Fill in Your Michigan Exemption Form

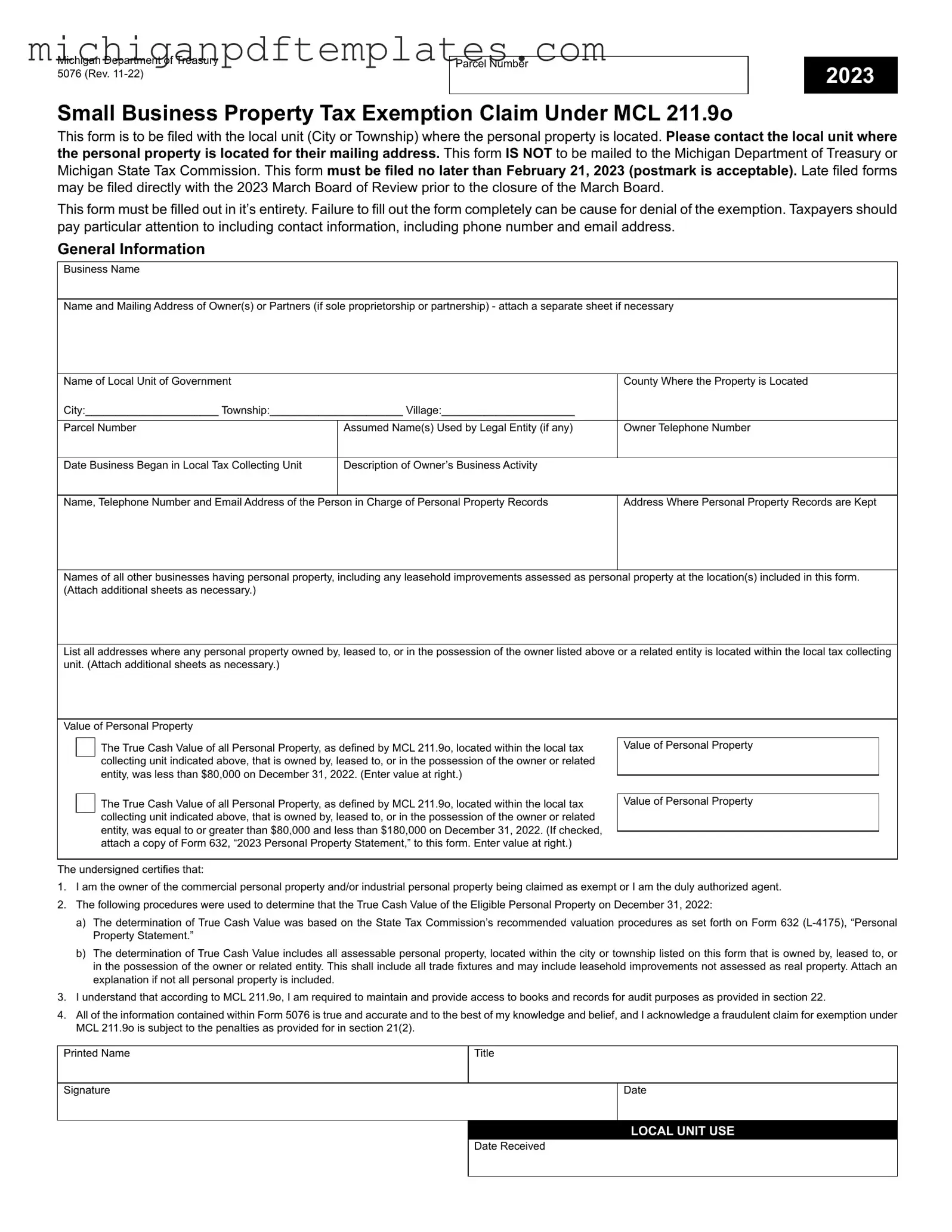

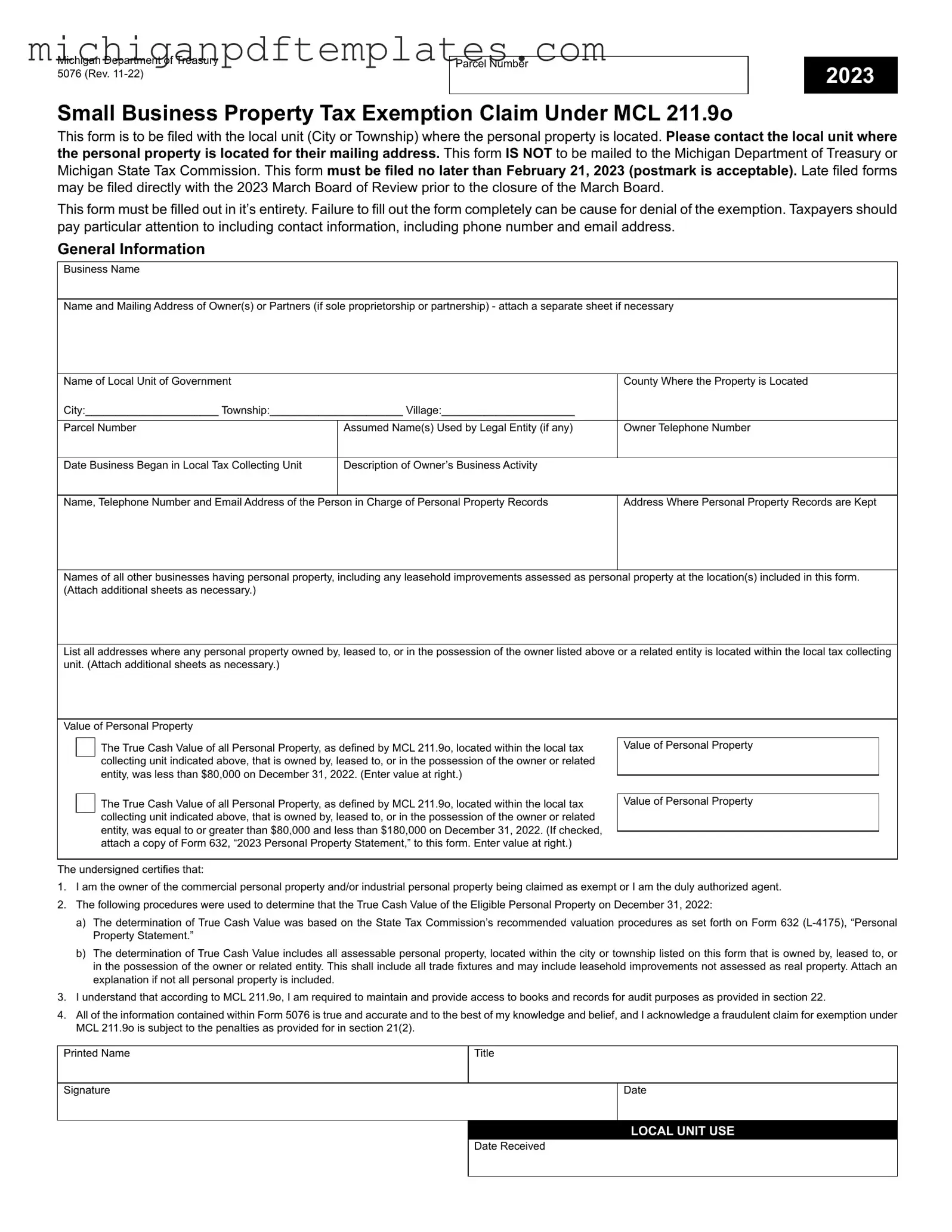

The Michigan Exemption form is a document used to claim a property tax exemption for eligible small businesses. Specifically, it allows businesses with less than $80,000 in personal property to avoid certain taxes, streamlining their financial obligations. To ensure you receive this exemption, fill out the form completely and submit it to your local city or township office by the deadline.

Start the process by filling out the form below.

Get Your Form Now

Fill in Your Michigan Exemption Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Exemption online quickly.