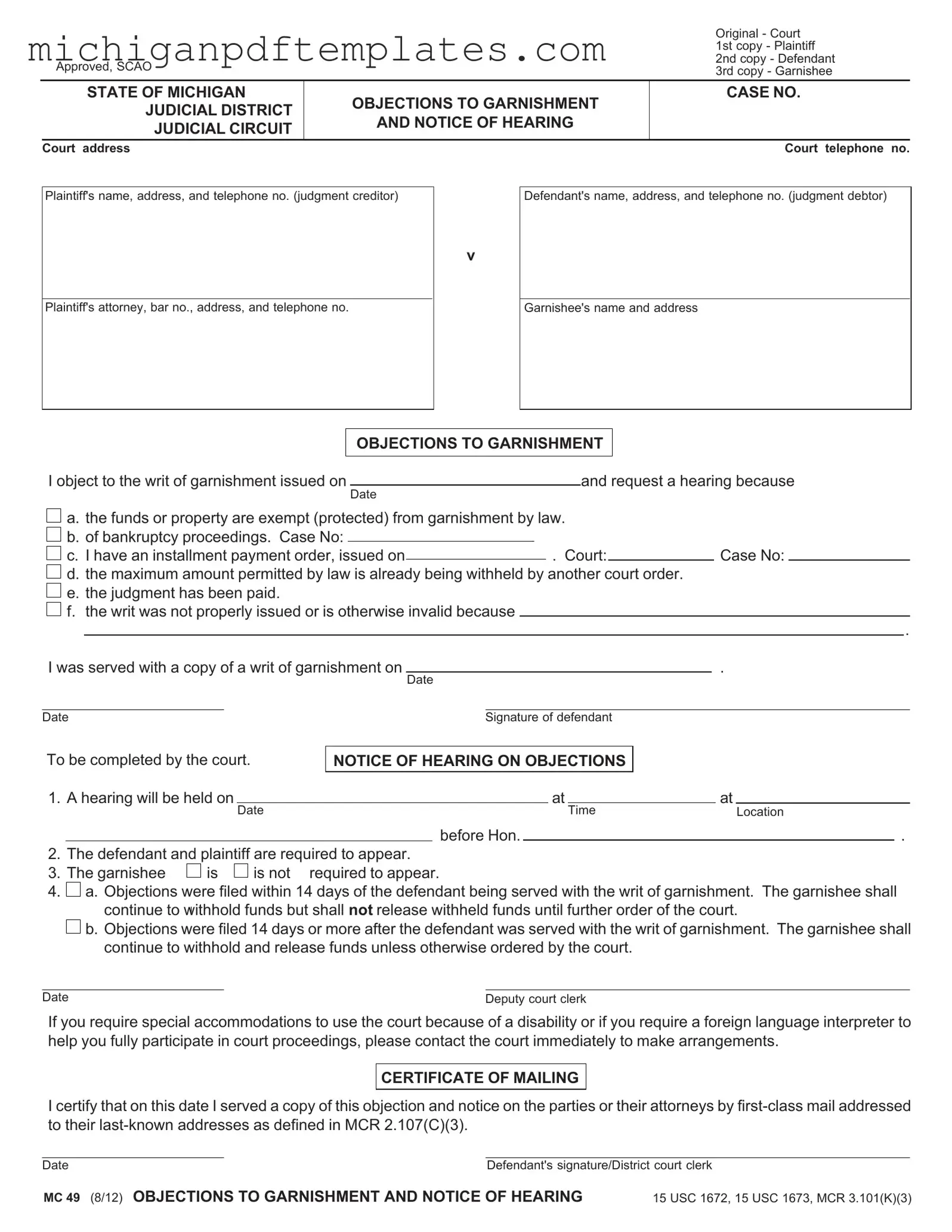

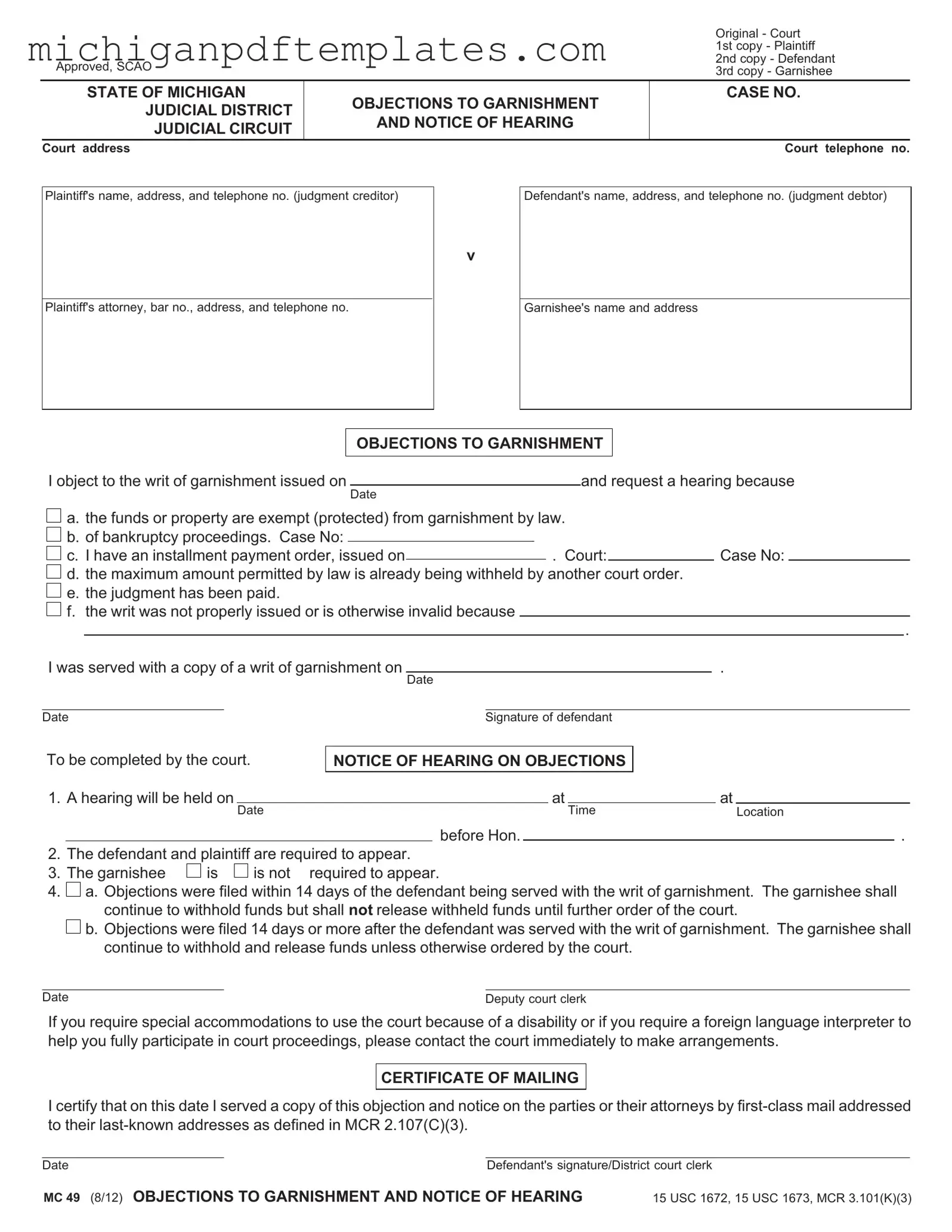

Fill in Your Michigan Mc 49 Form

The Michigan MC 49 form is used to file objections to garnishment and to notify the court of a hearing regarding those objections. This form allows individuals to contest a writ of garnishment by stating valid reasons such as exemption of funds, bankruptcy proceedings, or improper issuance of the garnishment. If you believe you have grounds to object, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Mc 49 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Mc 49 online quickly.