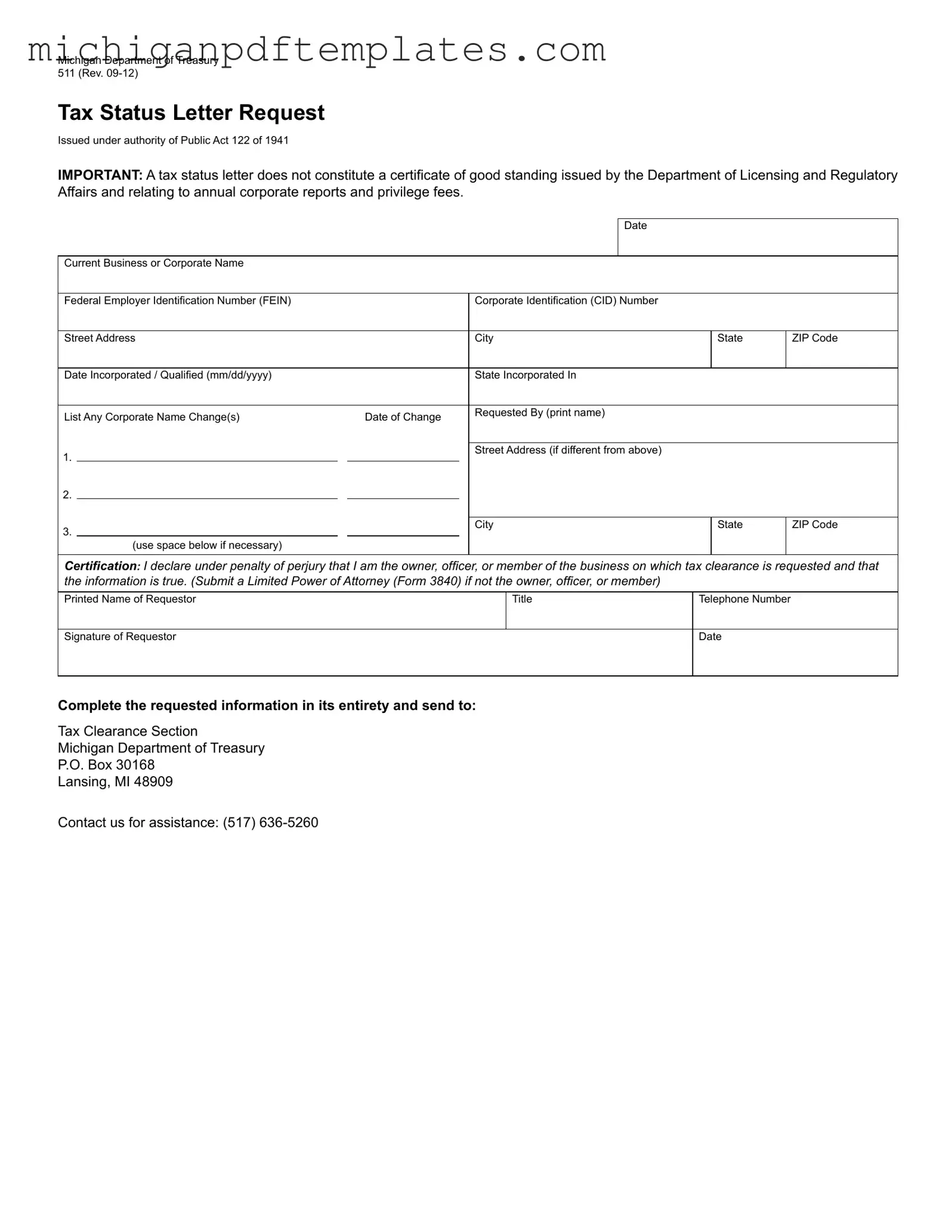

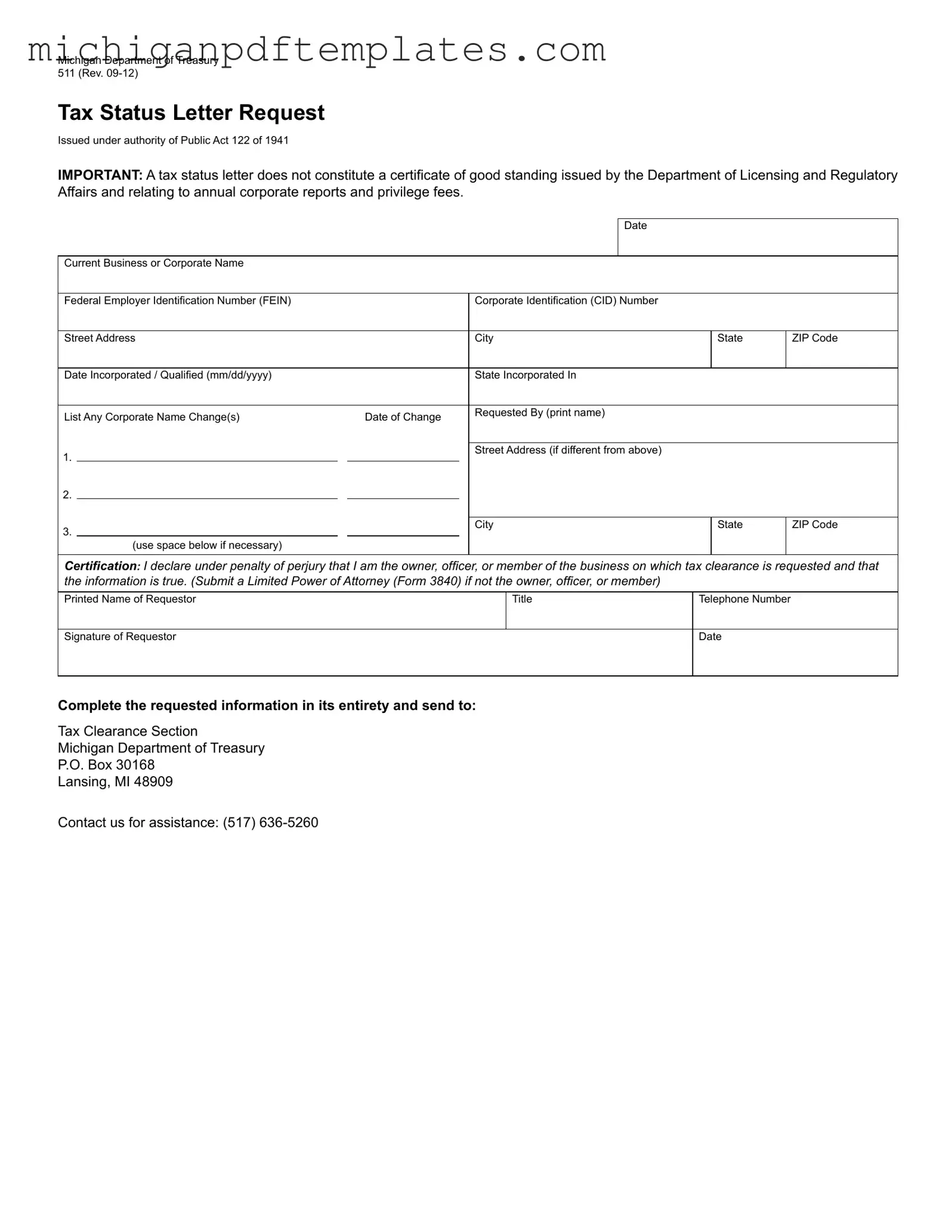

Fill in Your Michigan 511 Form

The Michigan 511 form is a request for a tax status letter from the Michigan Department of Treasury. This letter provides important information about a business's tax standing, but it is not the same as a certificate of good standing. If you need to fill out the Michigan 511 form, click the button below to get started.

Get Your Form Now

Fill in Your Michigan 511 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 511 online quickly.