Fill in Your Michigan 4652 Form

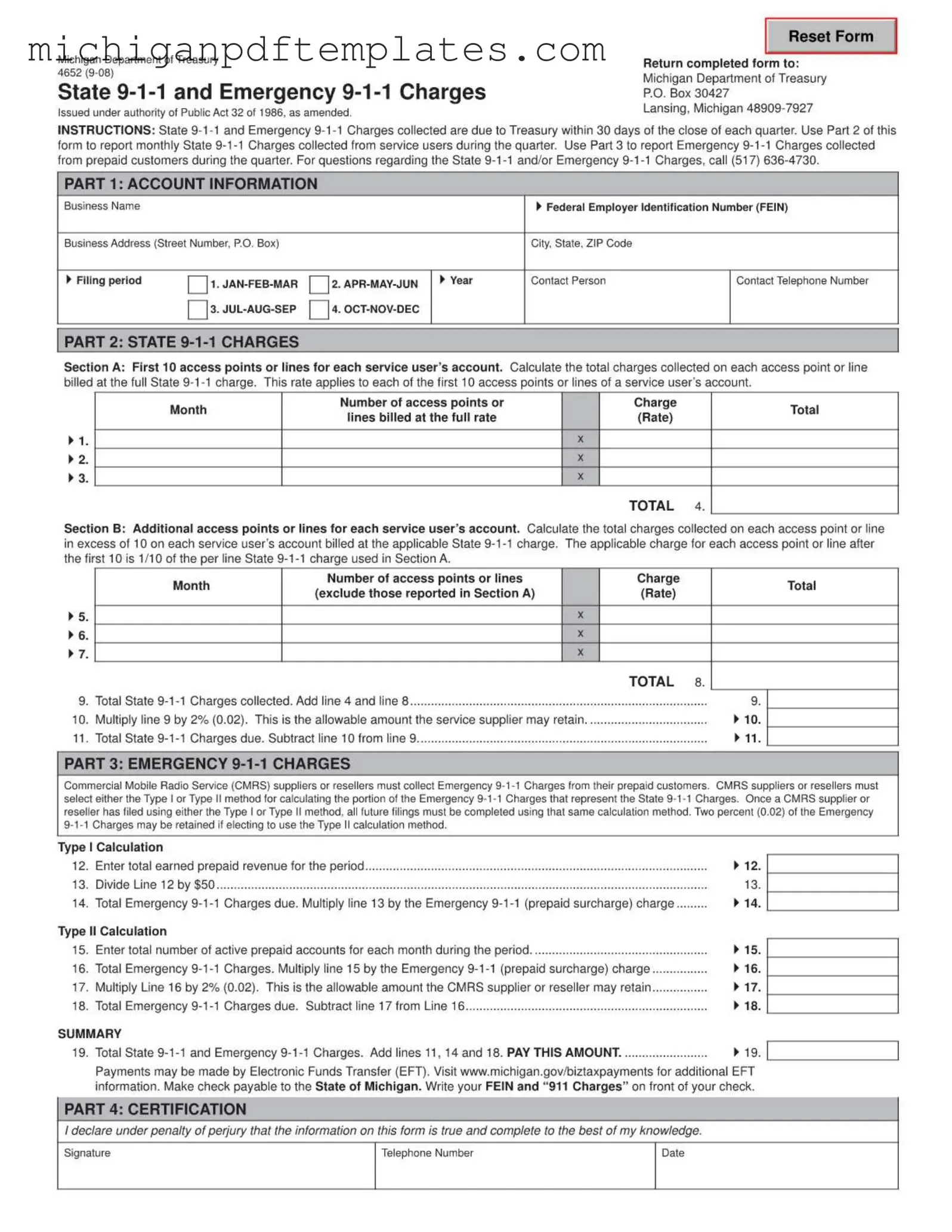

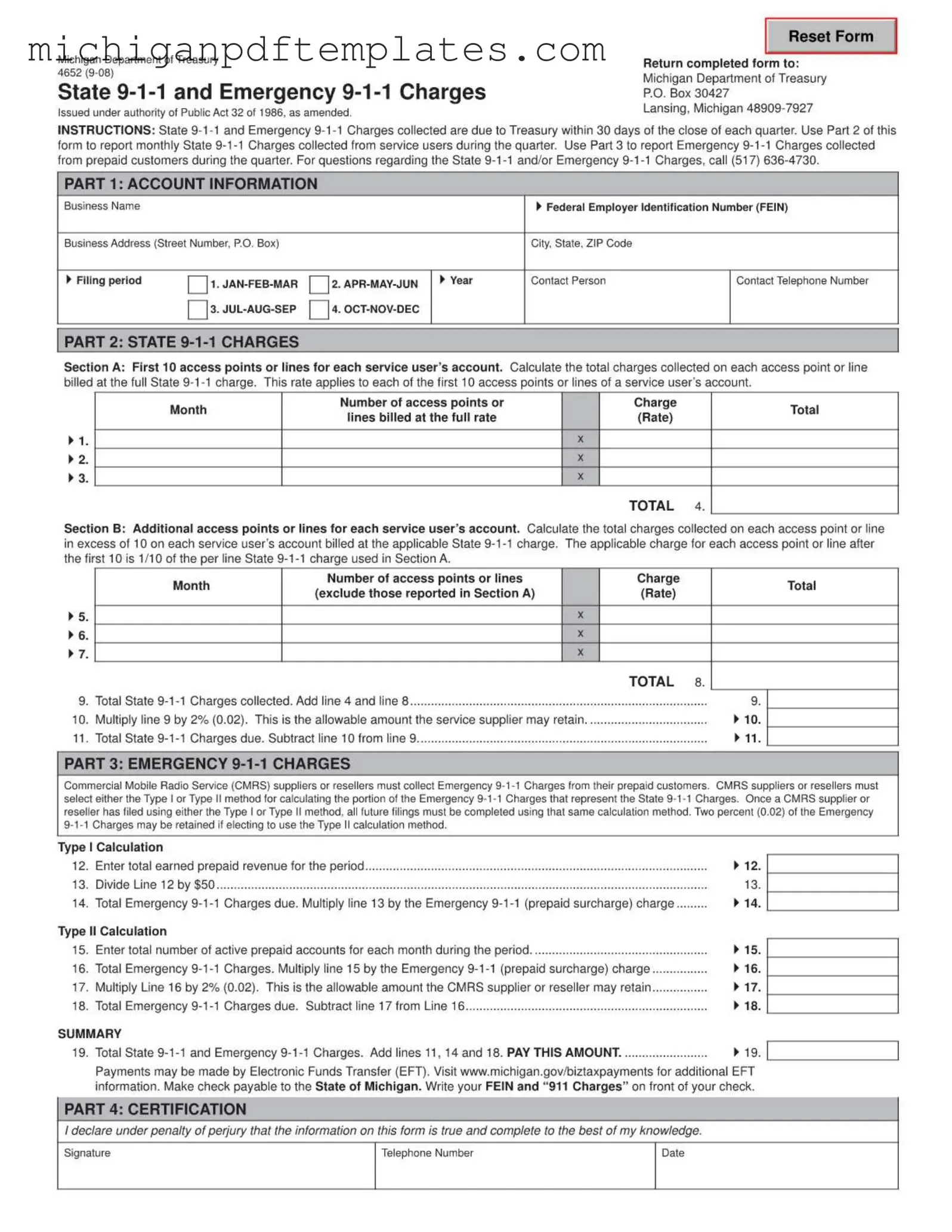

The Michigan 4652 form is a document used to report State and Emergency 9-1-1 charges collected by service providers. This form is essential for ensuring compliance with Public Act 32 of 1986, which mandates the timely reporting of these charges to the Michigan Department of Treasury. To fulfill your obligations, complete the form and submit it by the deadline specified.

Ready to get started? Fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 4652 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 4652 online quickly.