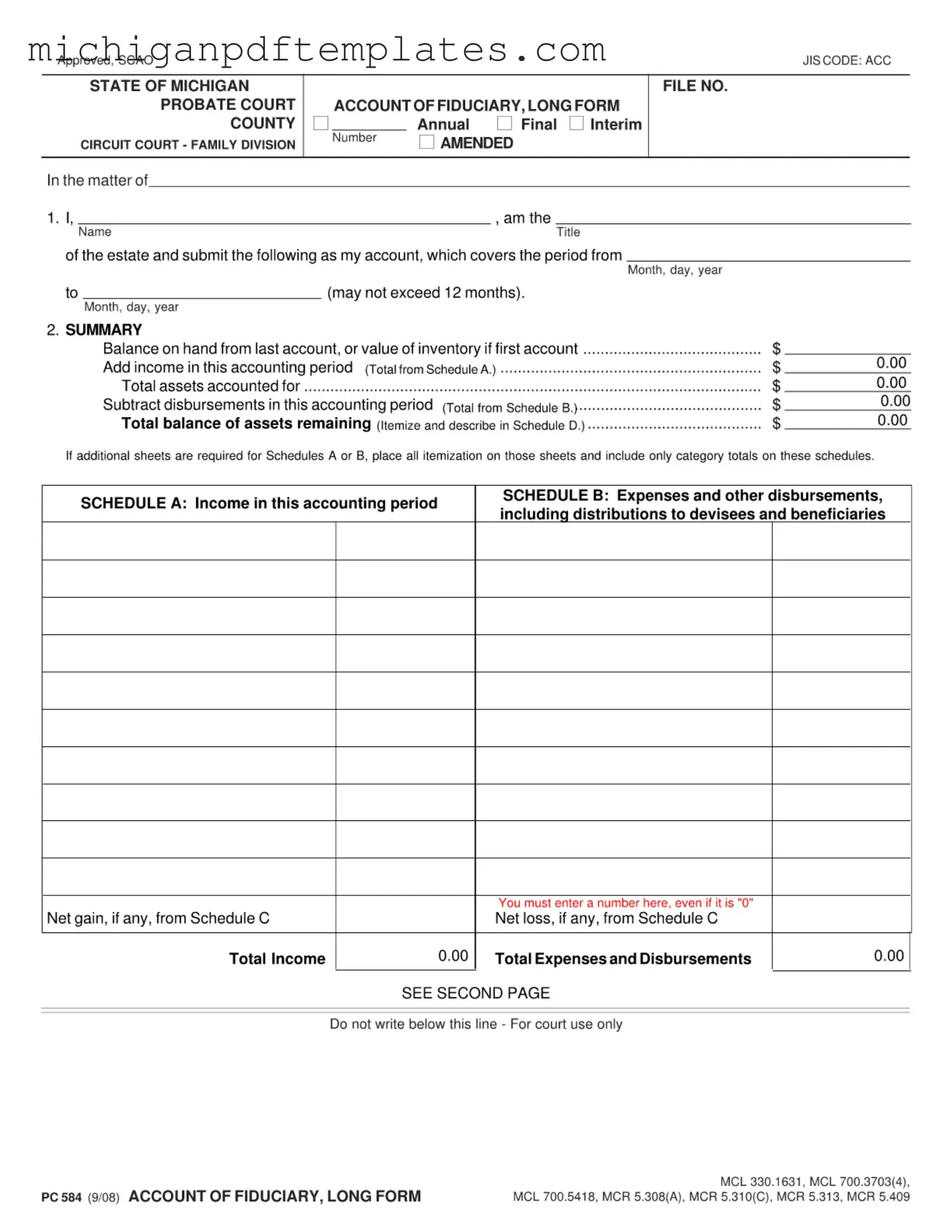

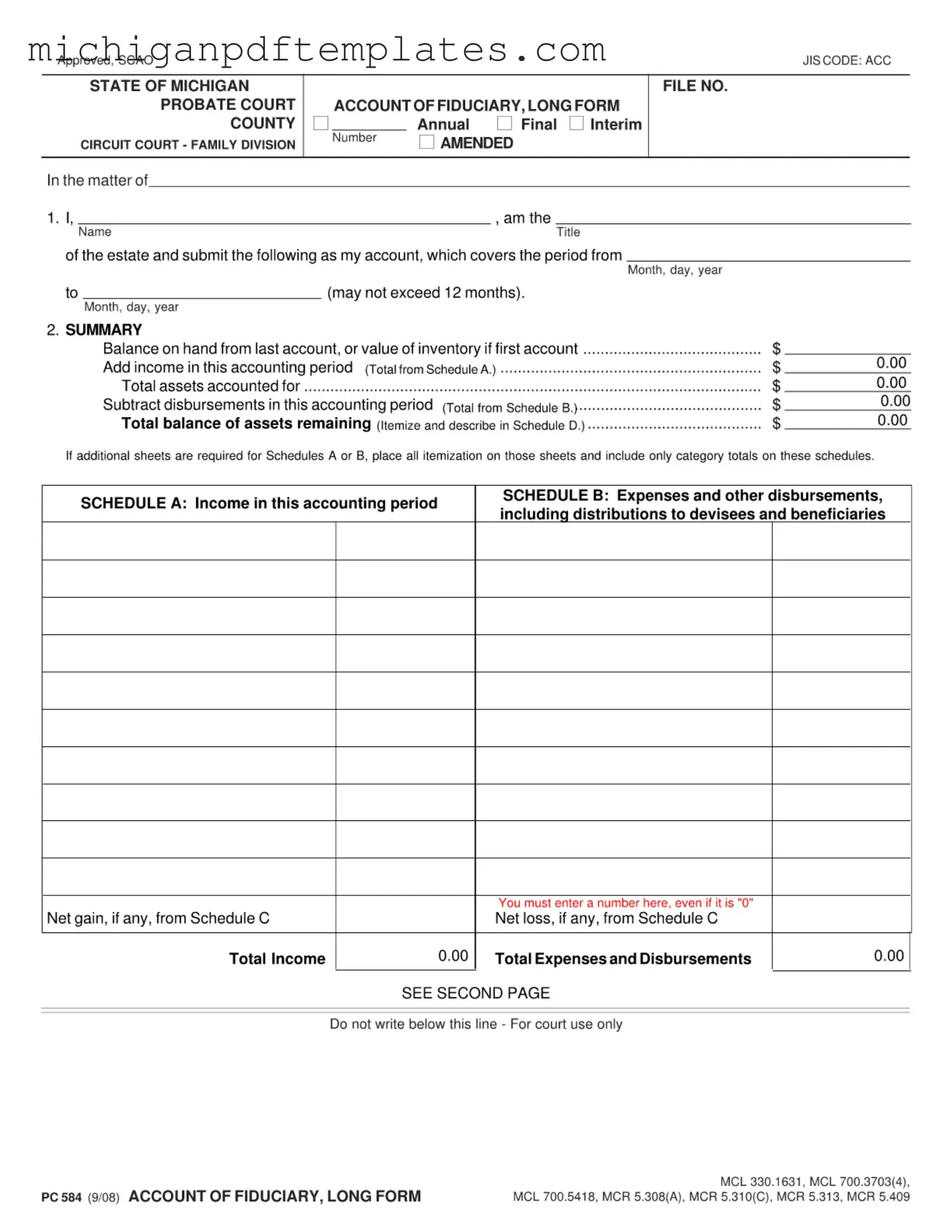

Fill in Your Michigan Pc 584 Form

The Michigan PC 584 form, known as the Account of Fiduciary, Long Form, is used to report the financial activities of a fiduciary over a specified period. This form helps ensure transparency and accountability in managing an estate or trust. If you need to fill out this form, please click the button below.

Get Your Form Now

Fill in Your Michigan Pc 584 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Pc 584 online quickly.