Fill in Your Michigan 4106 Form

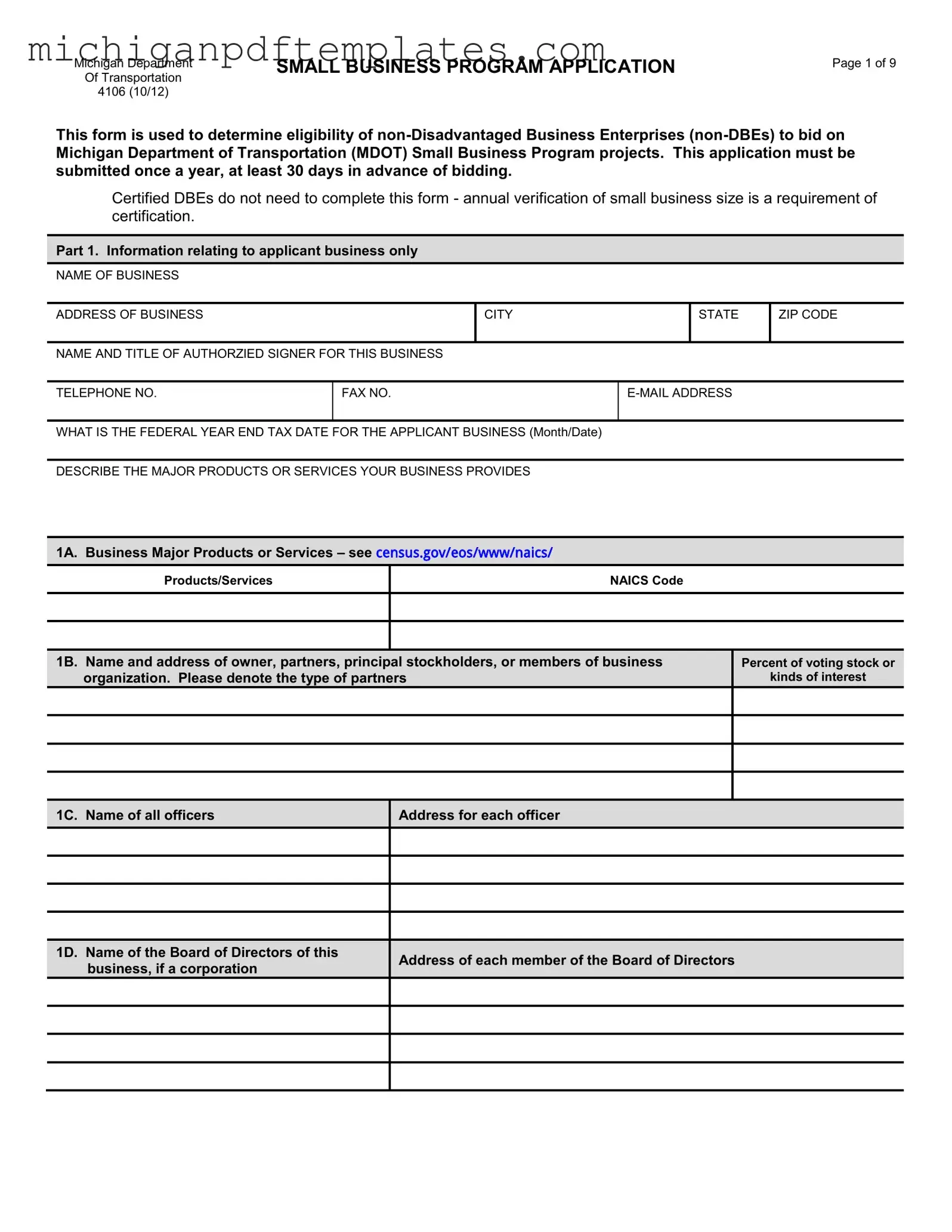

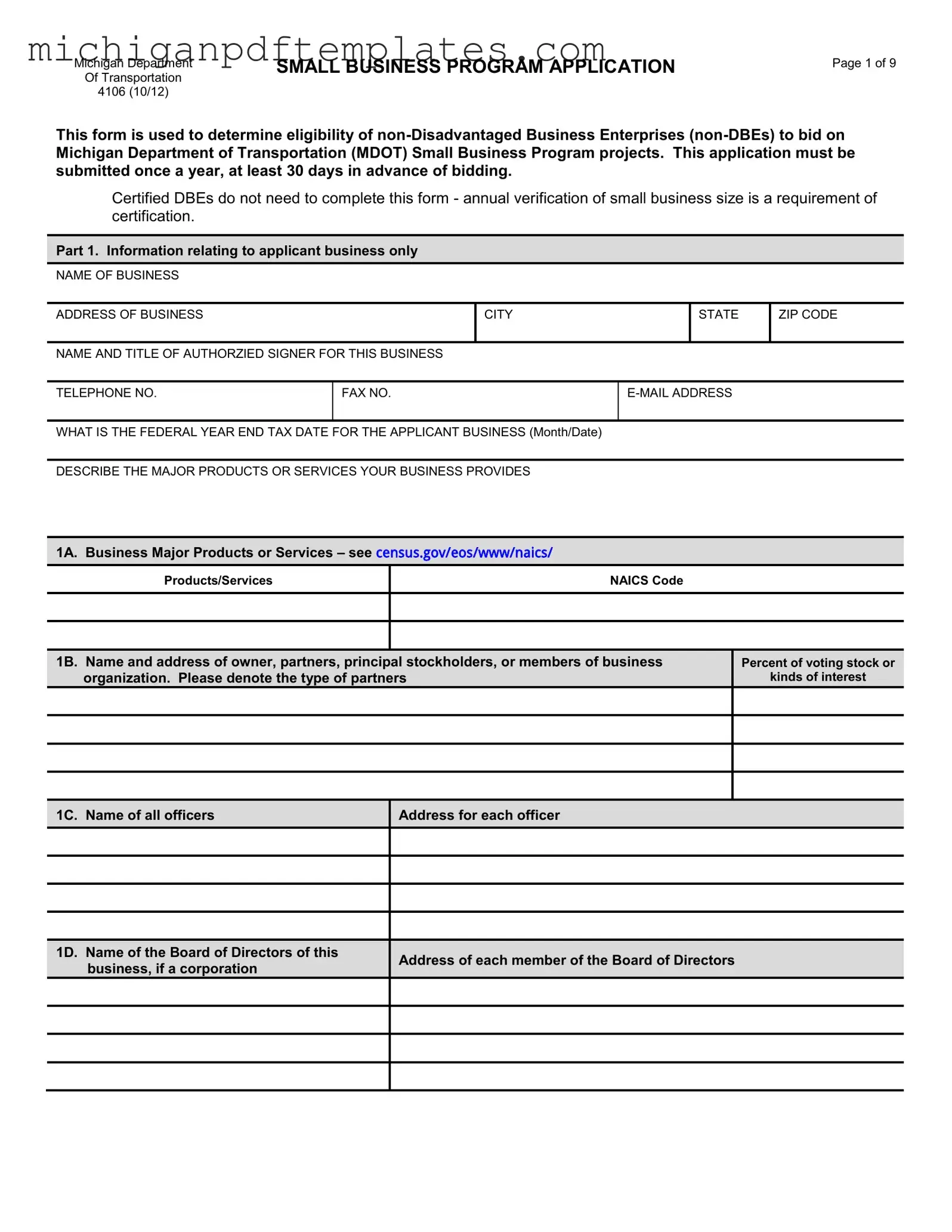

The Michigan 4106 form is an application used by non-Disadvantaged Business Enterprises (non-DBEs) to establish their eligibility for participation in the Michigan Department of Transportation's (MDOT) Small Business Program. This form must be submitted annually, at least 30 days before bidding on MDOT projects. Understanding the requirements and details of this form is essential for businesses looking to take advantage of the opportunities available through this program.

Ready to get started? Fill out the Michigan 4106 form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 4106 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 4106 online quickly.