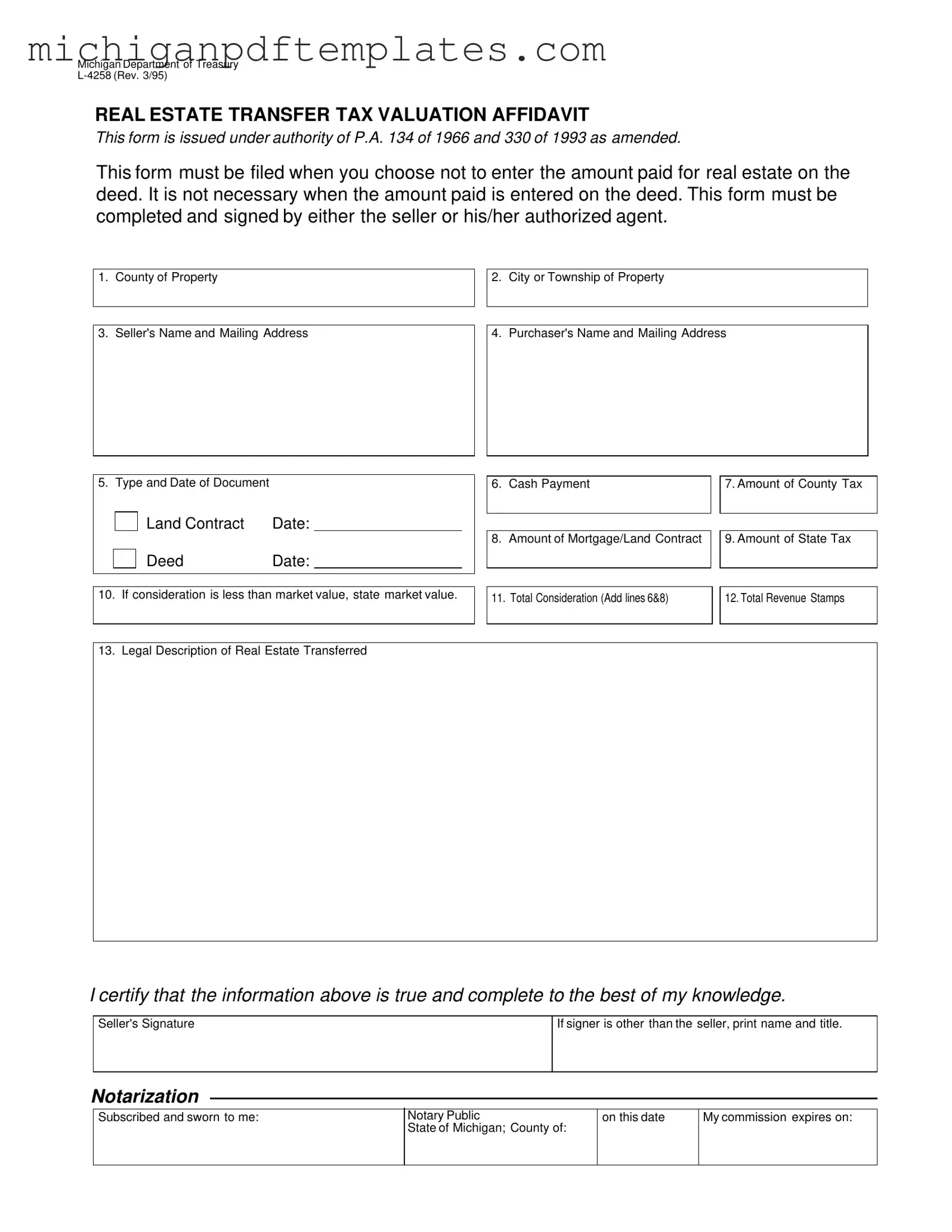

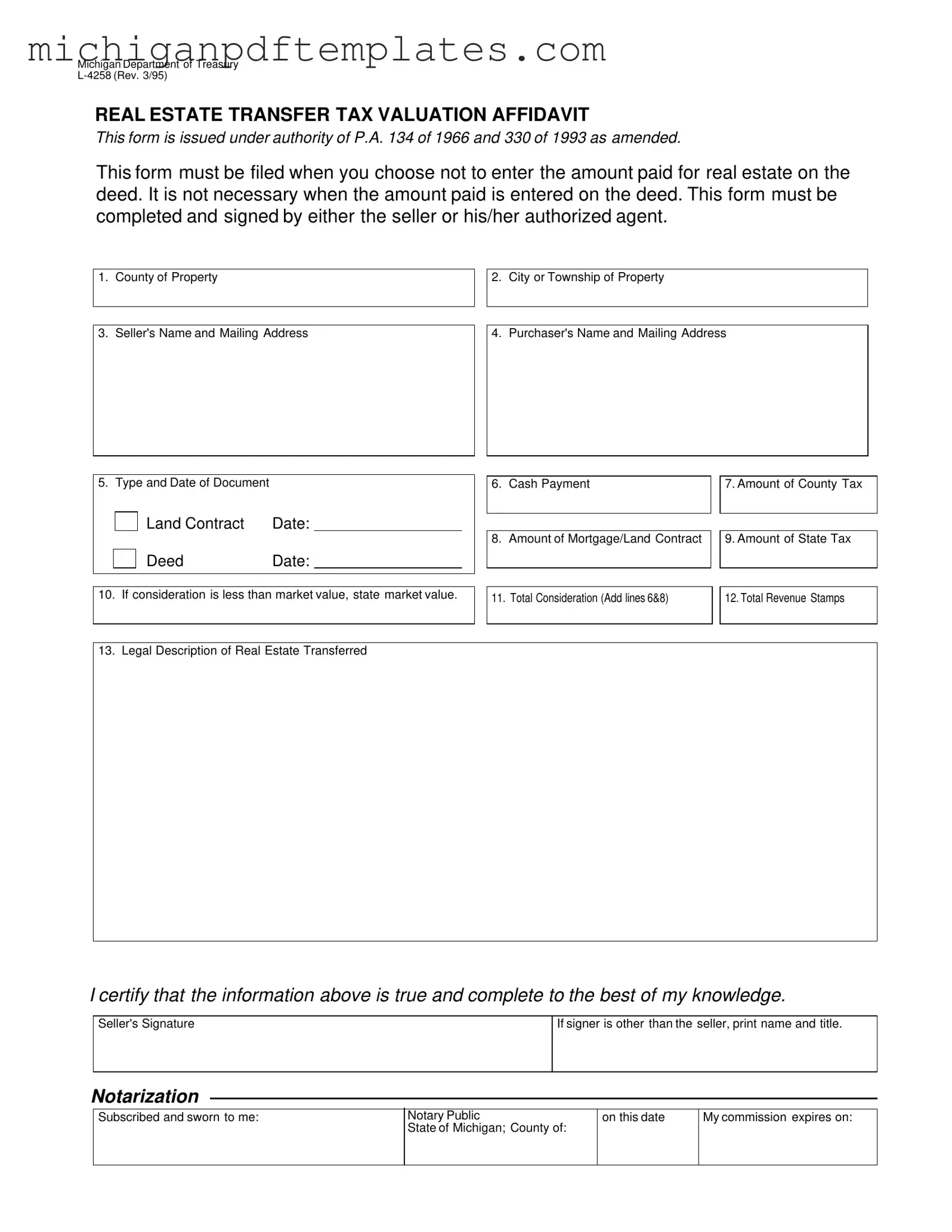

Fill in Your Michigan L 4258 Form

The Michigan L 4258 form, also known as the Real Estate Transfer Tax Valuation Affidavit, is a crucial document required when the amount paid for real estate is not specified on the deed. This form must be completed and signed by the seller or their authorized agent, ensuring compliance with state regulations. For those looking to navigate real estate transactions smoothly, filling out the L 4258 form is an essential step—click the button below to get started.

Get Your Form Now

Fill in Your Michigan L 4258 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan L 4258 online quickly.