Fill in Your Michigan 5156 Form

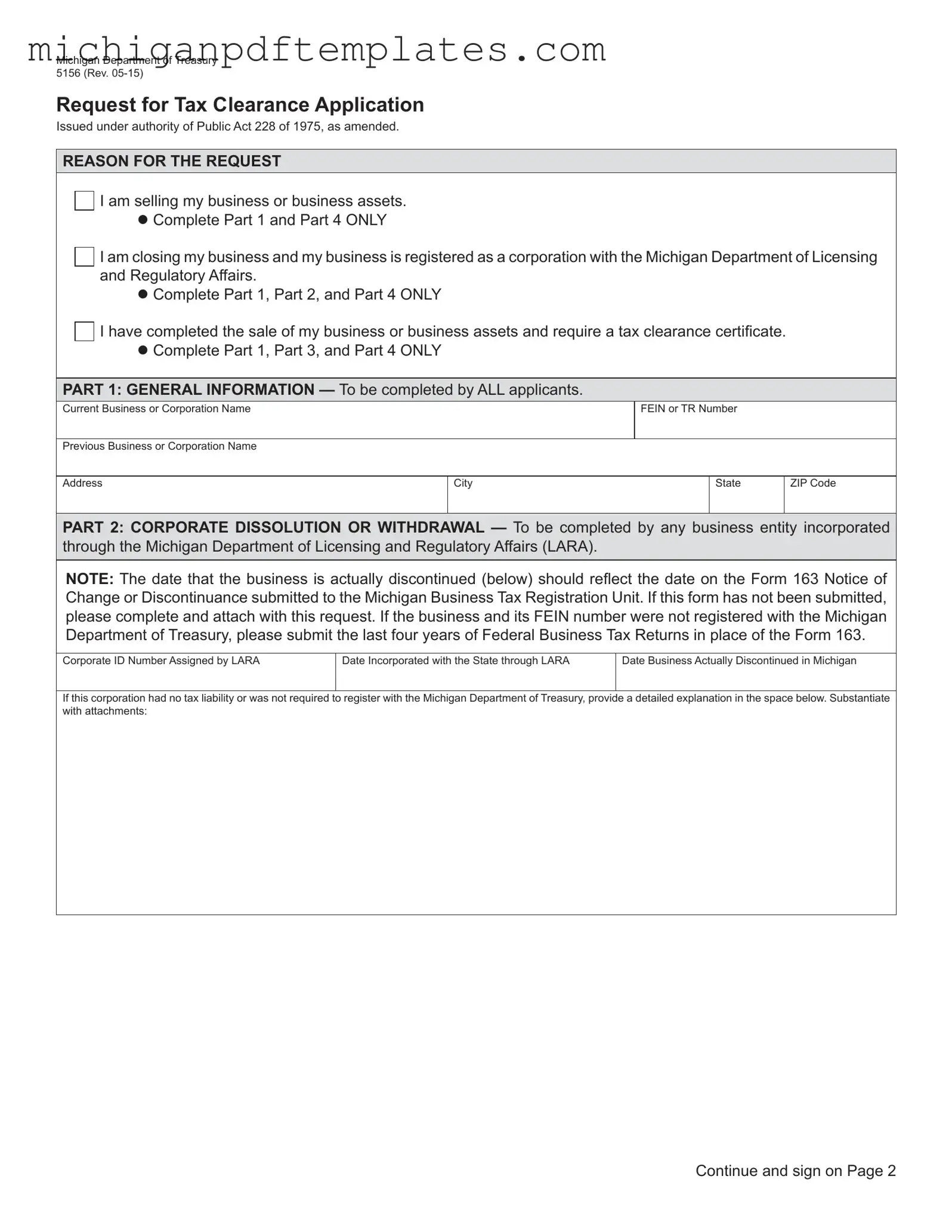

The Michigan Department of Treasury 5156 form is a Request for Tax Clearance Application, essential for businesses that are selling or closing their operations. This form helps ensure that all tax obligations are settled before the transfer of ownership or dissolution. Completing the 5156 form accurately is crucial for a smooth transition; fill it out by clicking the button below.

Get Your Form Now

Fill in Your Michigan 5156 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 5156 online quickly.