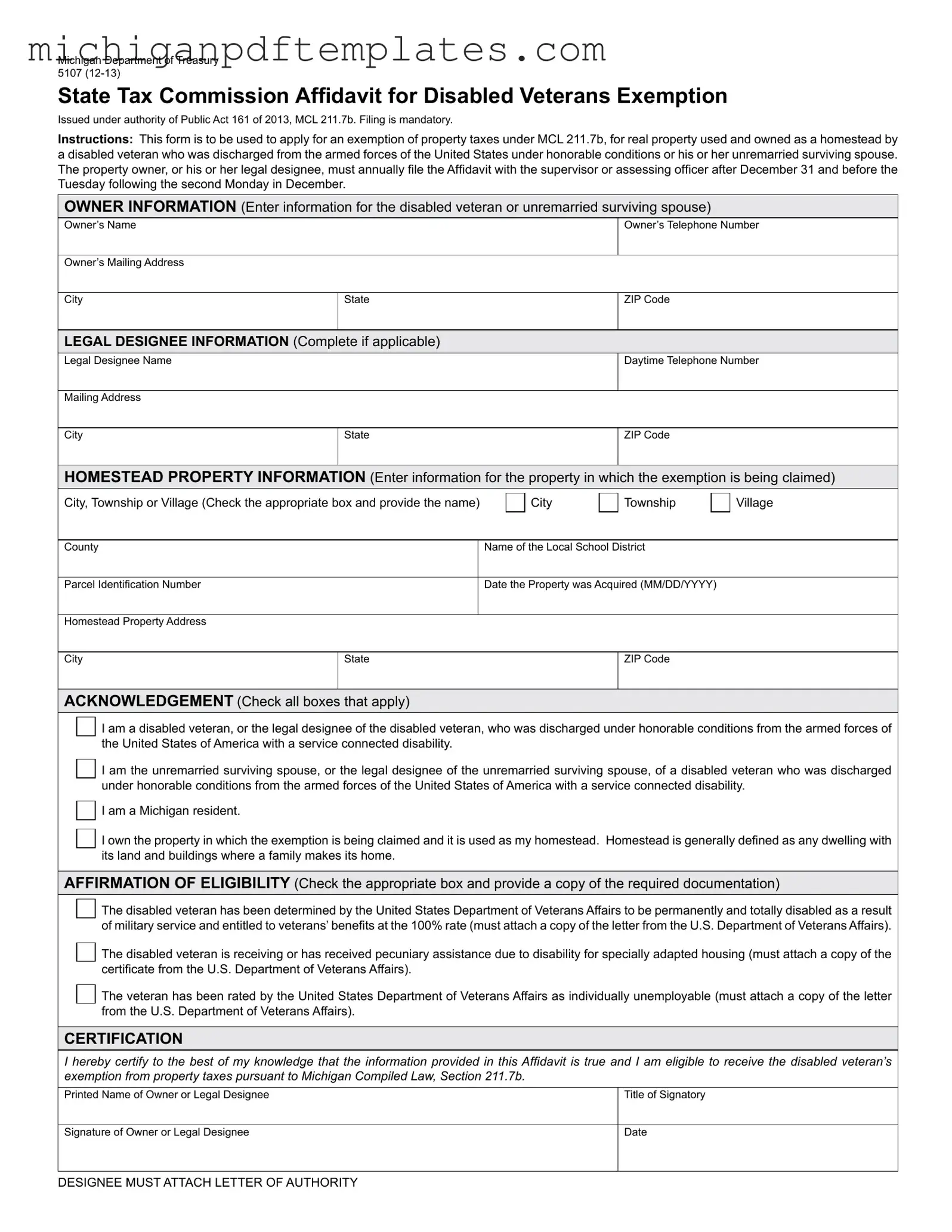

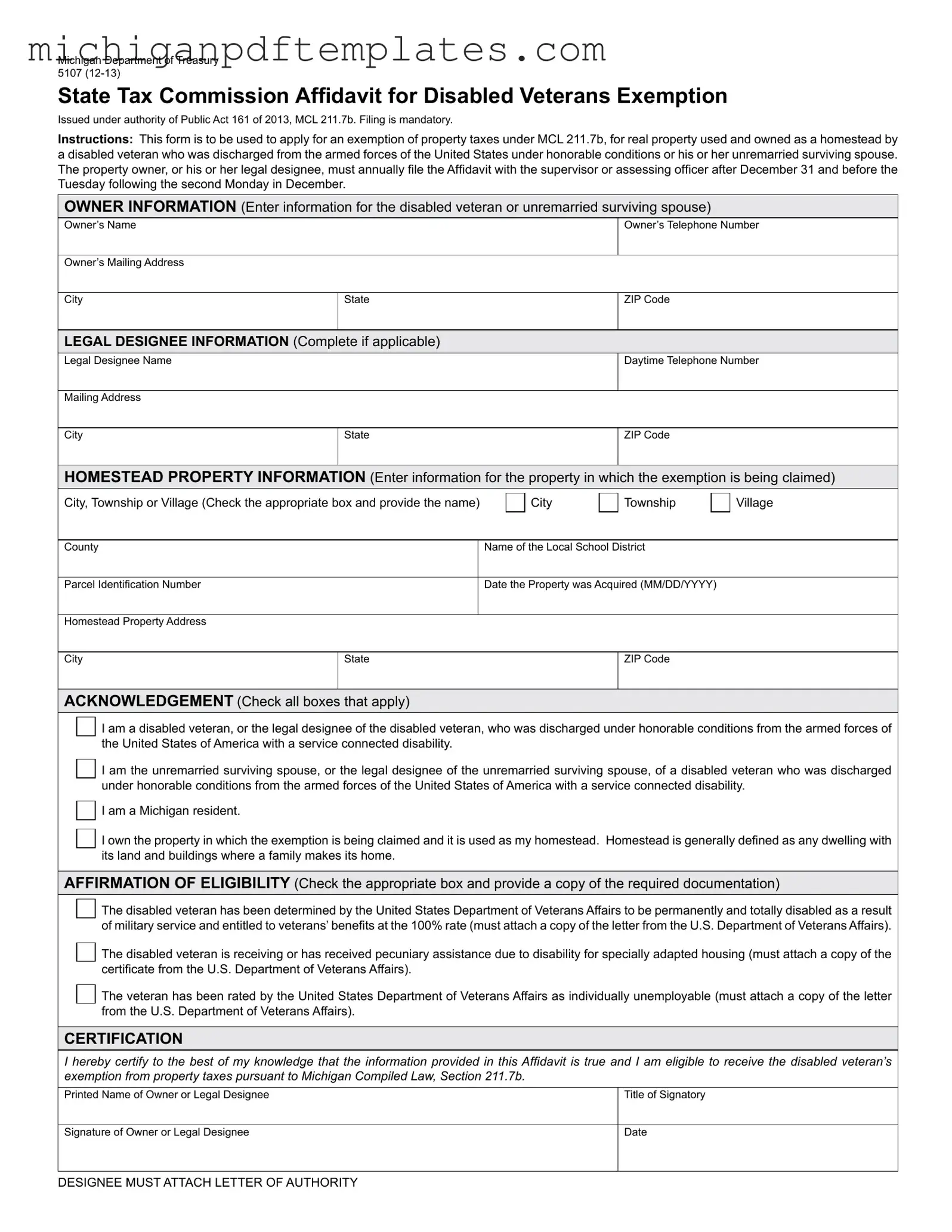

Fill in Your Michigan 5107 Form

The Michigan 5107 form is an essential document that allows disabled veterans and their unremarried surviving spouses to apply for an exemption from property taxes on their homestead. This affidavit, issued under Public Act 161 of 2013, ensures that those who have served honorably in the armed forces can benefit from financial relief. To take advantage of this exemption, complete the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 5107 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 5107 online quickly.