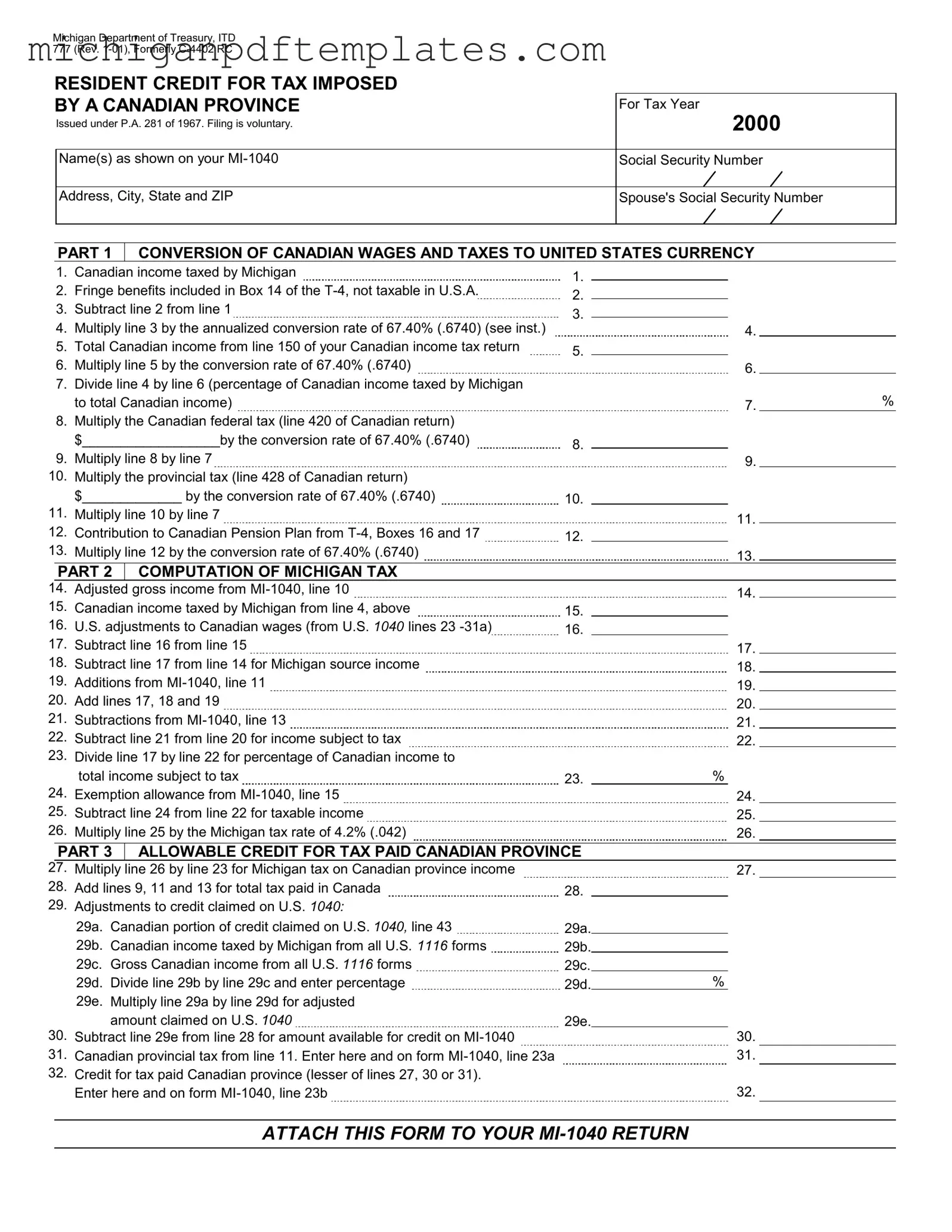

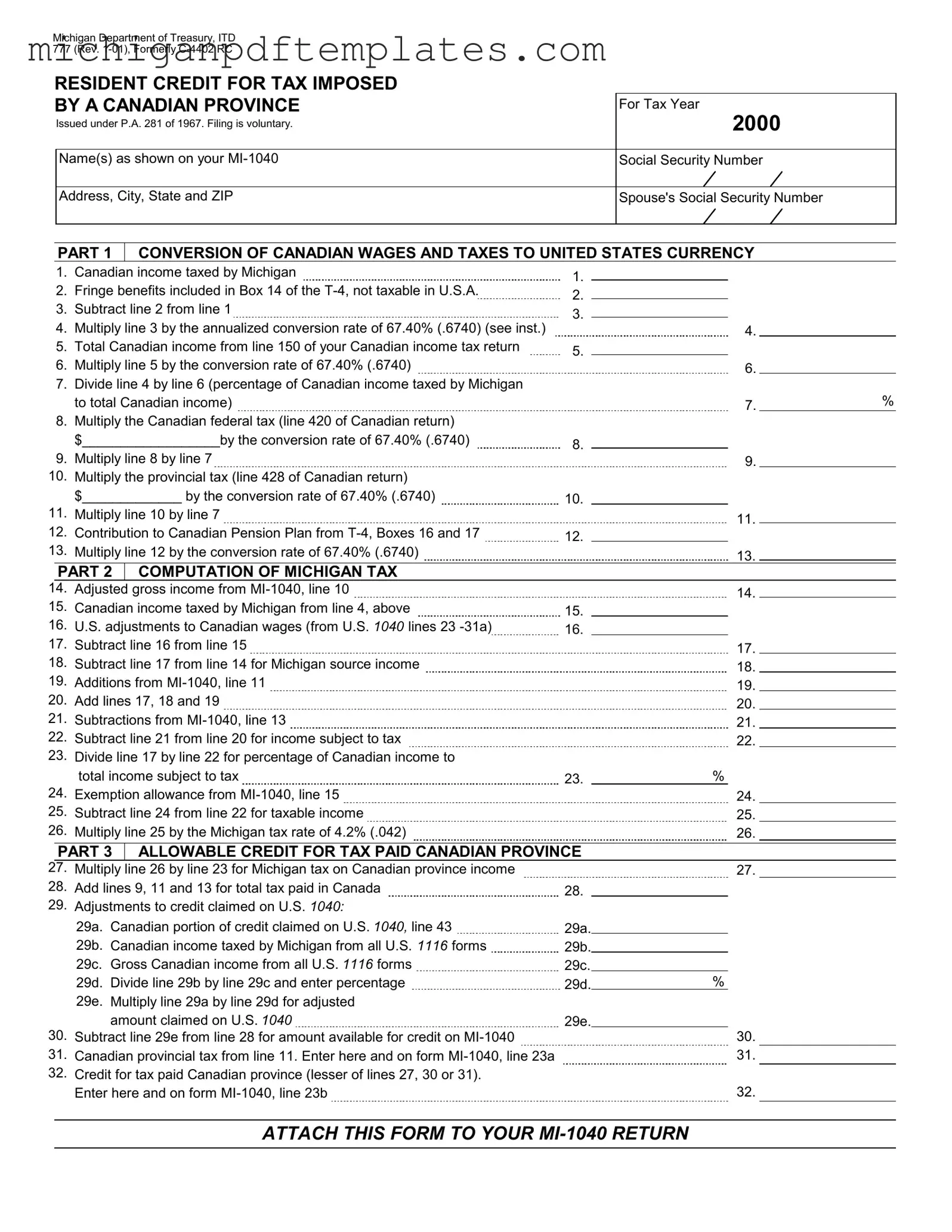

Fill in Your Michigan 777 Form

The Michigan 777 form, officially known as the ITD 777, is used to claim a resident credit for taxes imposed by a Canadian province. This form allows Michigan residents who have paid taxes in Canada to receive a credit against their Michigan tax liability. If you need to fill out the Michigan 777 form, please click the button below.

Get Your Form Now

Fill in Your Michigan 777 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 777 online quickly.