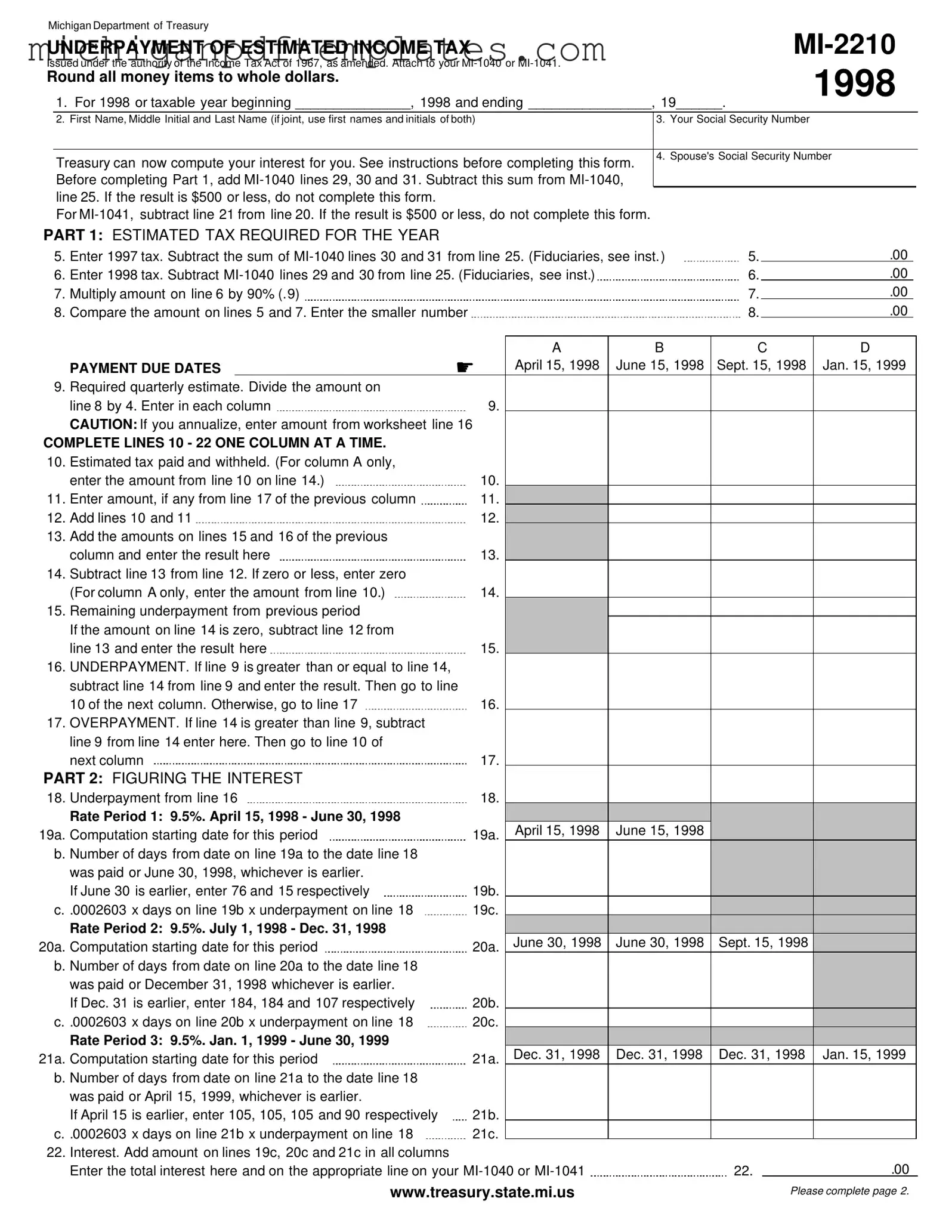

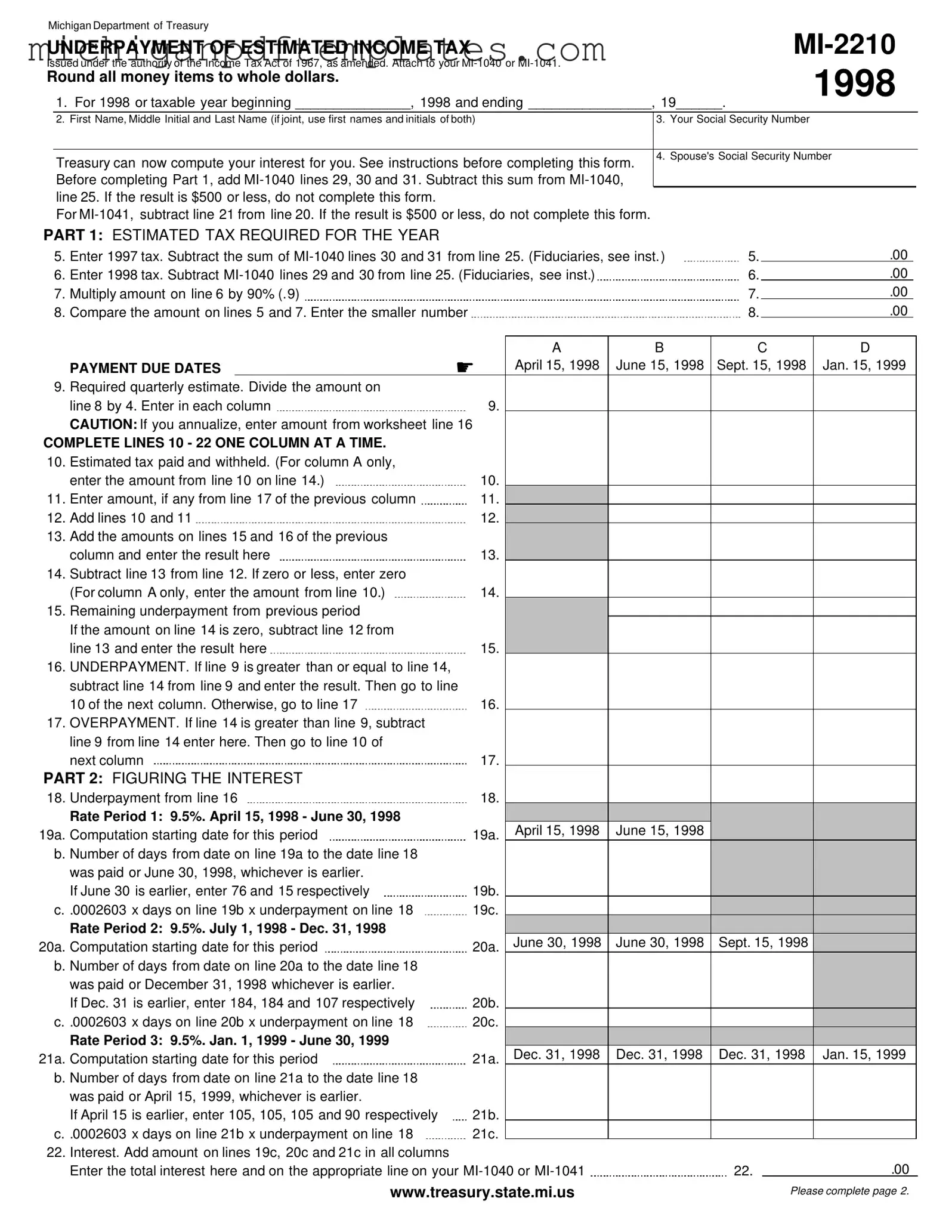

Fill in Your Michigan Mi 2210 Form

The Michigan Mi 2210 form is used to report underpayment of estimated income tax. This form helps taxpayers determine if they owe any penalties or interest for not making the required estimated payments throughout the year. If you need to fill out the form, please click the button below.

Get Your Form Now

Fill in Your Michigan Mi 2210 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Mi 2210 online quickly.