Fill in Your Michigan 807 Form

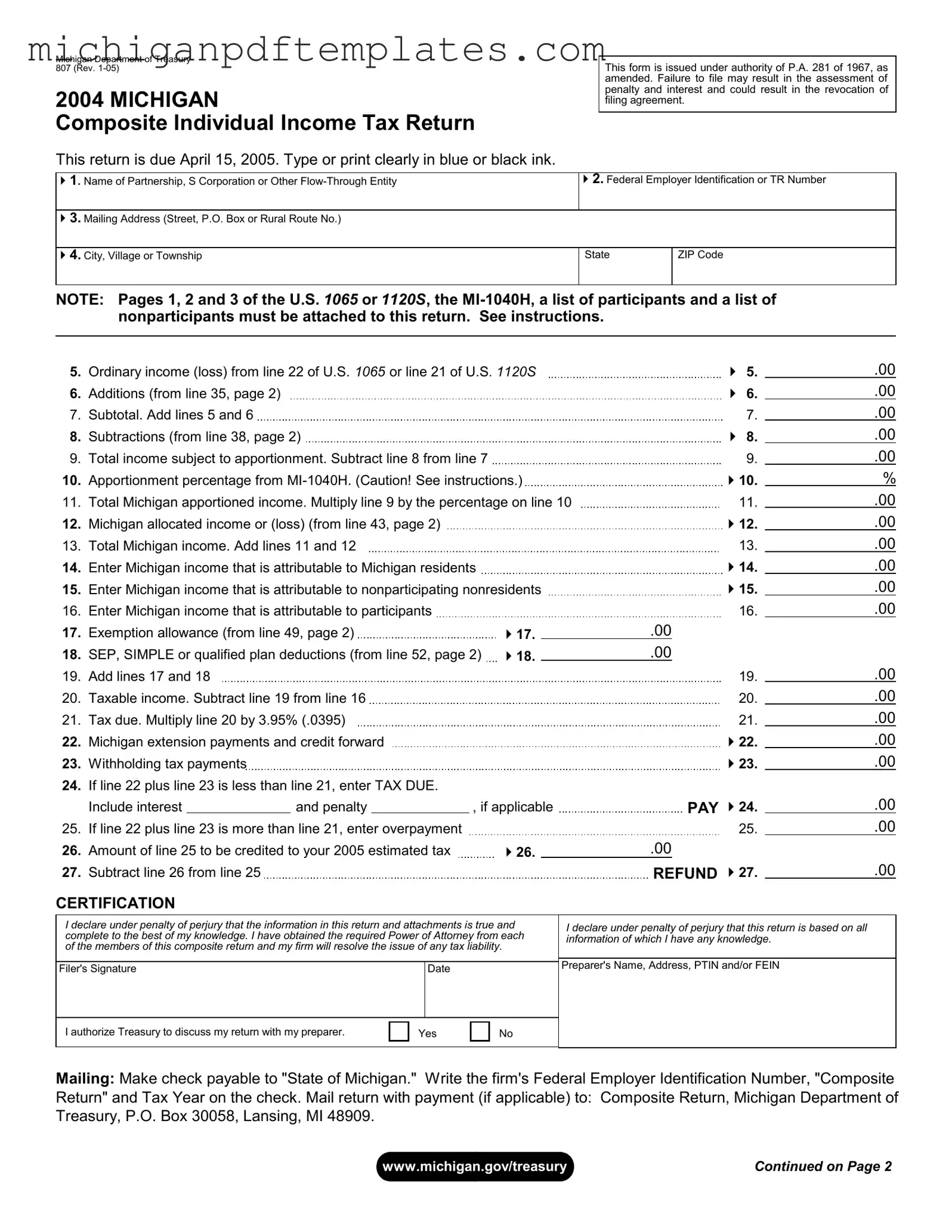

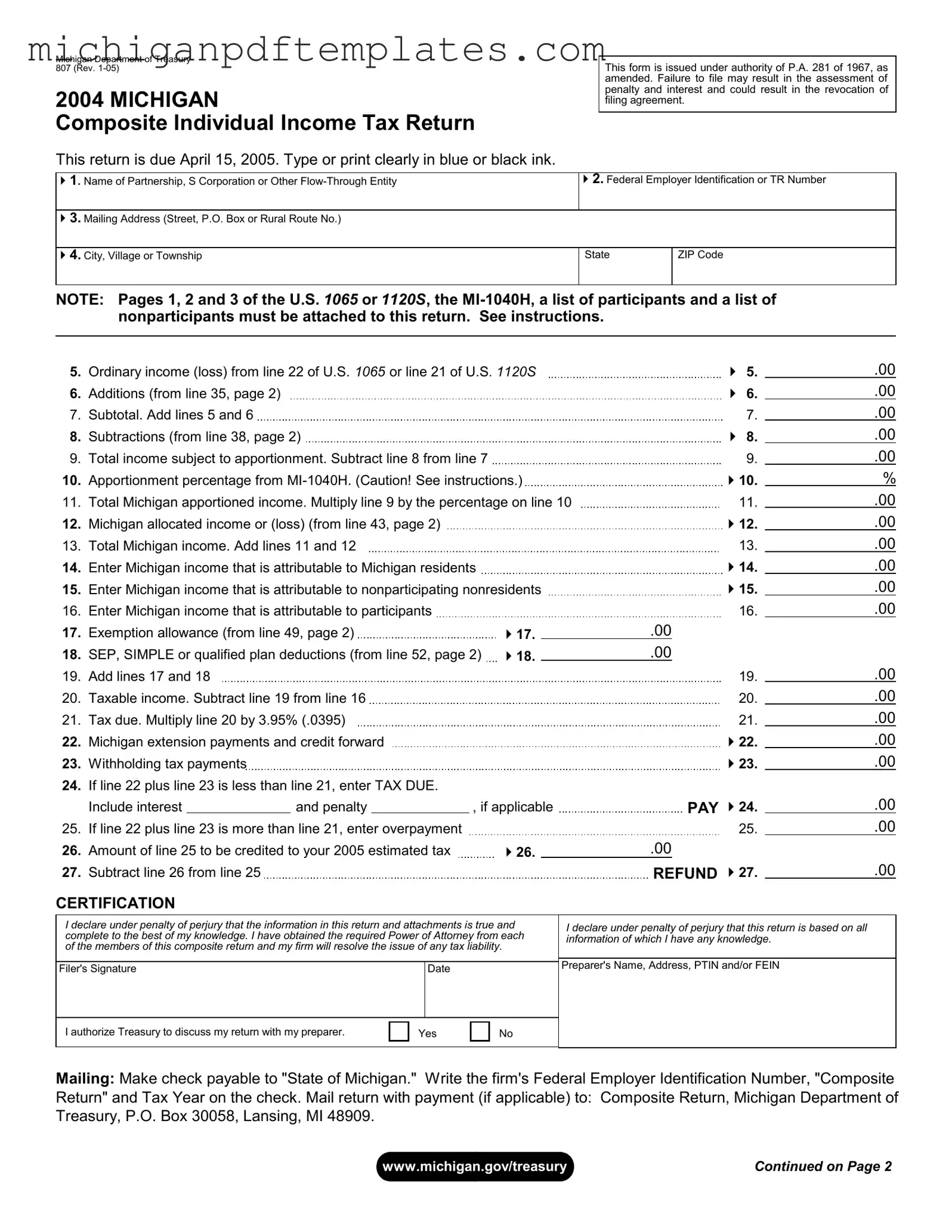

The Michigan 807 form, officially known as the Michigan Composite Individual Income Tax Return, serves as a crucial document for flow-through entities such as partnerships and S corporations operating within the state. This form enables these entities to report income and tax obligations on behalf of their nonresident members, streamlining the tax process. Ensuring accurate completion of this form is essential to avoid penalties and maintain compliance with state tax regulations.

Ready to fill out the Michigan 807 form? Click the button below to get started!

Get Your Form Now

Fill in Your Michigan 807 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 807 online quickly.