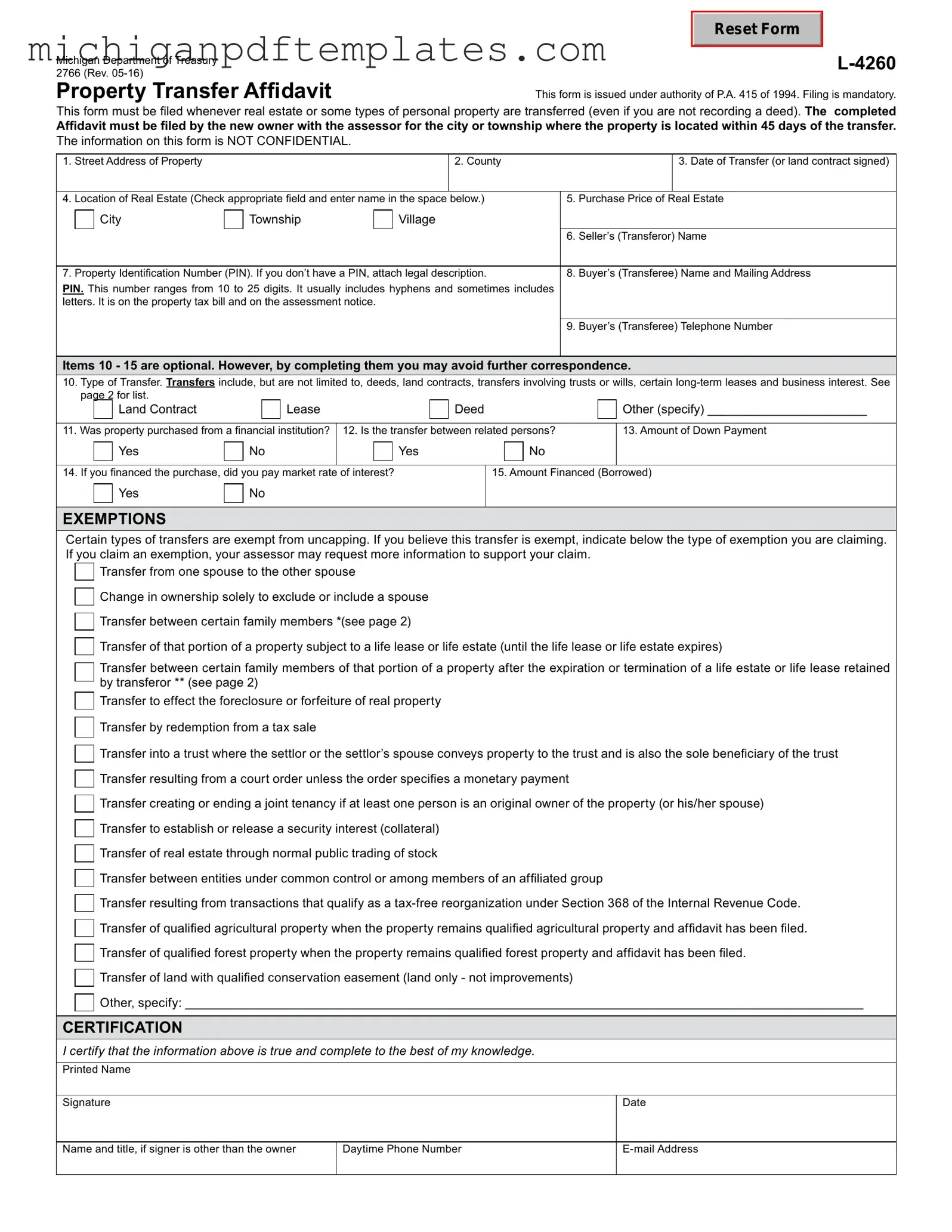

Fill in Your Michigan Property Transfer Affidavit 2766 Form

The Michigan Property Transfer Affidavit 2766 form is a crucial document used during the transfer of property ownership in Michigan. This form helps ensure that the state has accurate information regarding property transactions, which is essential for tax assessment purposes. Understanding how to properly complete and submit this affidavit is vital for both buyers and sellers involved in real estate transactions.

Ready to fill out the form? Click the button below to get started!

Get Your Form Now

Fill in Your Michigan Property Transfer Affidavit 2766 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Property Transfer Affidavit 2766 online quickly.