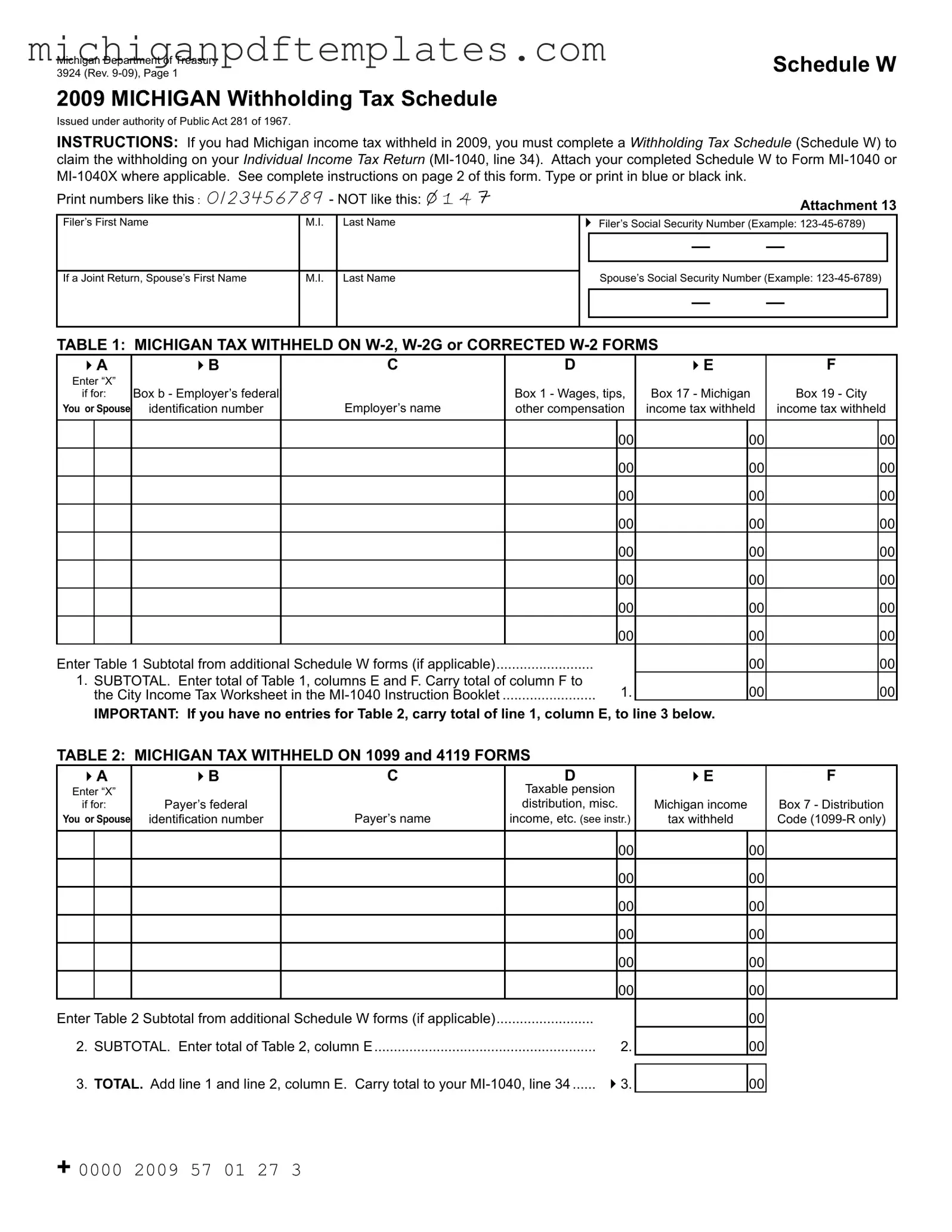

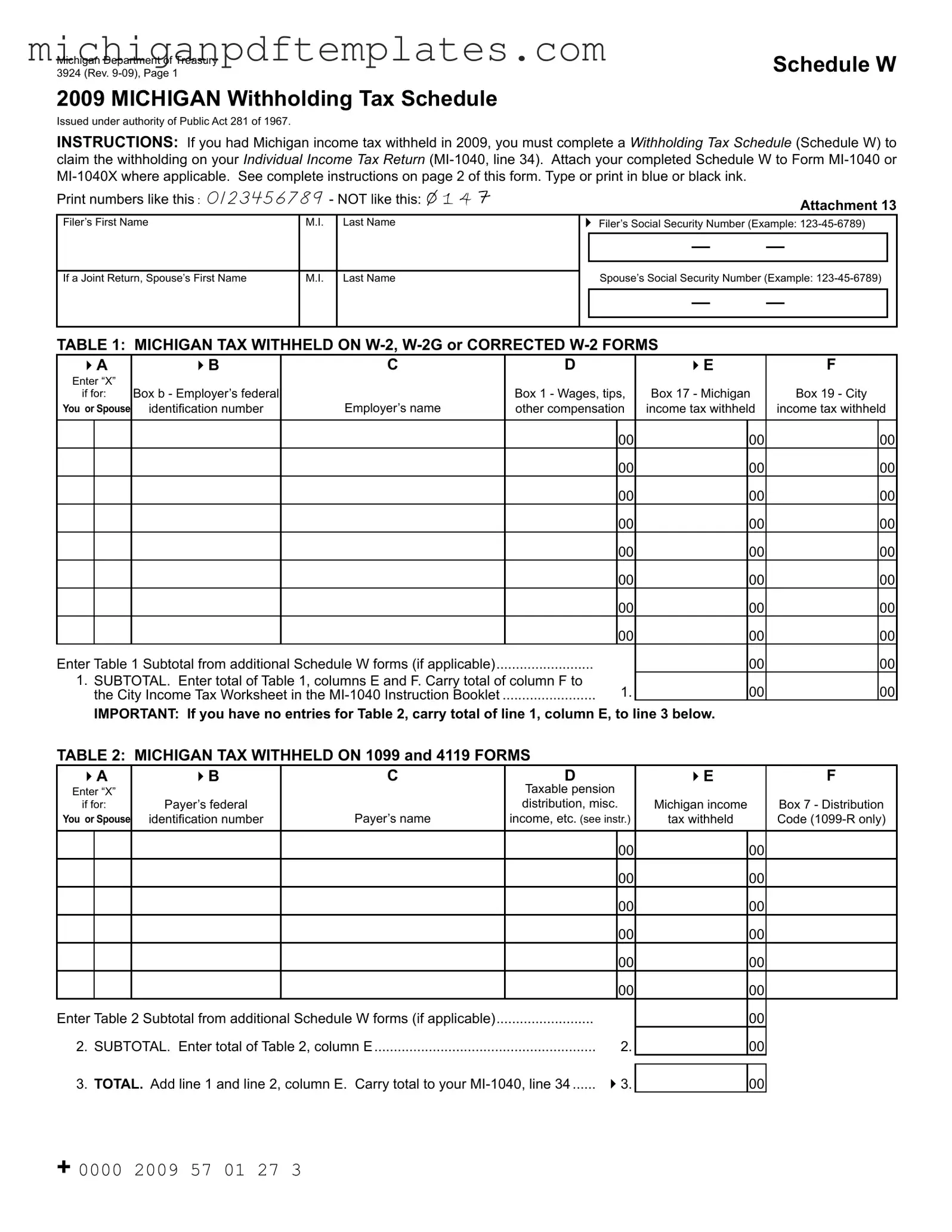

Fill in Your Michigan 3924 Form

The Michigan 3924 form, also known as the Withholding Tax Schedule, is a crucial document for individuals who had Michigan income tax withheld. This form allows you to report the amount of state and city income tax that has been deducted from your earnings, ensuring that you can claim these withholdings on your Individual Income Tax Return. Completing this form accurately is essential for a smooth tax filing process, so be sure to fill it out by clicking the button below.

Get Your Form Now

Fill in Your Michigan 3924 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 3924 online quickly.