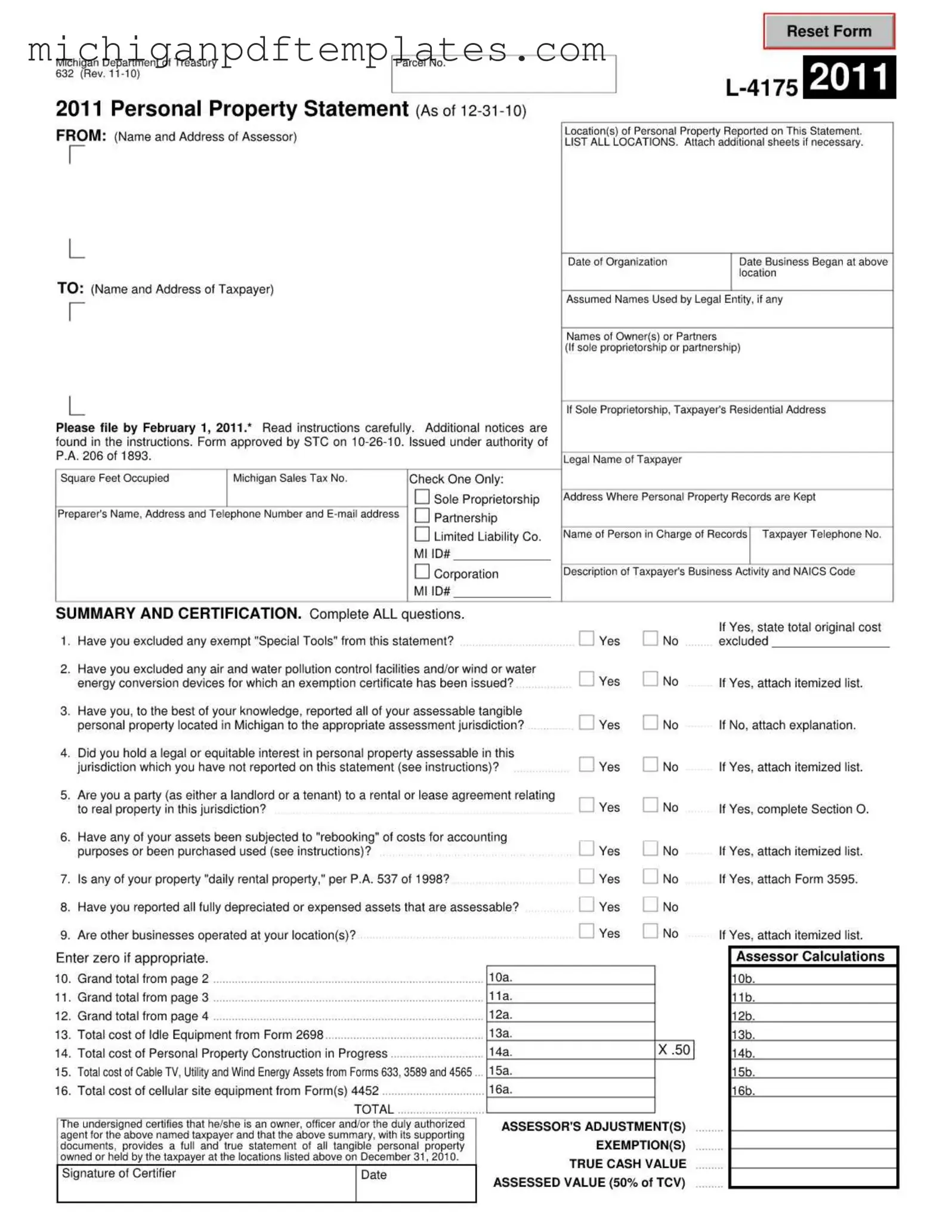

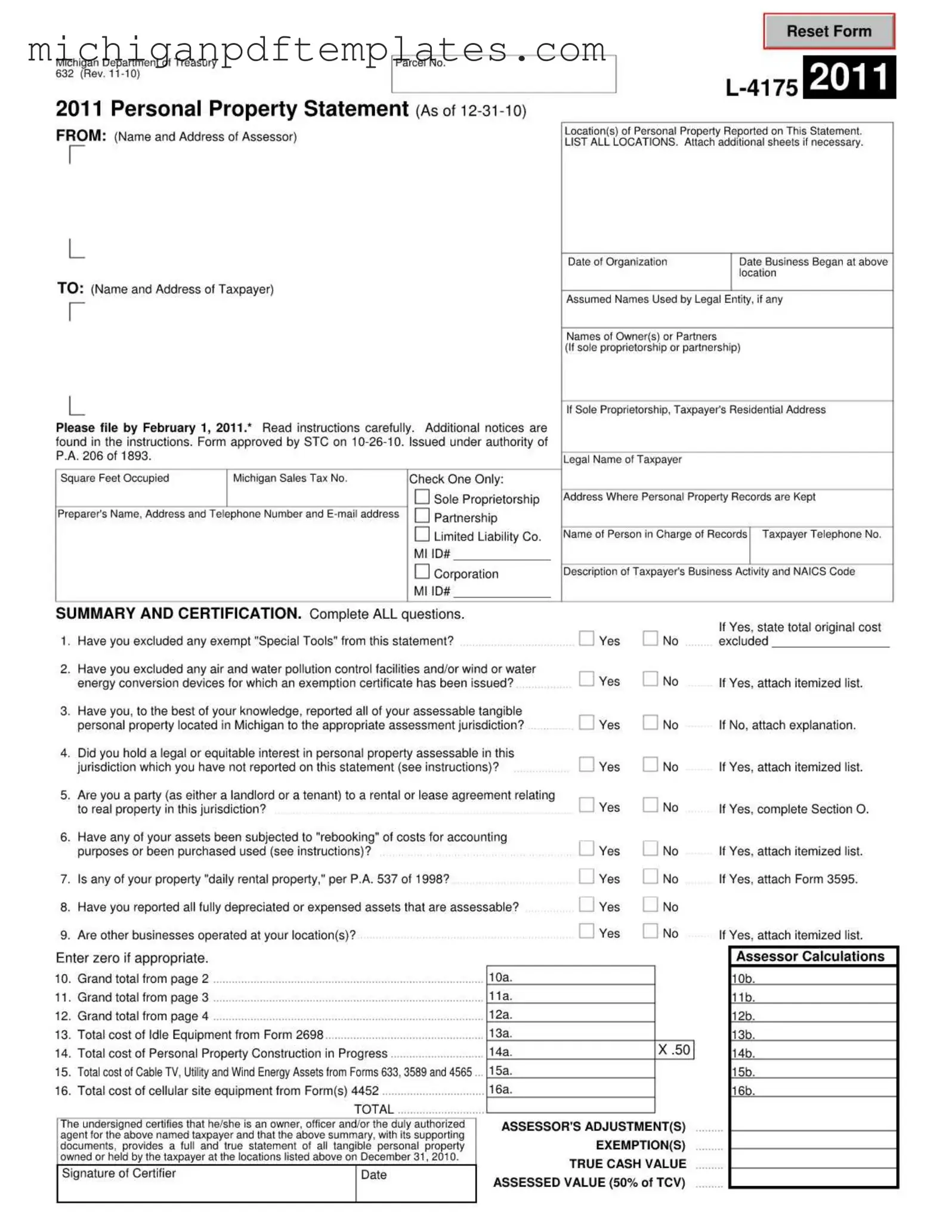

Fill in Your Michigan 632 Form

The Michigan 632 form is a crucial document used for reporting personal property owned by businesses in Michigan. This form ensures that all assessable tangible personal property is accurately reported to the appropriate assessment jurisdiction. Completing the Michigan 632 form is essential for compliance and to avoid potential penalties, so be sure to fill it out by the deadline.

Ready to get started? Click the button below to fill out the Michigan 632 form!

Get Your Form Now

Fill in Your Michigan 632 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 632 online quickly.