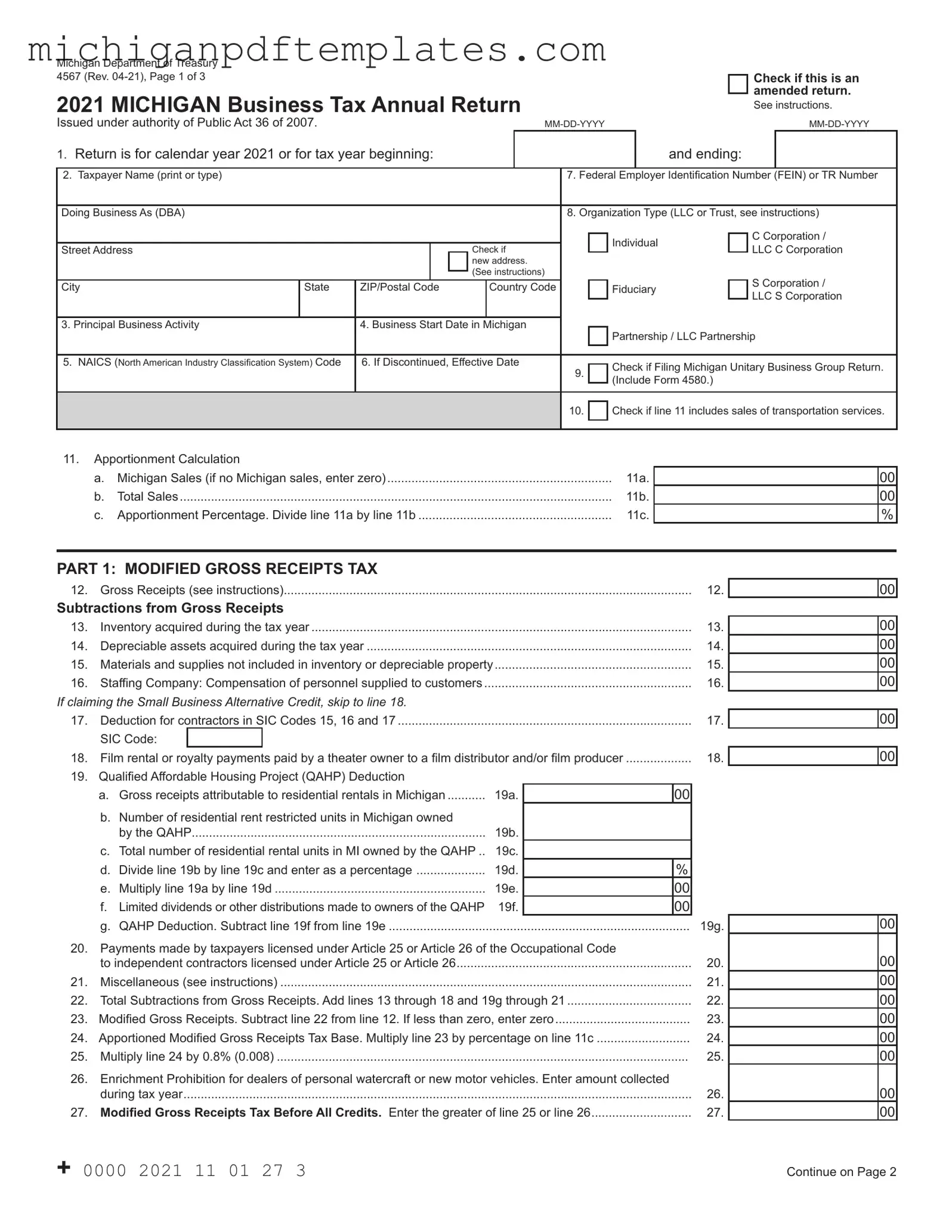

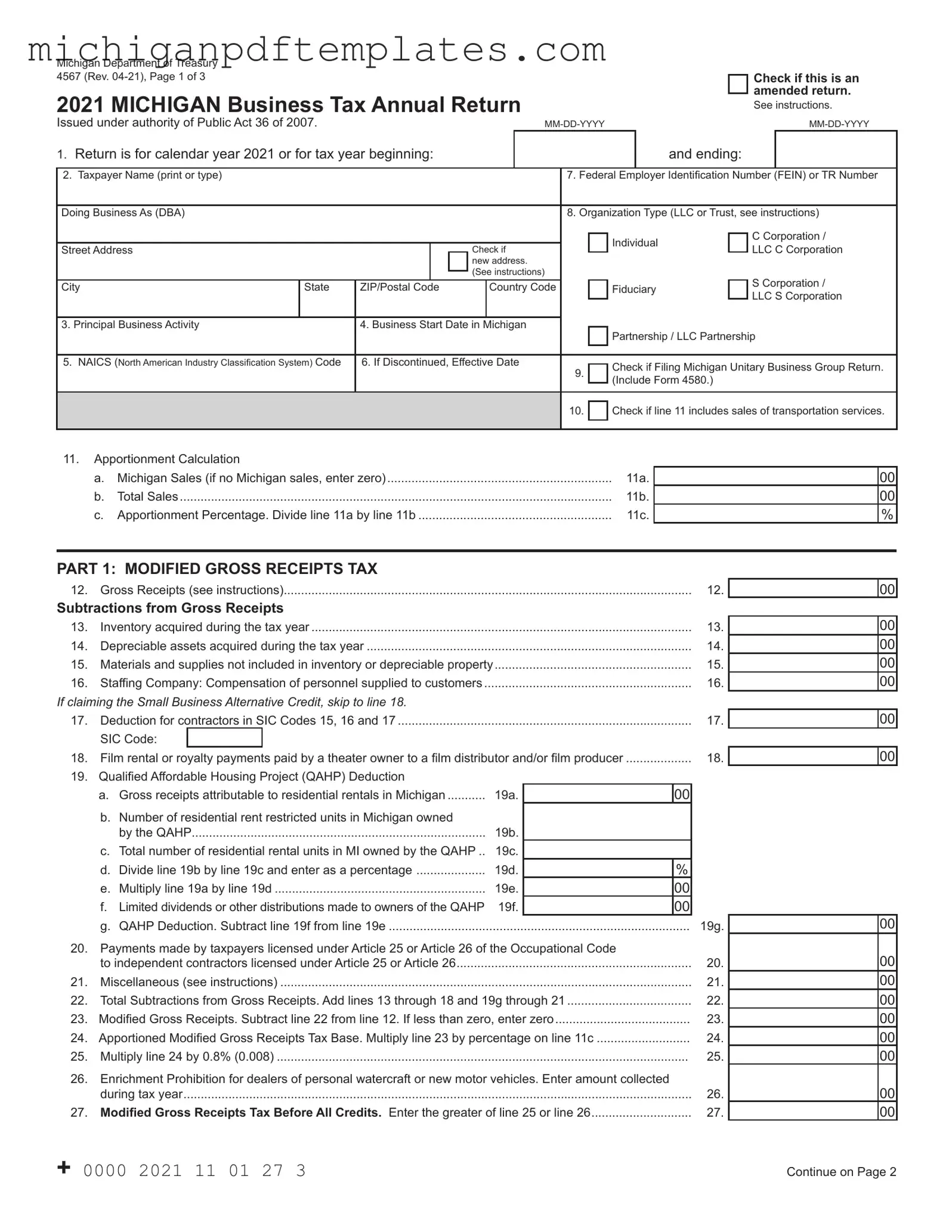

Fill in Your Michigan 4567 Form

The Michigan Department of Treasury Form 4567 is the Annual Return for the Michigan Business Tax (MBT). This form is essential for businesses operating in Michigan to report their modified gross receipts tax and business income tax. Understanding how to fill it out accurately can help ensure compliance and avoid potential penalties.

Ready to get started? Fill out the Michigan 4567 form by clicking the button below!

Get Your Form Now

Fill in Your Michigan 4567 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 4567 online quickly.