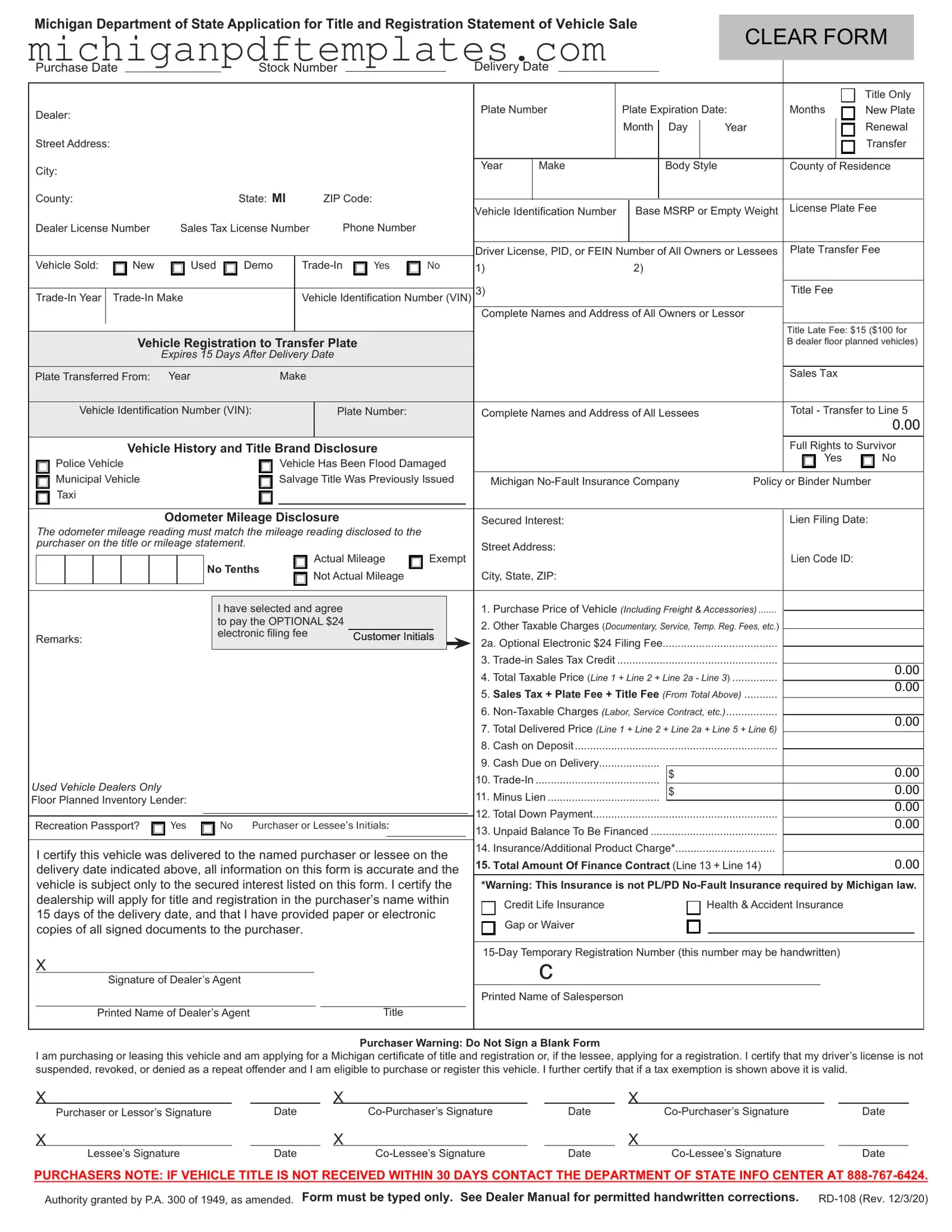

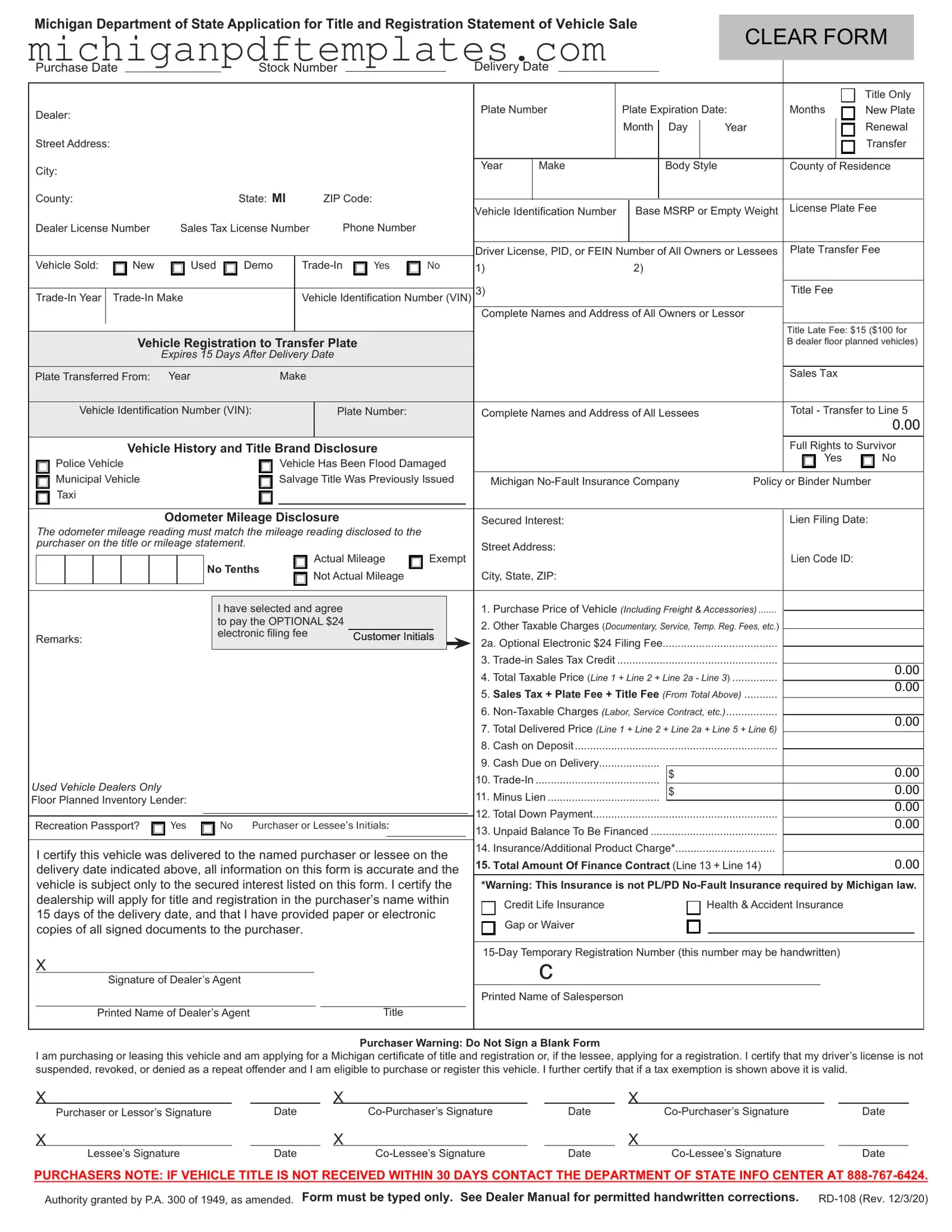

Fill in Your Michigan Category Weight Form

The Michigan Category Weight form is a crucial document used for the application of vehicle title and registration in the state of Michigan. This form captures essential information about the vehicle, its sale, and the parties involved, ensuring a smooth transition of ownership. For a hassle-free experience, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan Category Weight Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan Category Weight online quickly.