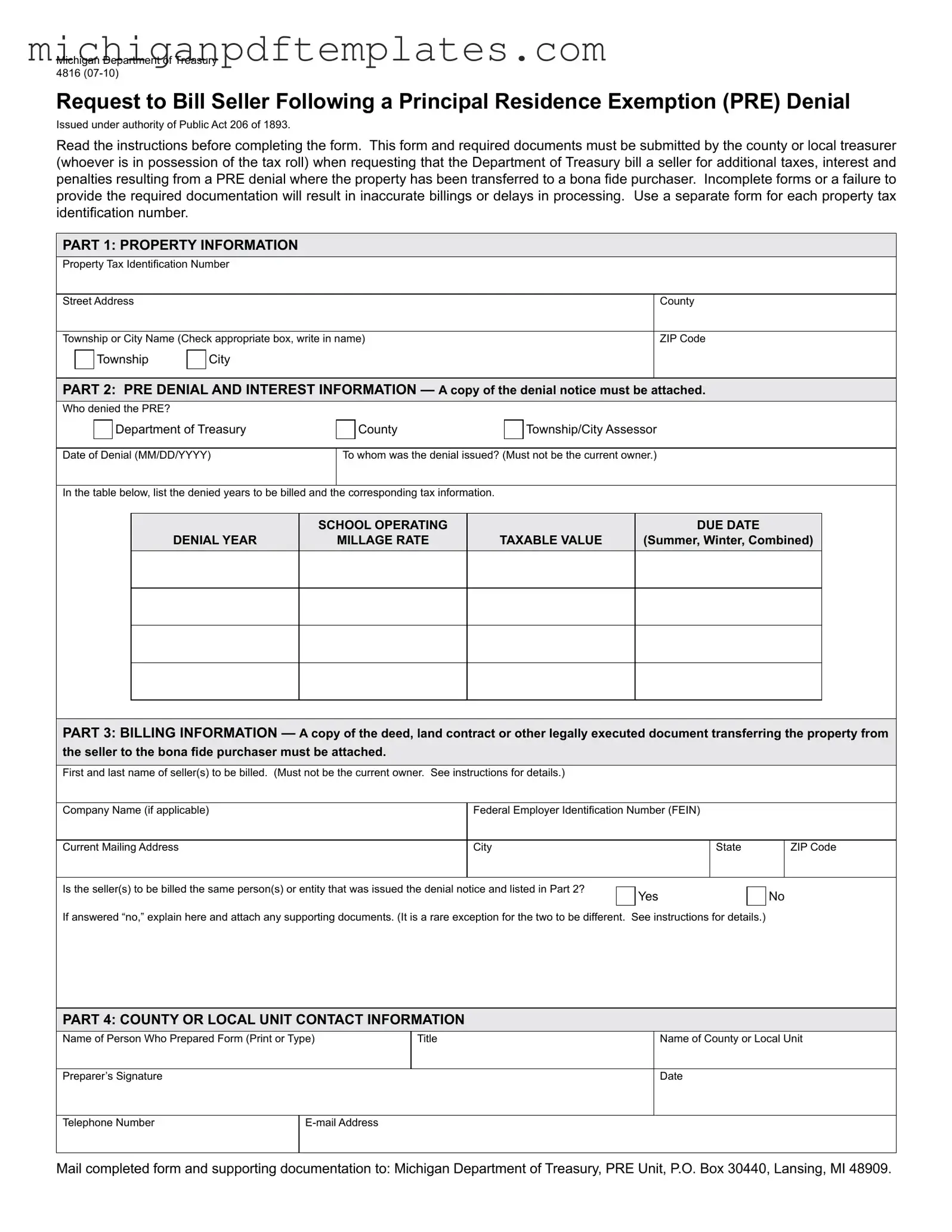

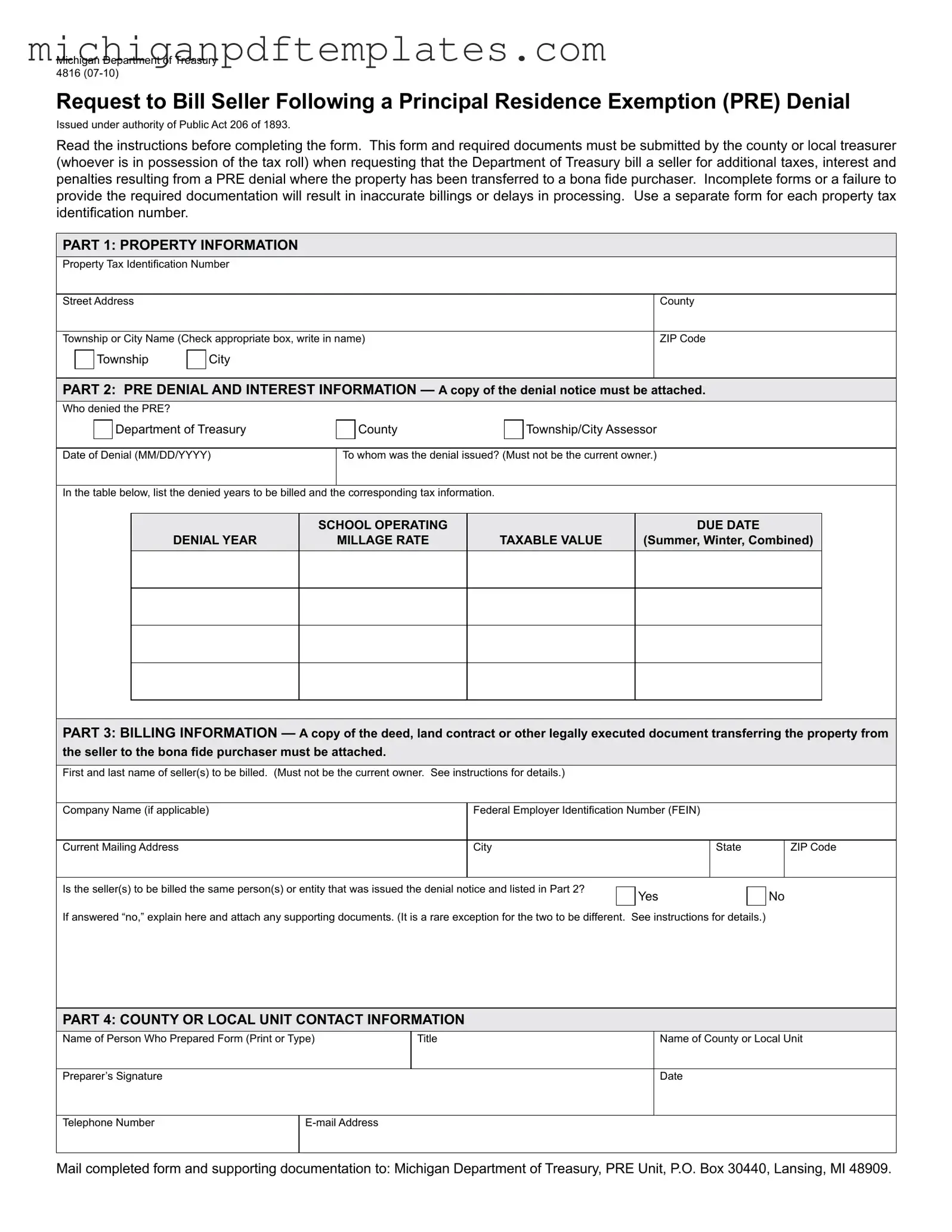

Fill in Your Michigan 4816 Form

The Michigan 4816 form is a request submitted to the Department of Treasury, specifically designed to bill a seller for additional taxes, interest, and penalties following a Principal Residence Exemption (PRE) denial. This form must be filled out by the county or local treasurer when the property in question has been transferred to a bona fide purchaser. Ensuring all required information and documentation is provided is essential for accurate processing and billing.

Ready to complete the Michigan 4816 form? Click the button below to get started.

Get Your Form Now

Fill in Your Michigan 4816 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 4816 online quickly.