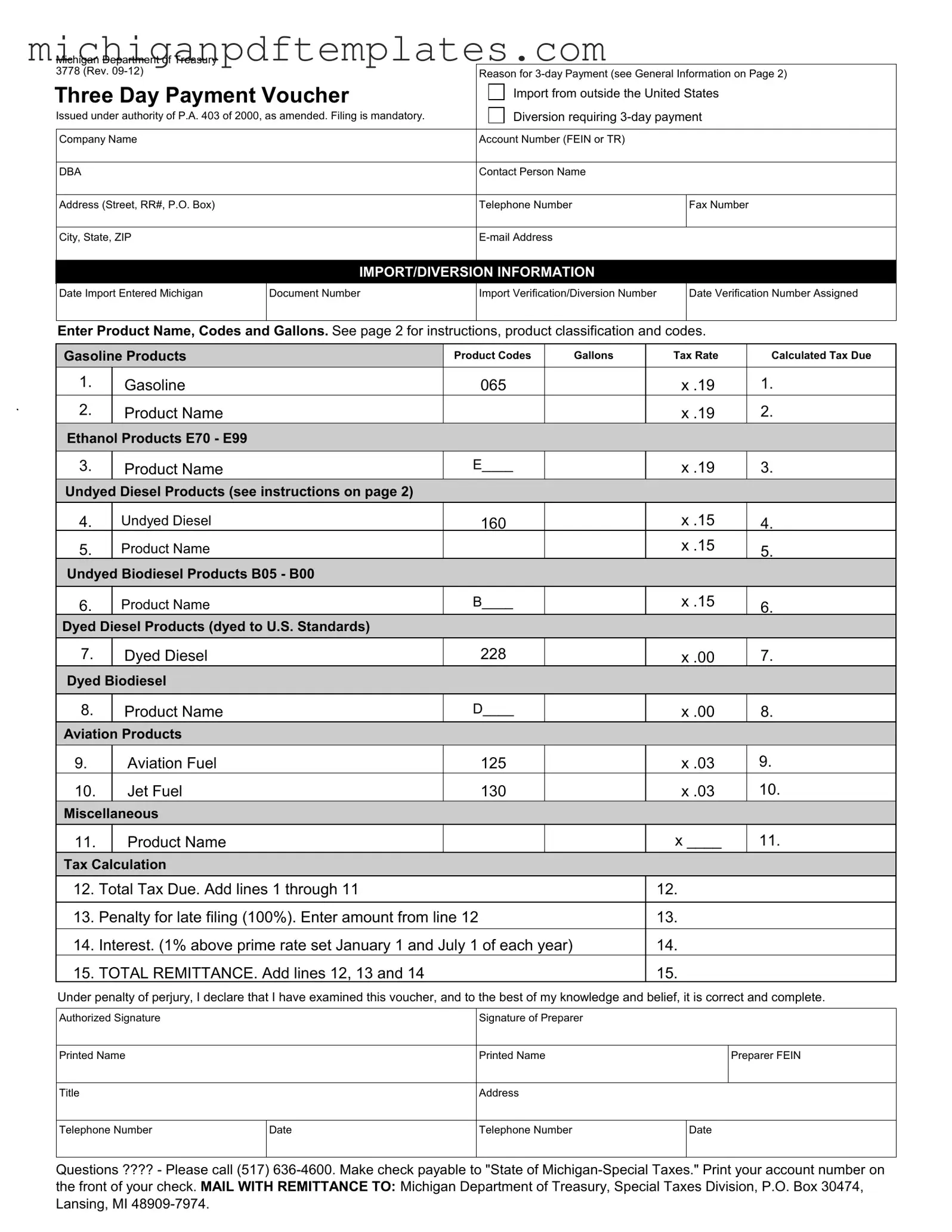

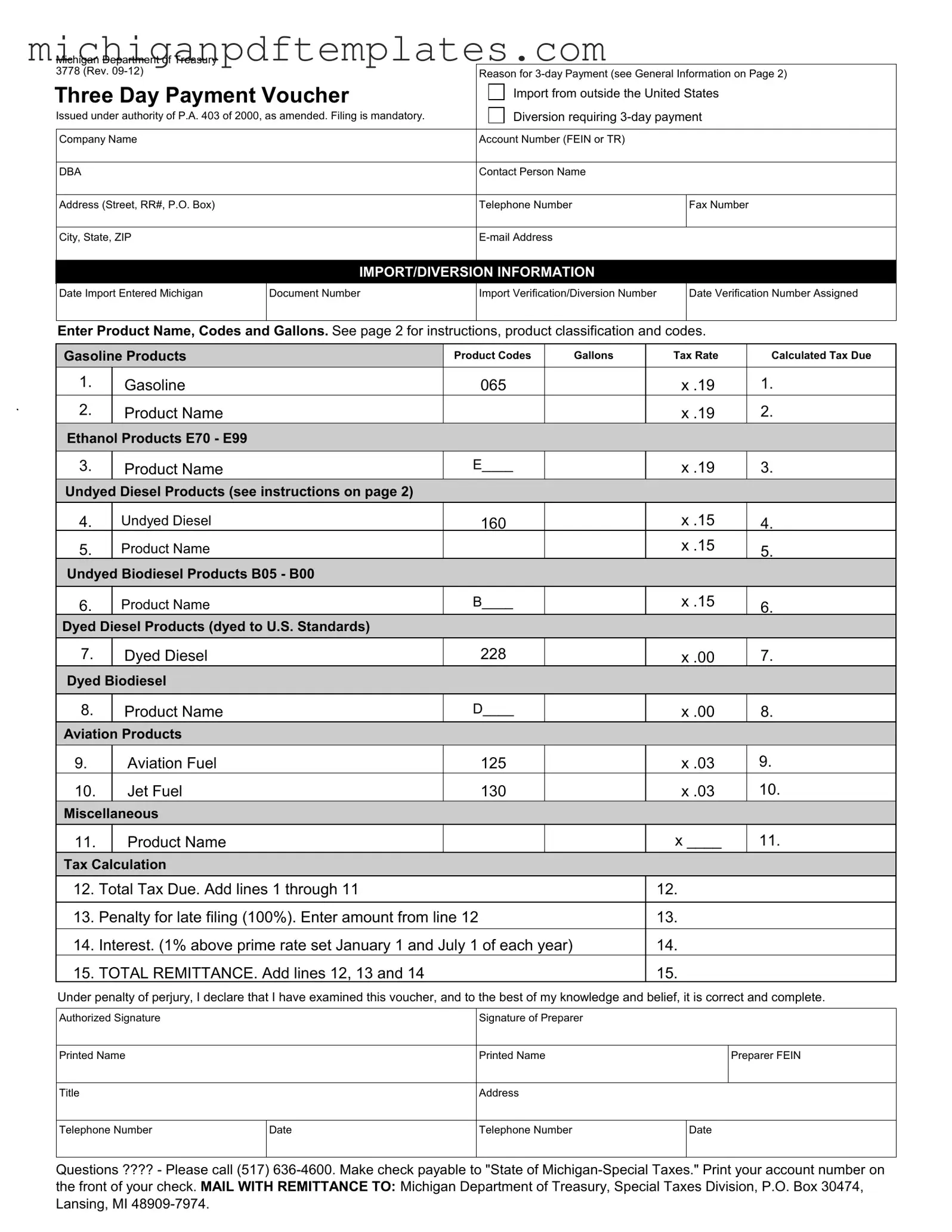

Fill in Your Michigan 3778 Form

The Michigan Department of Treasury 3778 form, also known as the Three Day Payment Voucher, is essential for reporting and paying taxes on imported or diverted motor fuel. This form must be submitted within three business days of the relevant event to avoid penalties. Understanding how to accurately complete the Michigan 3778 form is crucial for compliance and to ensure timely payments.

Ready to fill out the form? Click the button below to get started!

Get Your Form Now

Fill in Your Michigan 3778 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 3778 online quickly.