Fill in Your Michigan Probate Form

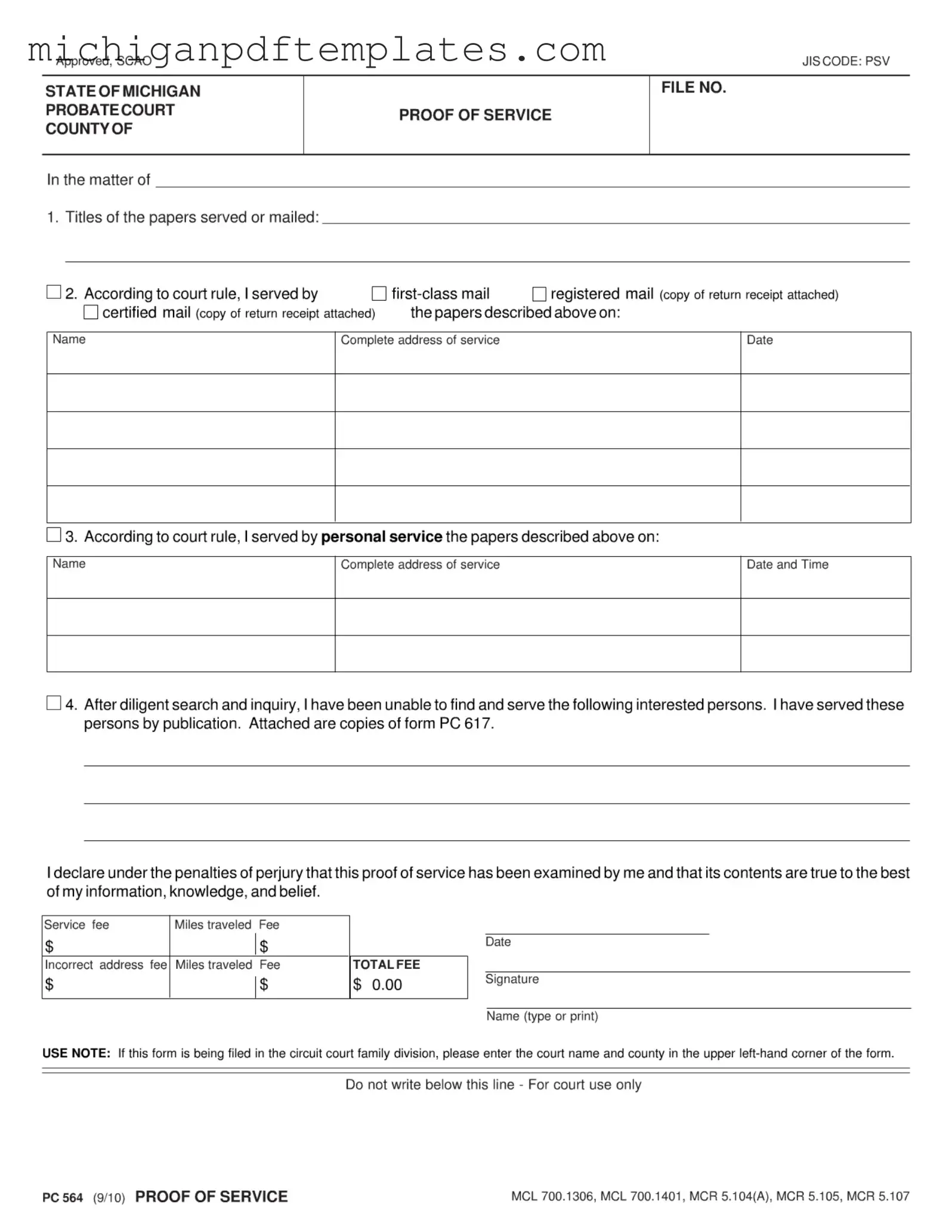

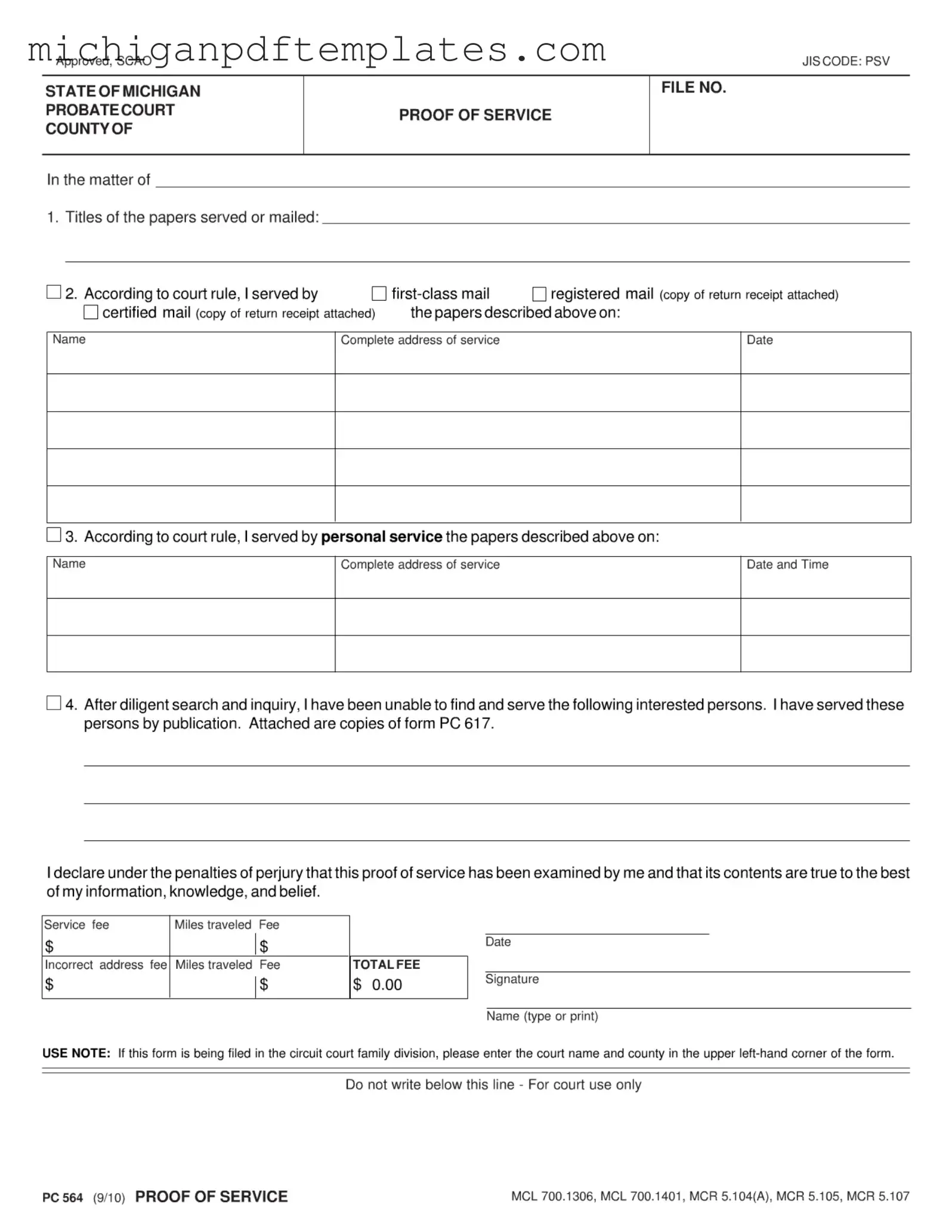

The Michigan Probate form is an essential document used in the probate process, primarily to provide proof that legal papers have been served to interested parties. This form outlines how and when these documents were delivered, ensuring that all necessary individuals are informed about the proceedings. To fill out the form, click the button below.

Get Your Form Now

Fill in Your Michigan Probate Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Probate online quickly.