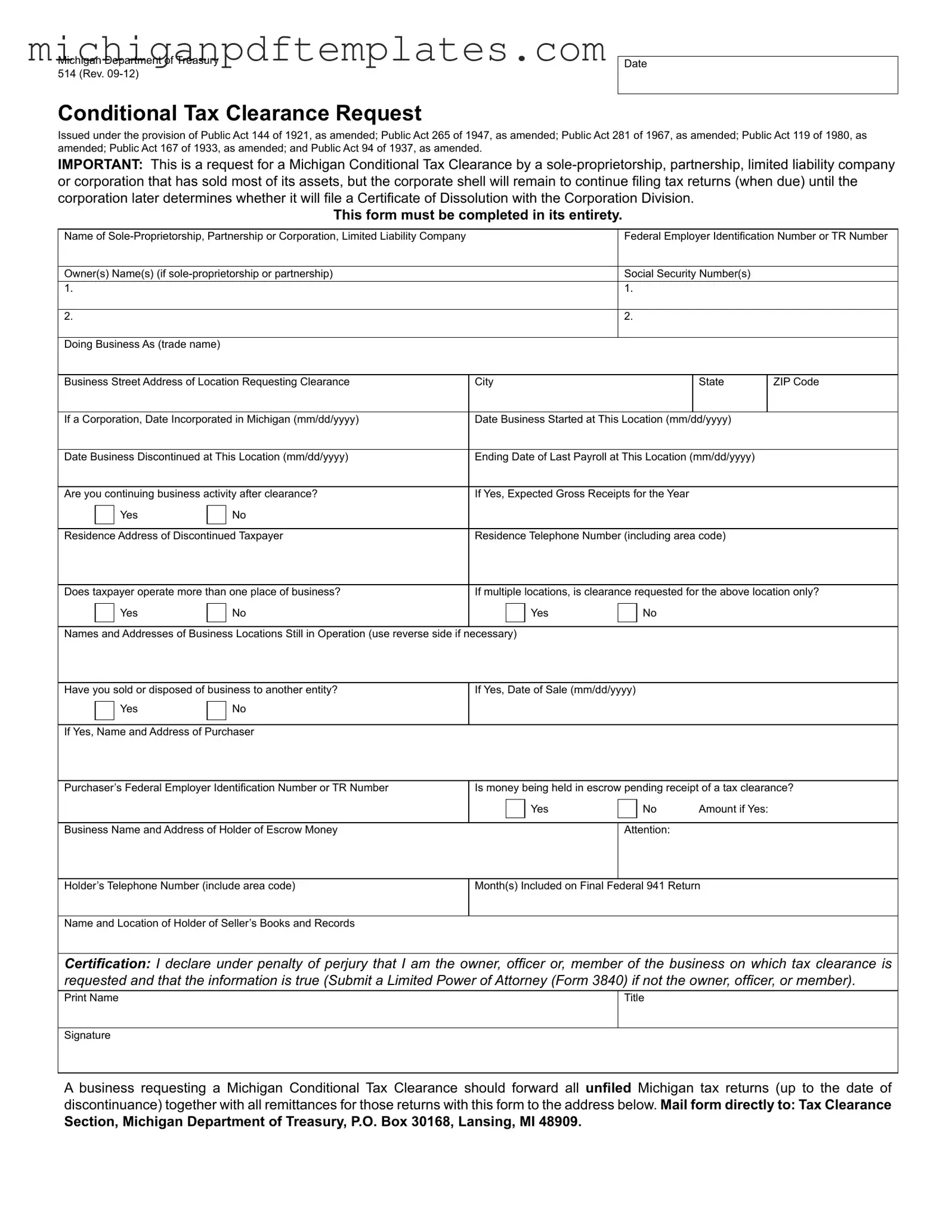

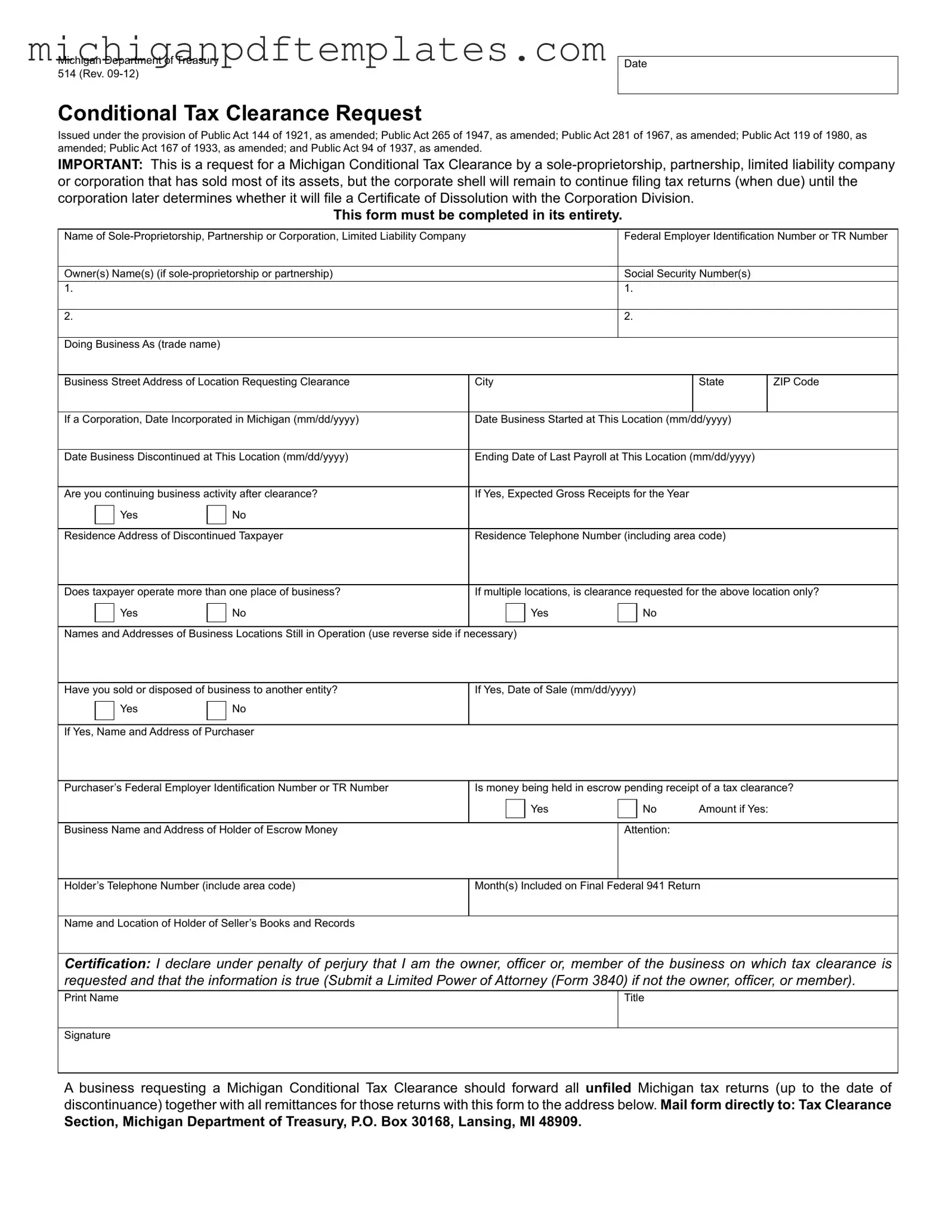

Fill in Your Michigan 514 Form

The Michigan 514 form is a Conditional Tax Clearance Request used by businesses in Michigan, including sole proprietorships, partnerships, and corporations, that have sold most of their assets but wish to maintain their corporate status while filing tax returns. This form is essential for ensuring that all tax obligations are settled before a business can proceed with certain transactions or dissolve. If you’re ready to navigate this process, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 514 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 514 online quickly.