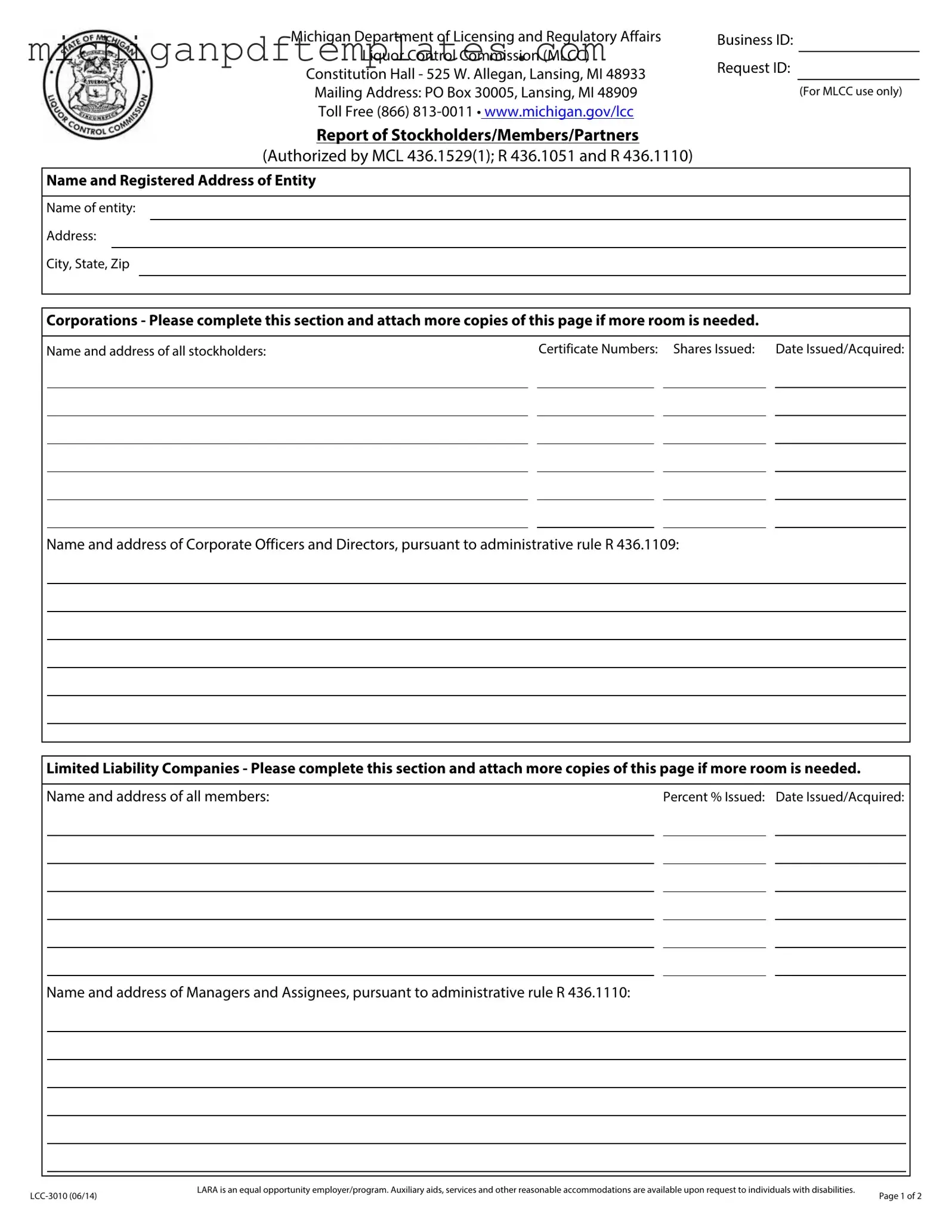

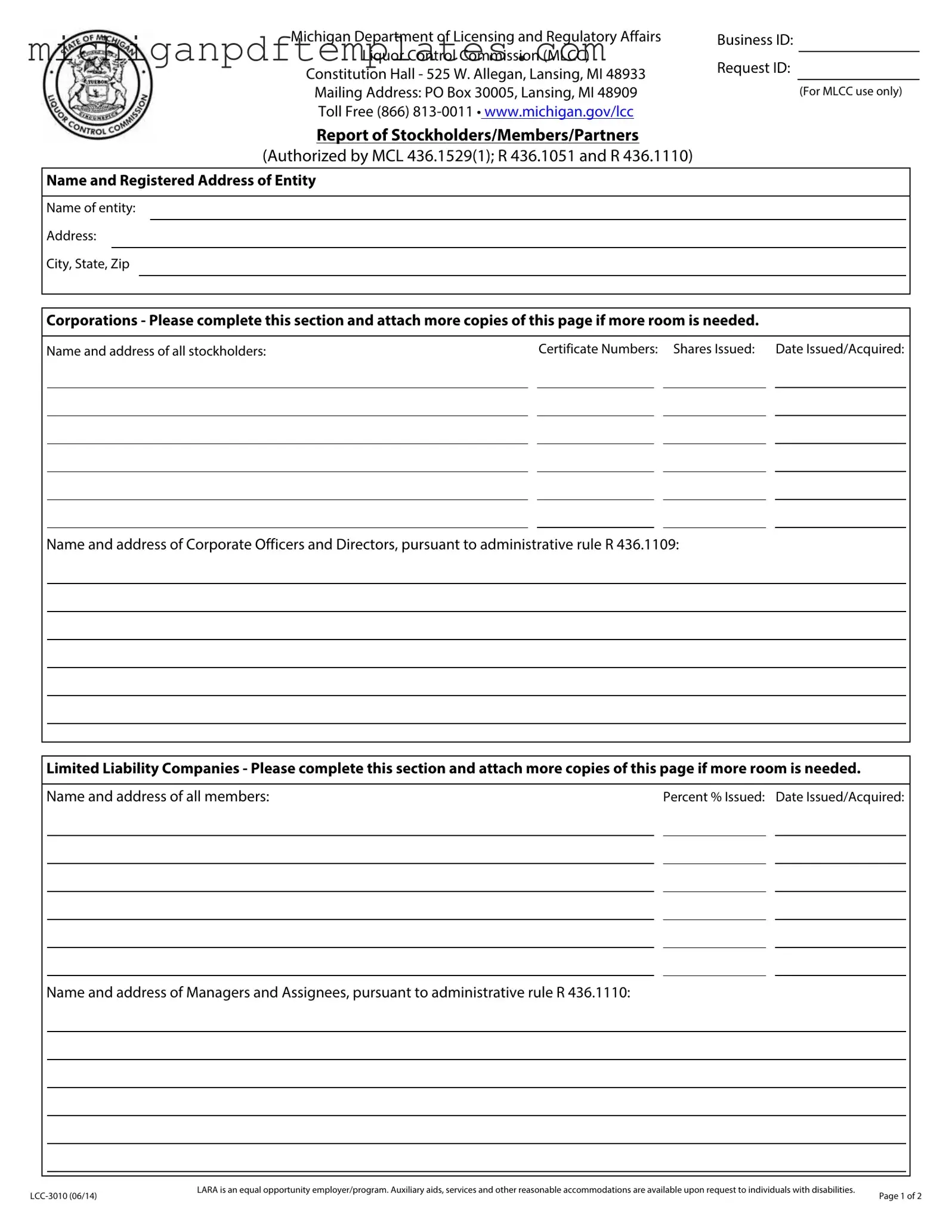

Fill in Your Michigan Lcc 3010 Form

The Michigan LCC 3010 form is a crucial document used to report information about stockholders, members, or partners of a business seeking liquor licensing in Michigan. This form ensures compliance with state regulations and provides transparency regarding ownership. For those ready to navigate the licensing process, filling out the LCC 3010 is an essential step—click the button below to get started.

Get Your Form Now

Fill in Your Michigan Lcc 3010 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Lcc 3010 online quickly.