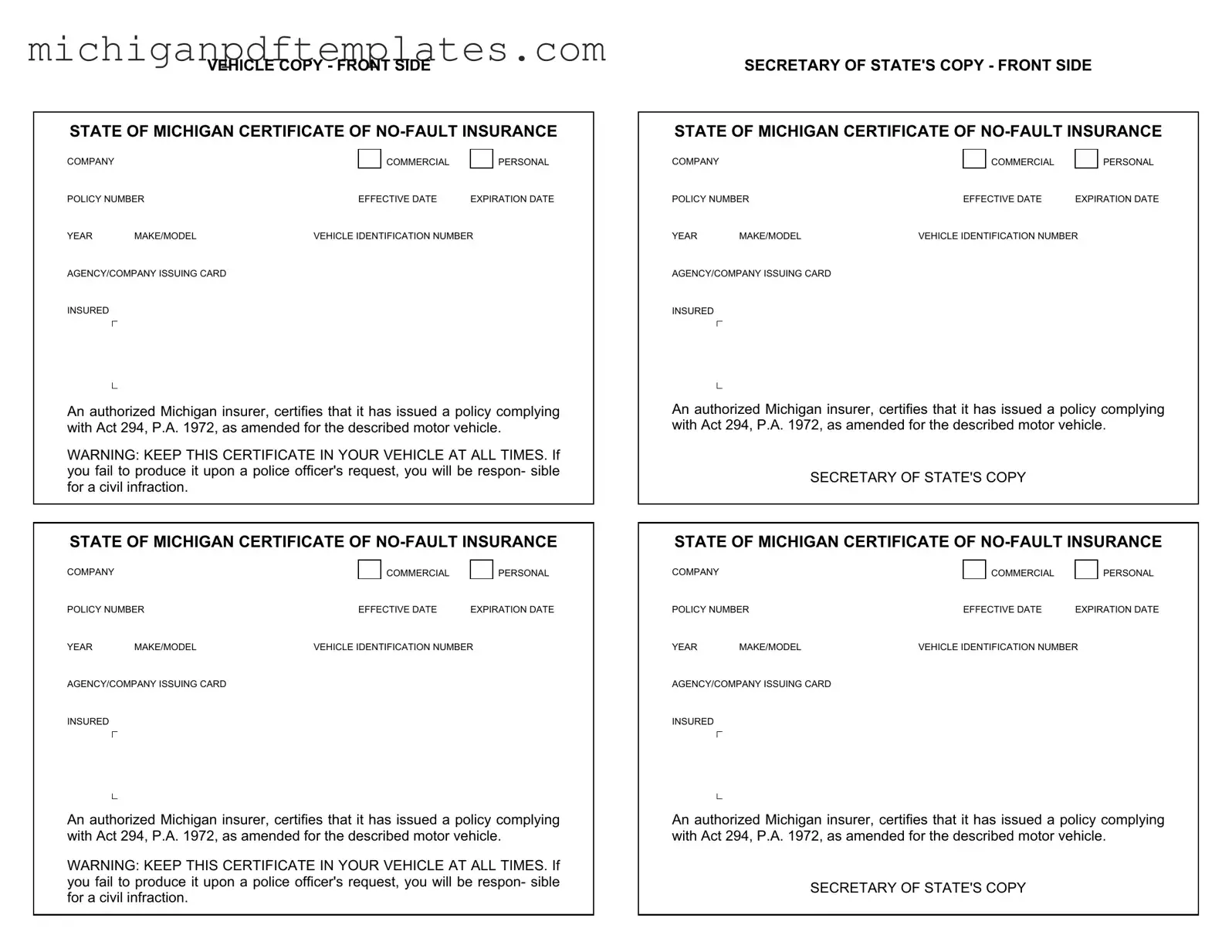

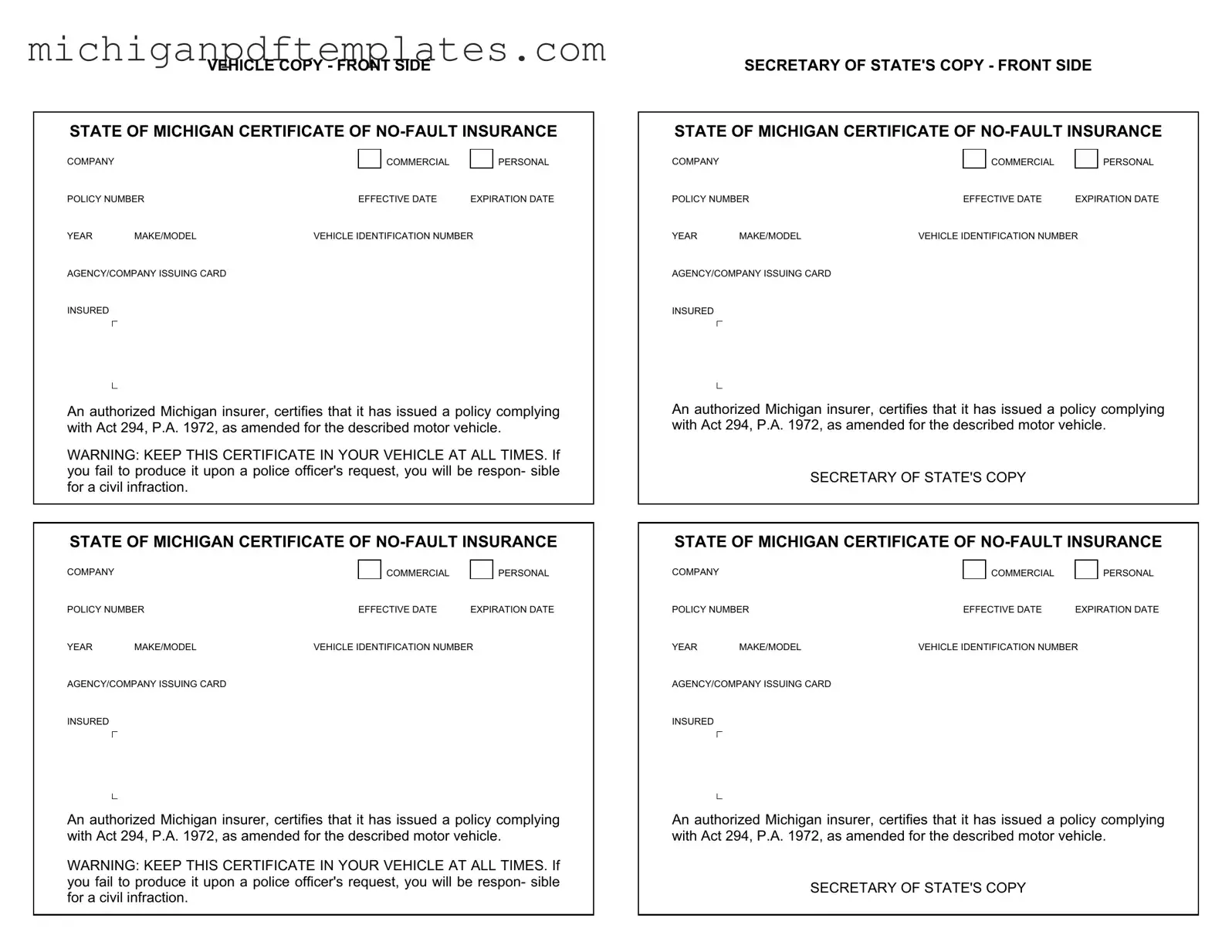

Fill in Your Michigan No Fault Insurance Form

The Michigan No Fault Insurance form serves as a certification that a motor vehicle is insured in accordance with state law. This document is essential for vehicle owners and registrants in Michigan, as it demonstrates compliance with the insurance requirements outlined in Act 294, P.A. 1972. Failure to present this form when requested by law enforcement can result in civil penalties.

To ensure you are properly insured, fill out the Michigan No Fault Insurance form by clicking the button below.

Get Your Form Now

Fill in Your Michigan No Fault Insurance Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan No Fault Insurance online quickly.