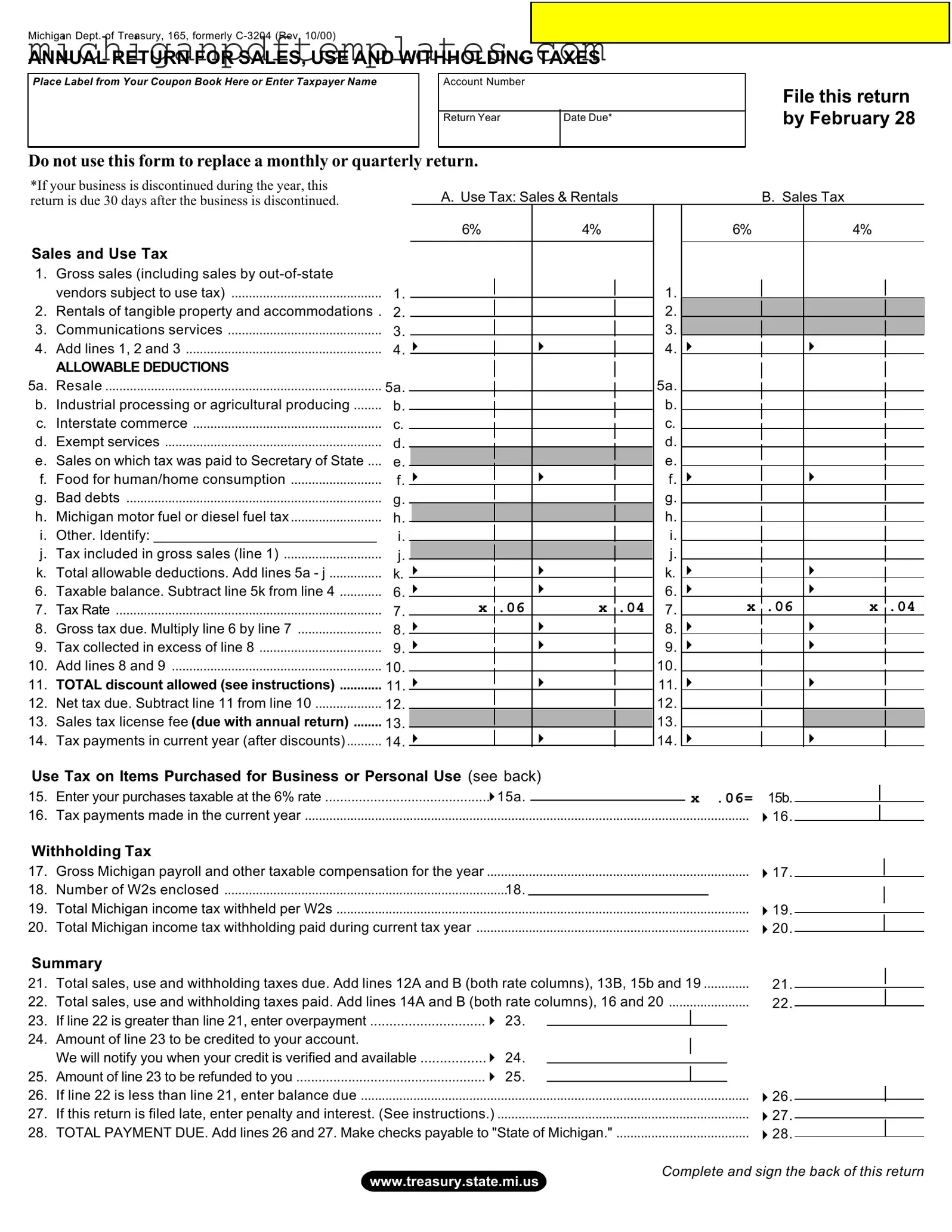

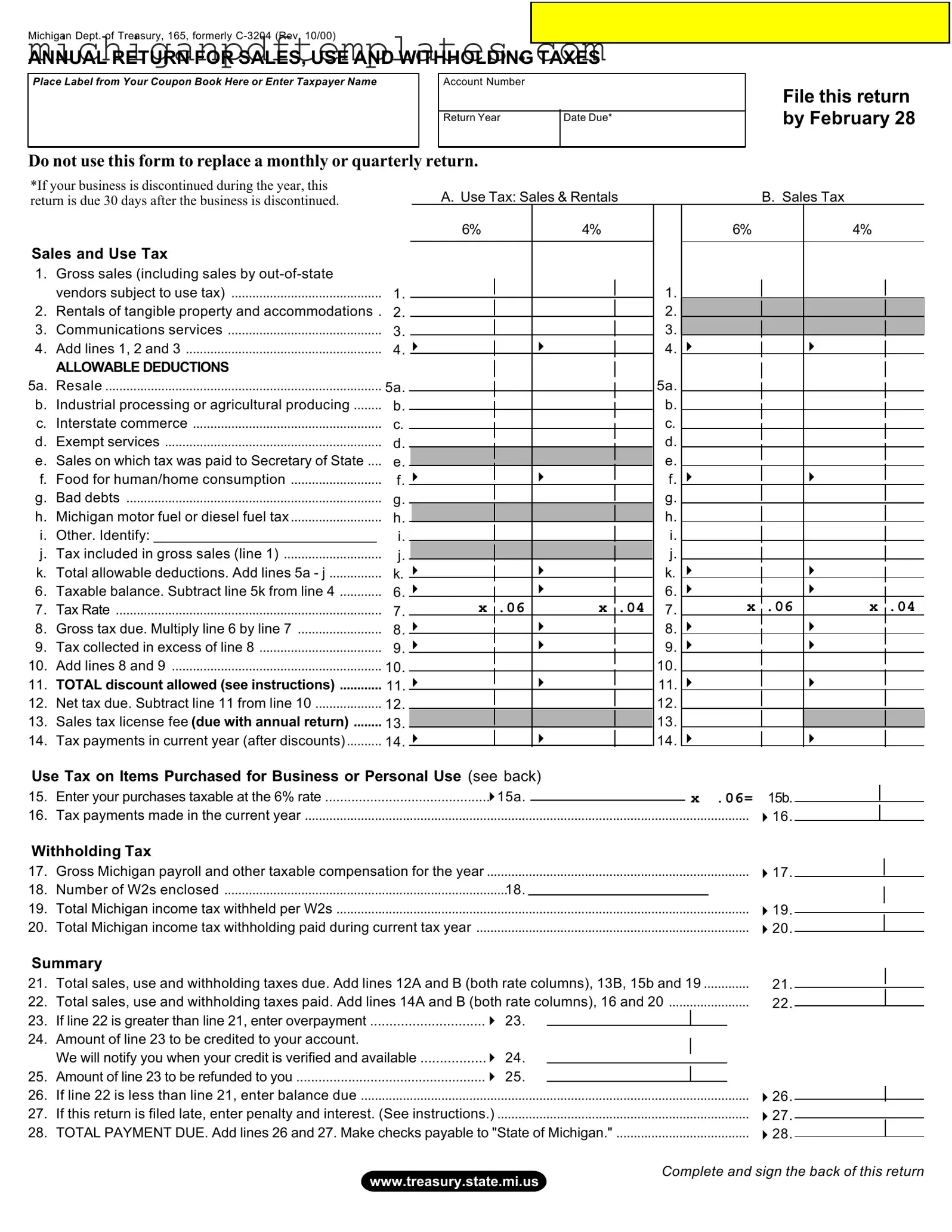

Fill in Your Michigan C 3204 Form

The Michigan C 3204 form is an annual return used for reporting sales, use, and withholding taxes in the state of Michigan. This form must be submitted by February 28 each year, or within 30 days if a business is discontinued. Completing this form accurately is essential for compliance, so be sure to fill it out by clicking the button below.

Get Your Form Now

Fill in Your Michigan C 3204 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan C 3204 online quickly.