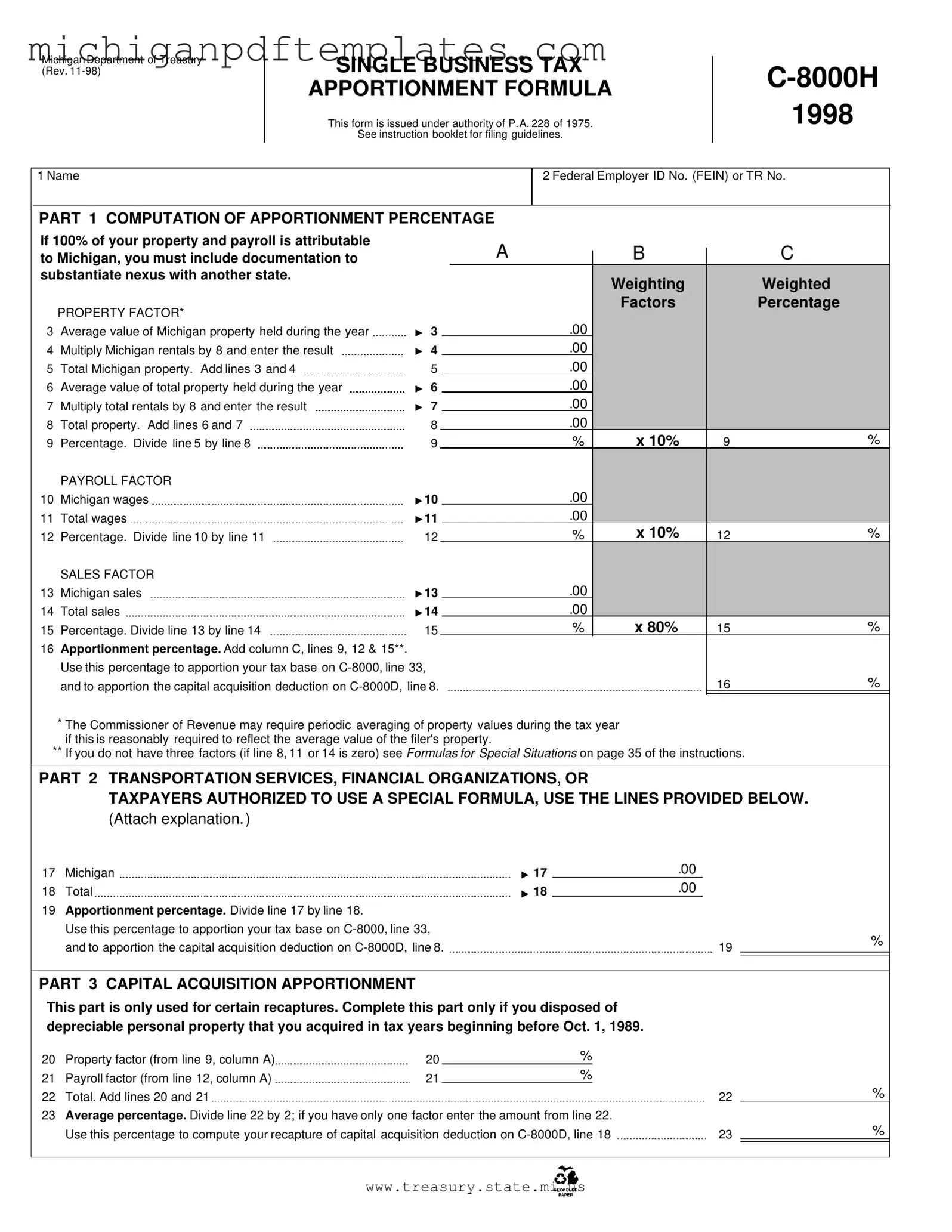

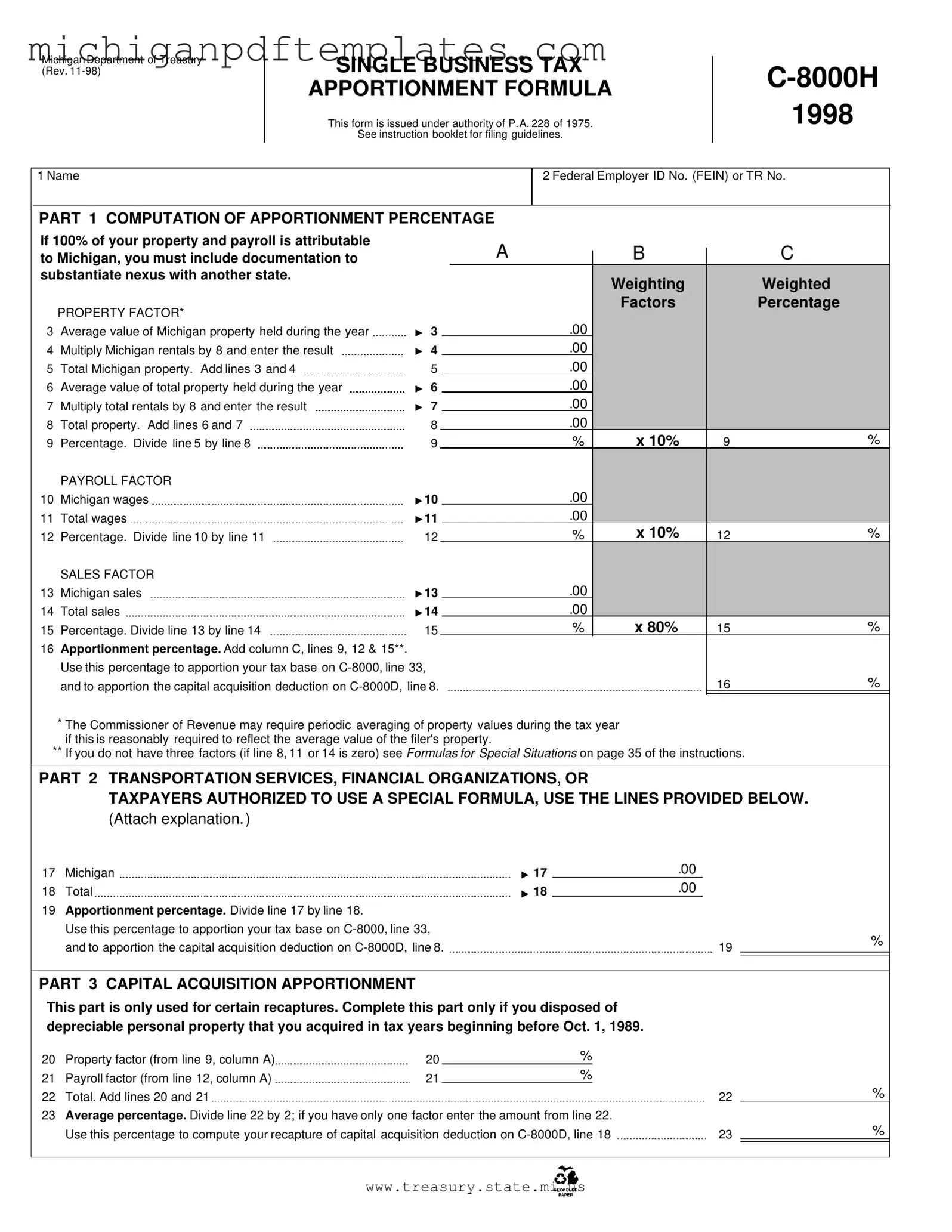

Fill in Your Michigan C 8000H Form

The Michigan C 8000H form is a crucial document used for calculating the apportionment percentage of a business's tax base under the Single Business Tax. Issued by the Michigan Department of Treasury, this form helps businesses determine how much of their income is taxable in Michigan based on property, payroll, and sales factors. Completing this form accurately is essential for compliance and ensuring that your business pays the correct amount of taxes.

Ready to get started? Click the button below to fill out the Michigan C 8000H form.

Get Your Form Now

Fill in Your Michigan C 8000H Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan C 8000H online quickly.