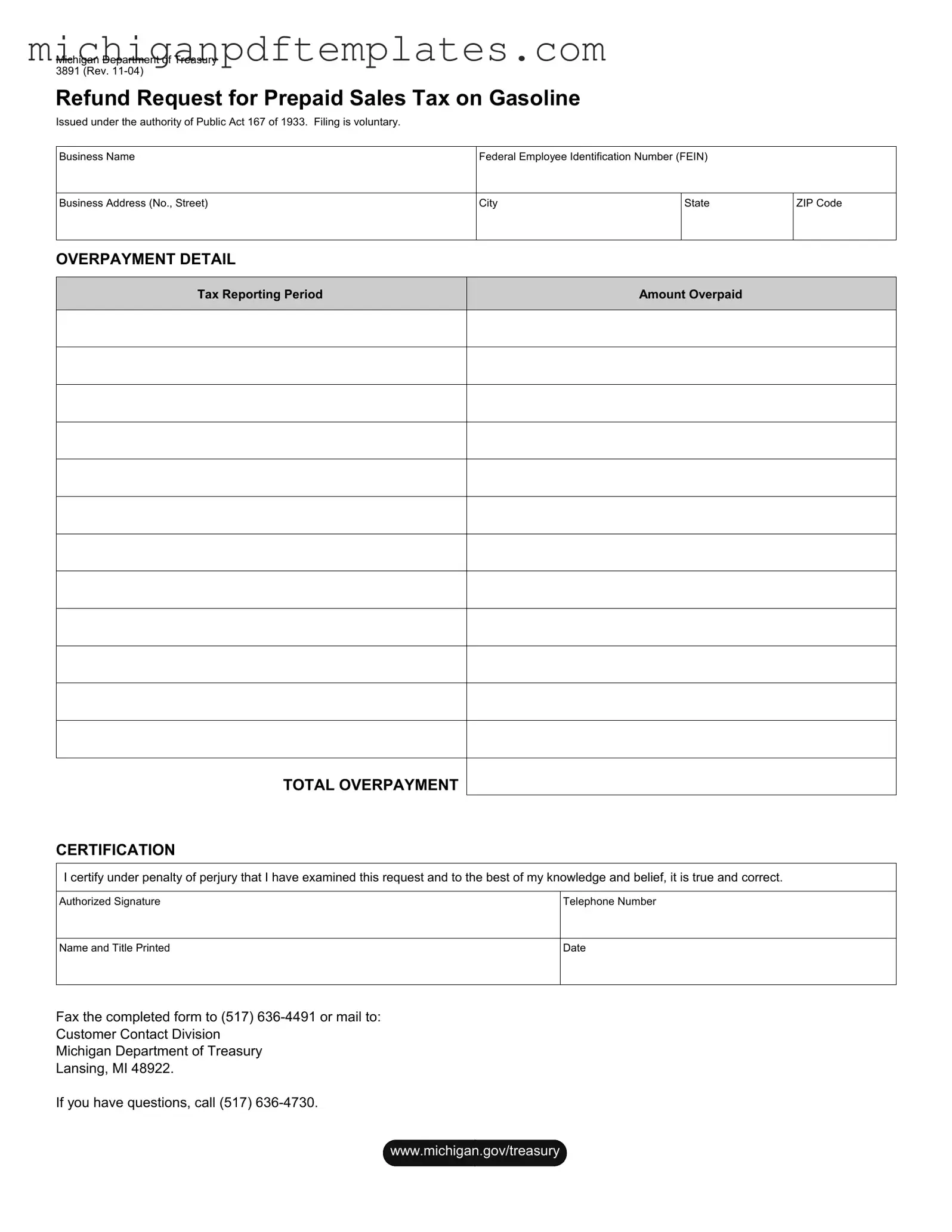

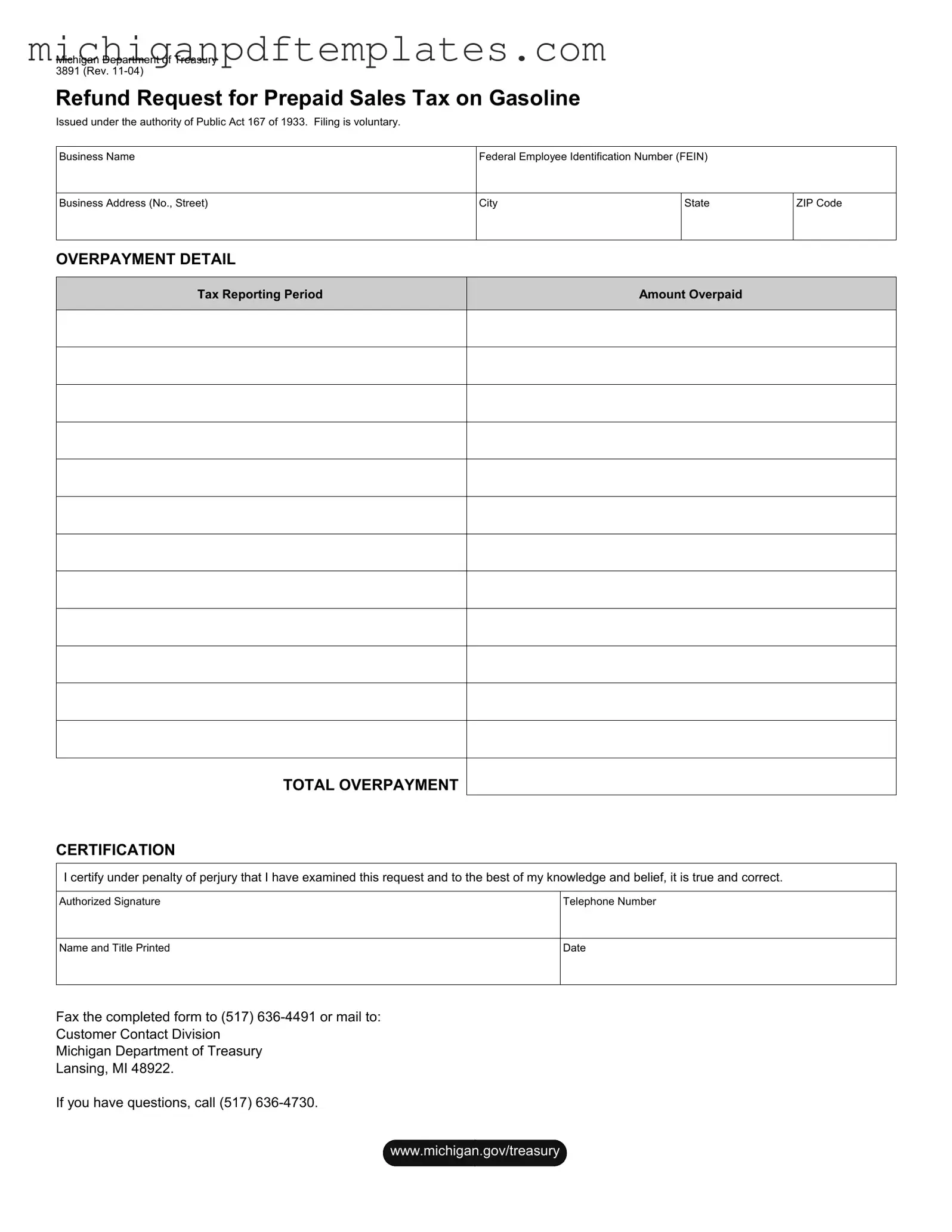

Fill in Your Michigan 3891 Form

The Michigan Department of Treasury 3891 form is a Refund Request for Prepaid Sales Tax on Gasoline, designed for businesses that have overpaid this tax. This form, issued under the authority of Public Act 167 of 1933, allows businesses to reclaim funds through a voluntary filing process. To initiate your refund, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 3891 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 3891 online quickly.