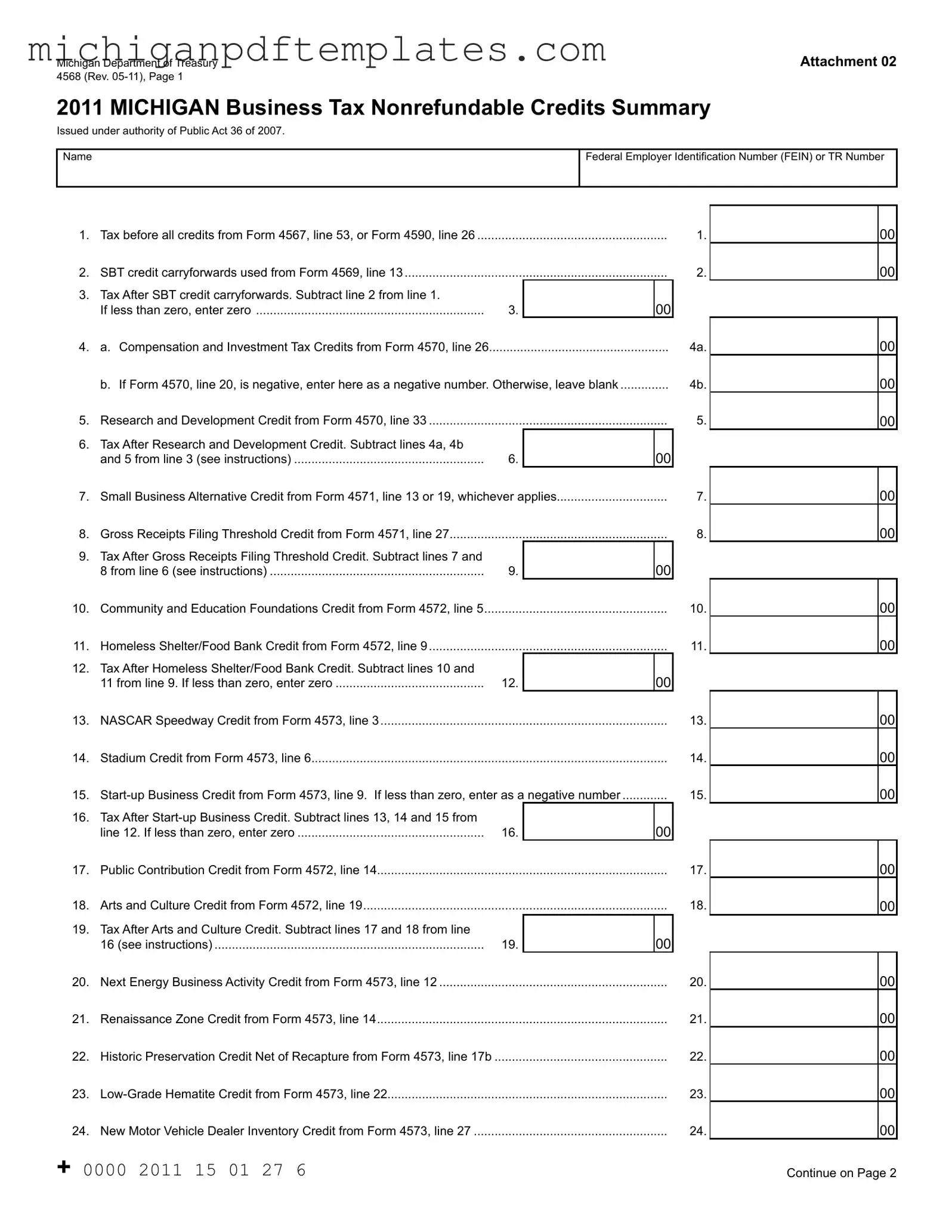

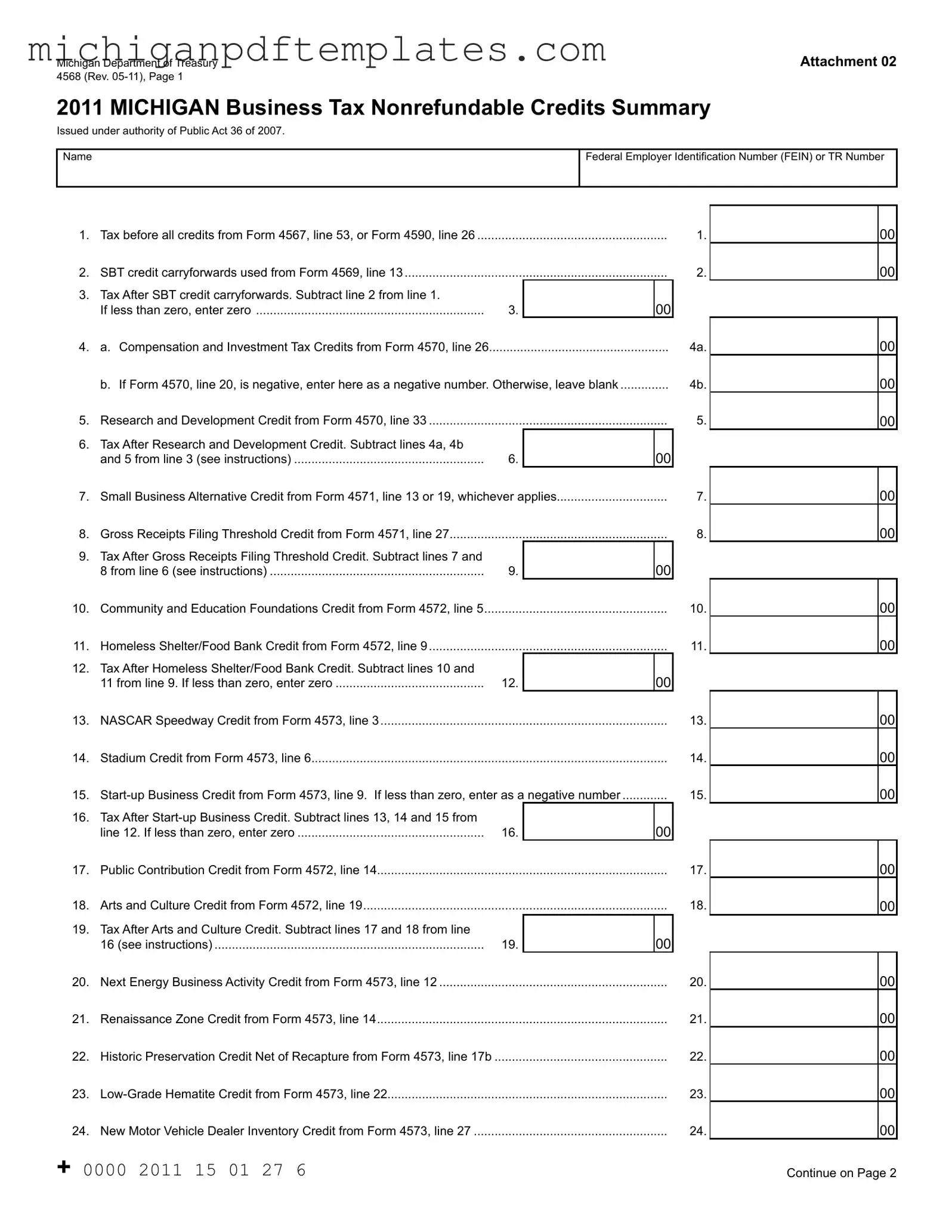

Fill in Your Michigan 4568 Form

The Michigan 4568 form is a summary used by businesses to report nonrefundable tax credits under the Michigan Business Tax. This form helps determine a taxpayer's liability after applying various credits, ensuring that all eligible deductions are accurately accounted for. Completing this form correctly can significantly impact your tax obligations, so it’s important to fill it out carefully.

Ready to take the next step? Fill out the Michigan 4568 form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 4568 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 4568 online quickly.