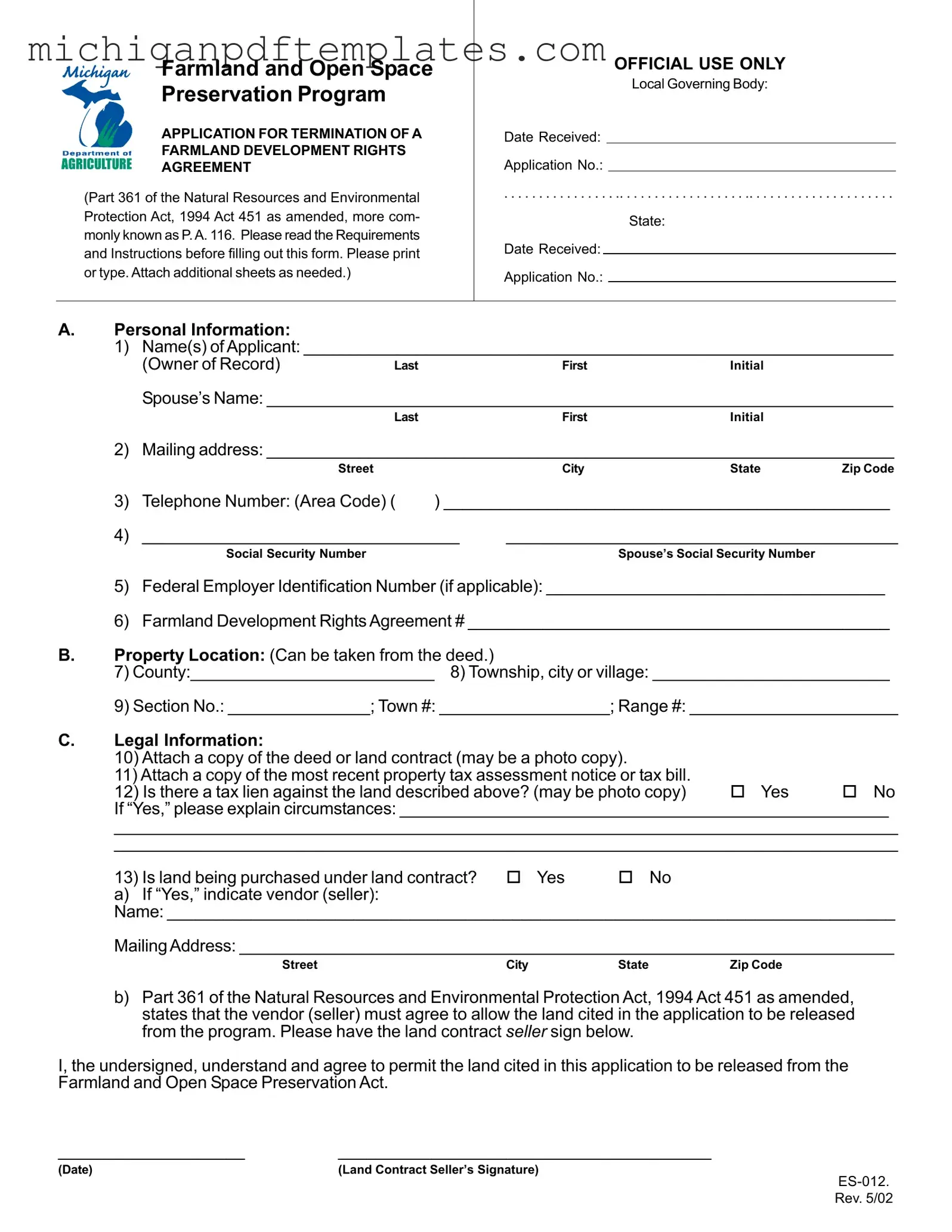

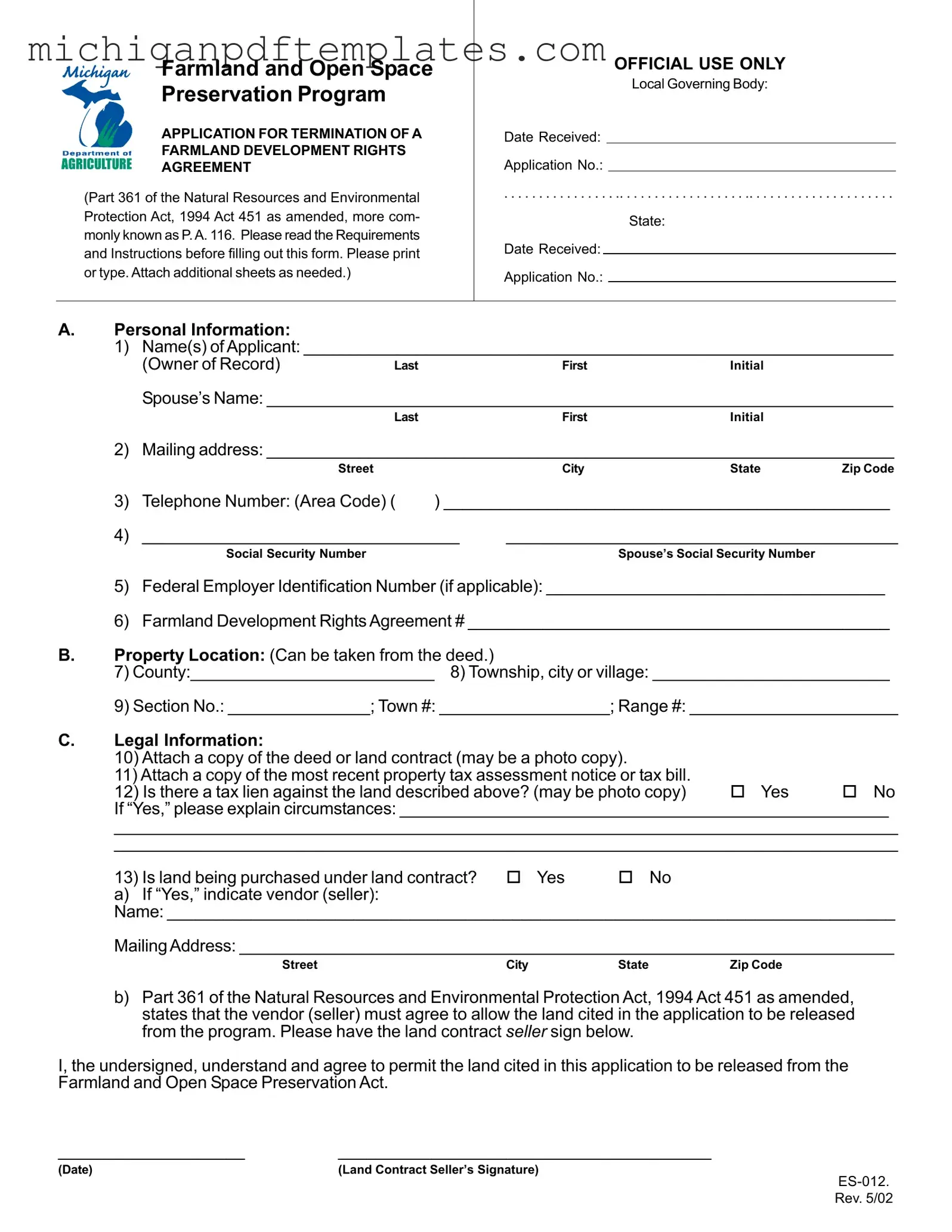

Fill in Your Michigan Es 012 Form

The Michigan ES 012 form is an application for the termination of a Farmland Development Rights Agreement, as outlined in Part 361 of the Natural Resources and Environmental Protection Act. This form is designed for landowners seeking to withdraw their property from the Farmland and Open Space Preservation Program, commonly known as P.A. 116. It is essential to review the requirements and instructions carefully before completing the form.

To begin the process of terminating your agreement, please fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Es 012 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Es 012 online quickly.