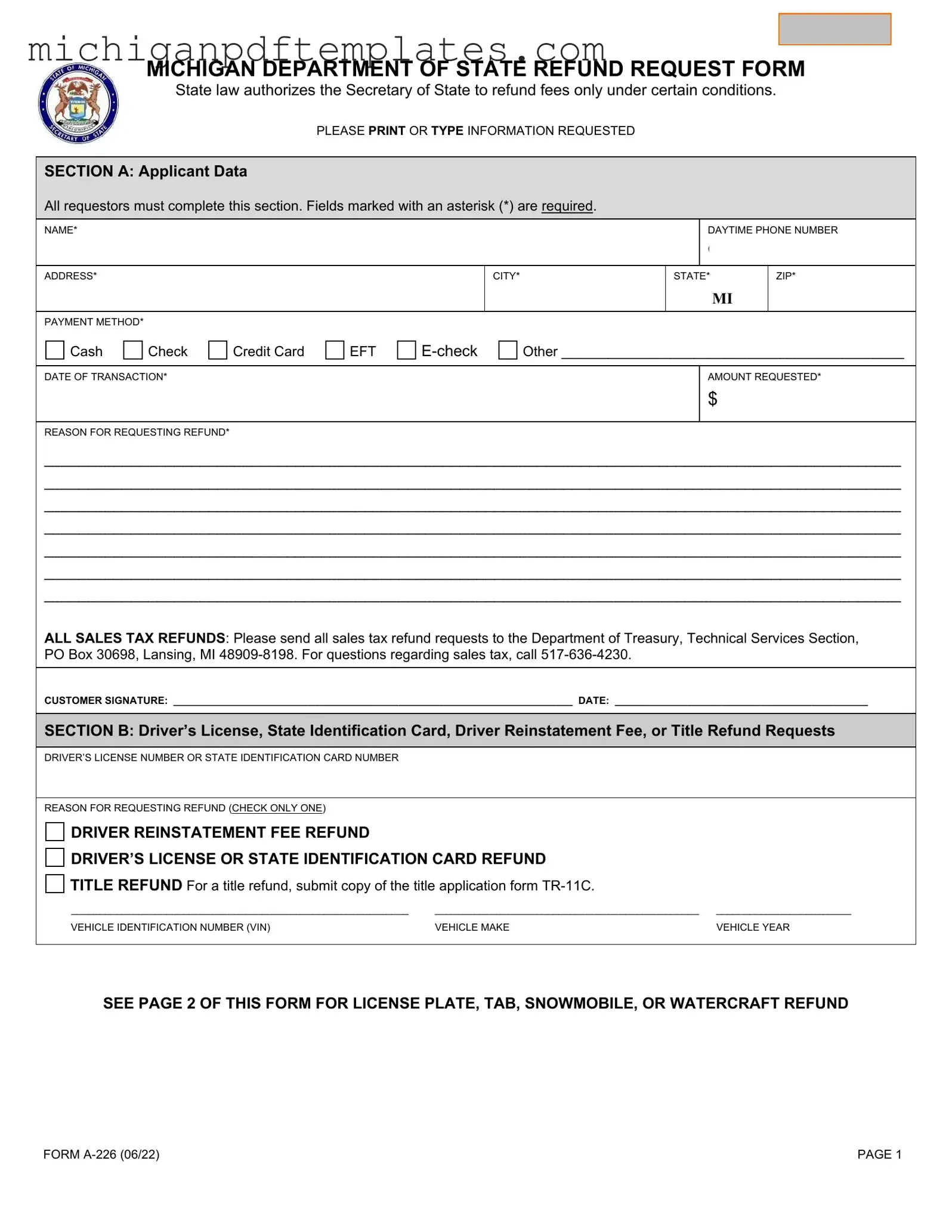

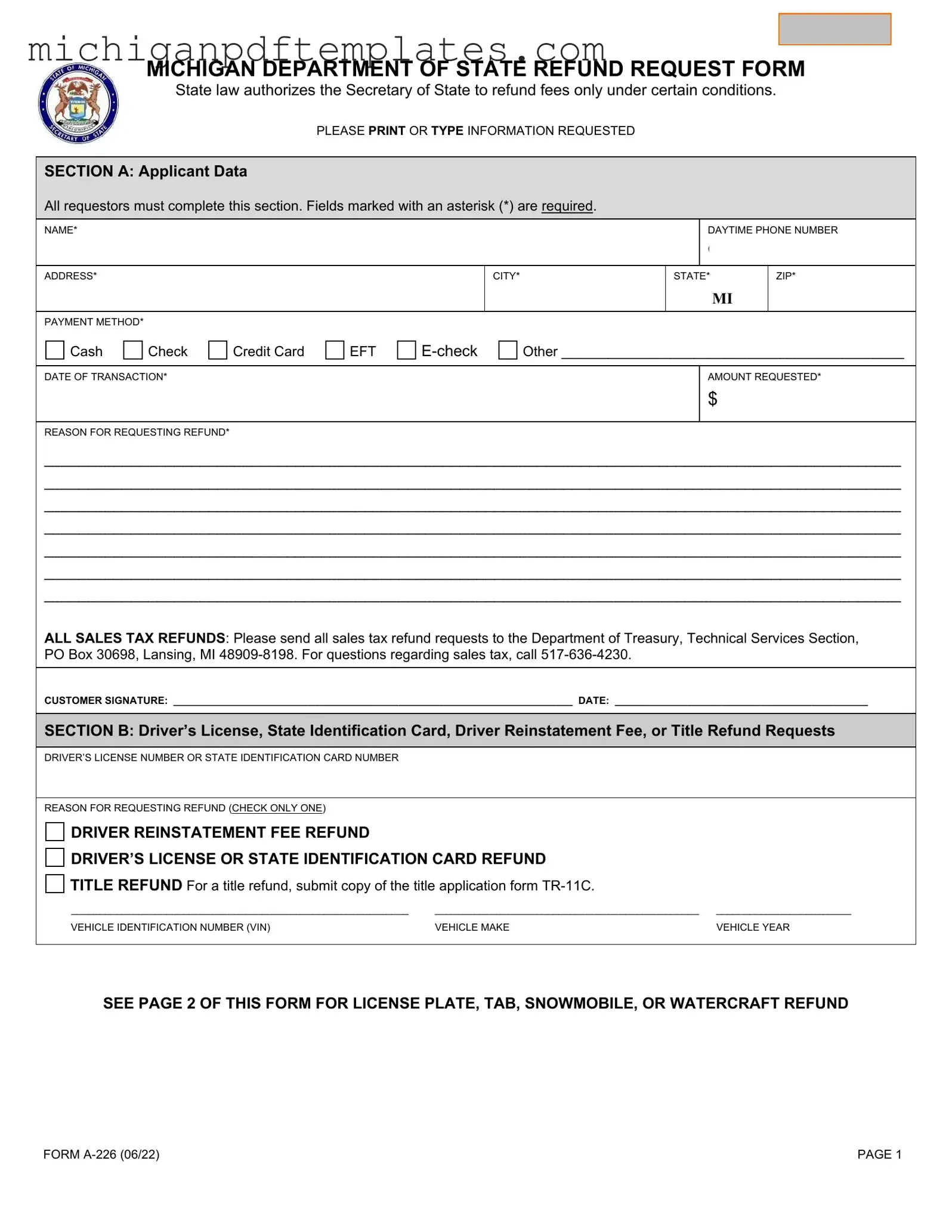

Fill in Your Michigan A 226 Form

The Michigan A 226 form is a refund request form used by individuals seeking to reclaim fees paid to the Michigan Department of State. This form is essential for various refund requests, including those for driver’s licenses, vehicle registrations, and other related fees. To initiate your refund process, please fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan A 226 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan A 226 online quickly.