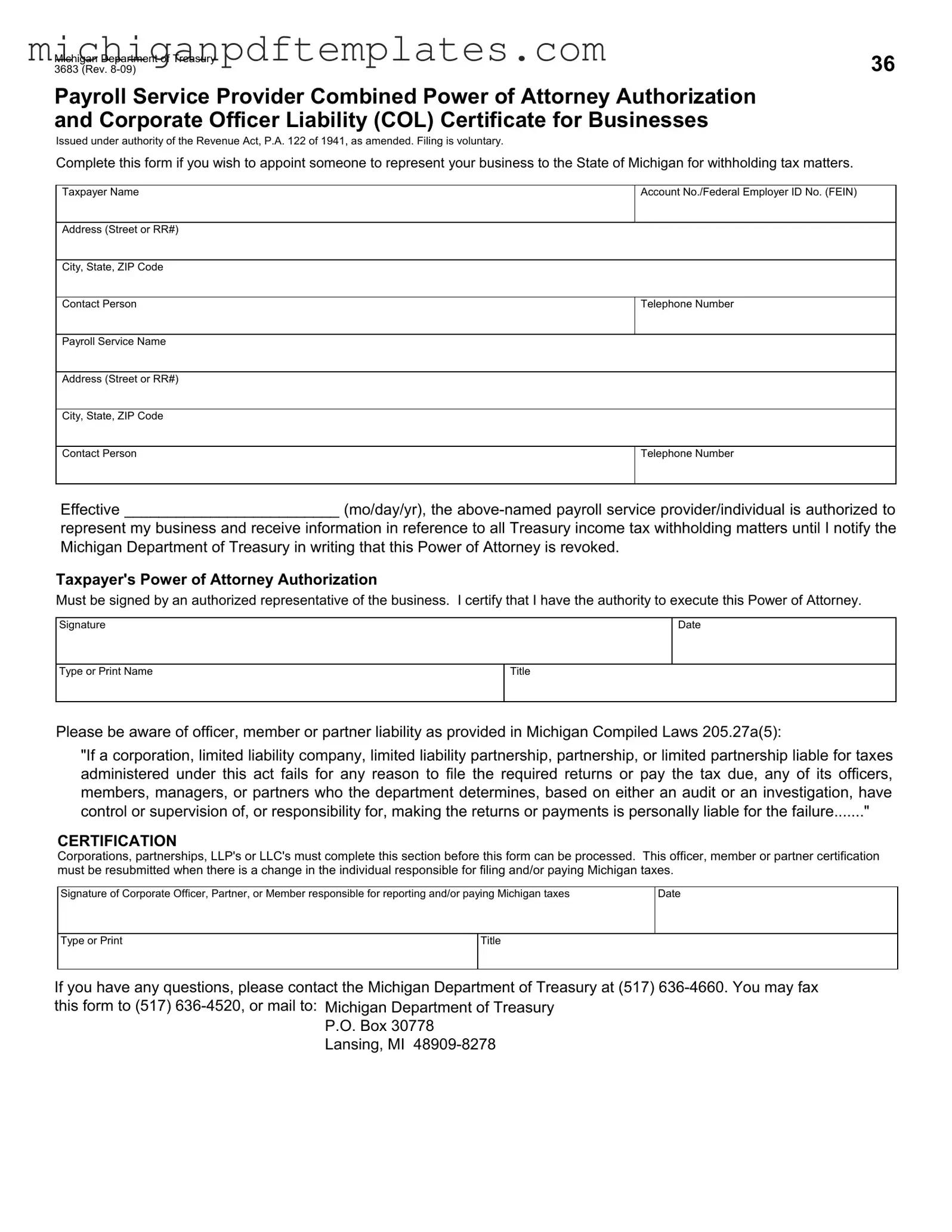

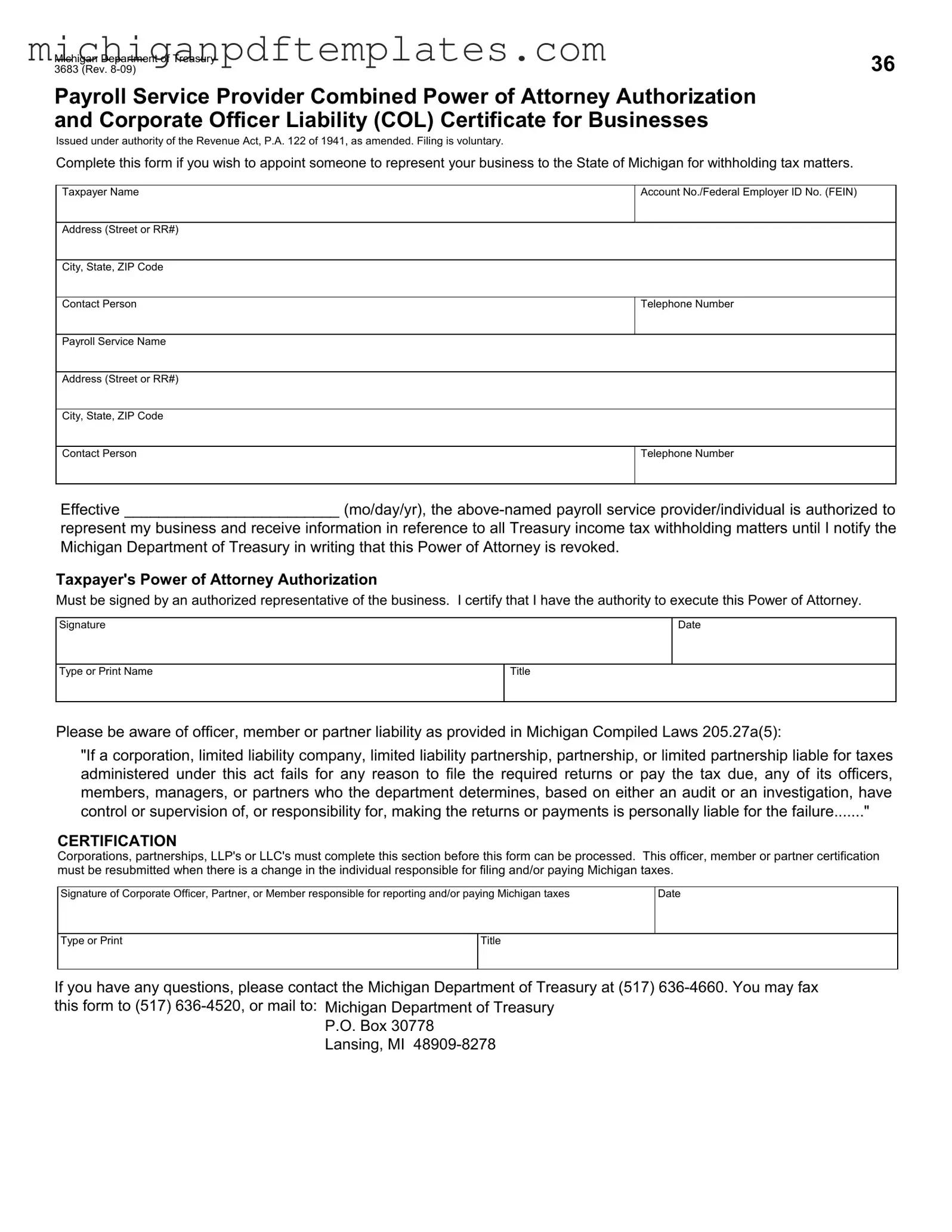

Fill in Your Michigan 3683 Form

The Michigan 3683 form serves as a Payroll Service Provider Combined Power of Attorney Authorization and Corporate Officer Liability Certificate for businesses. This form allows a business to appoint a representative to manage withholding tax matters with the State of Michigan. To ensure compliance and protect your business interests, consider filling out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 3683 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 3683 online quickly.