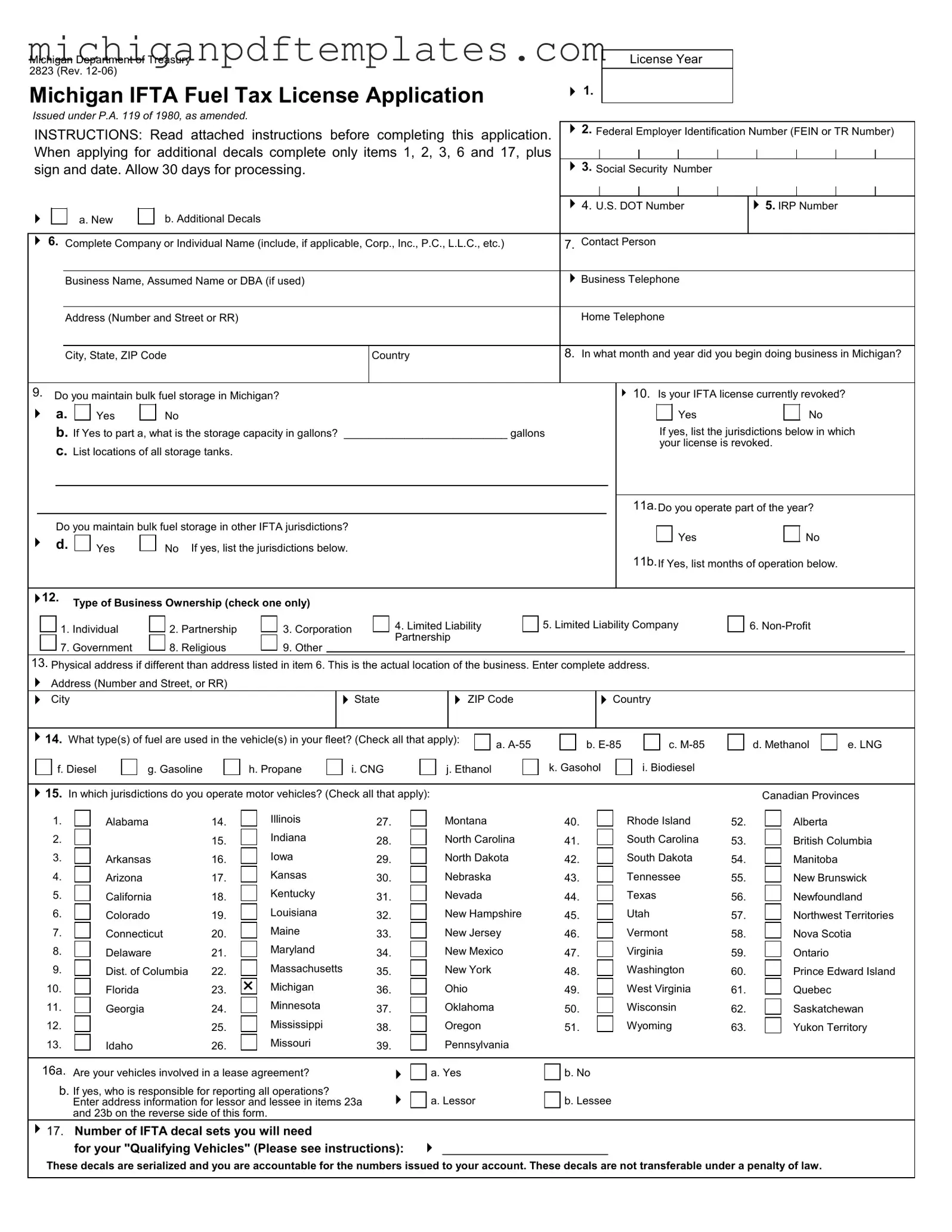

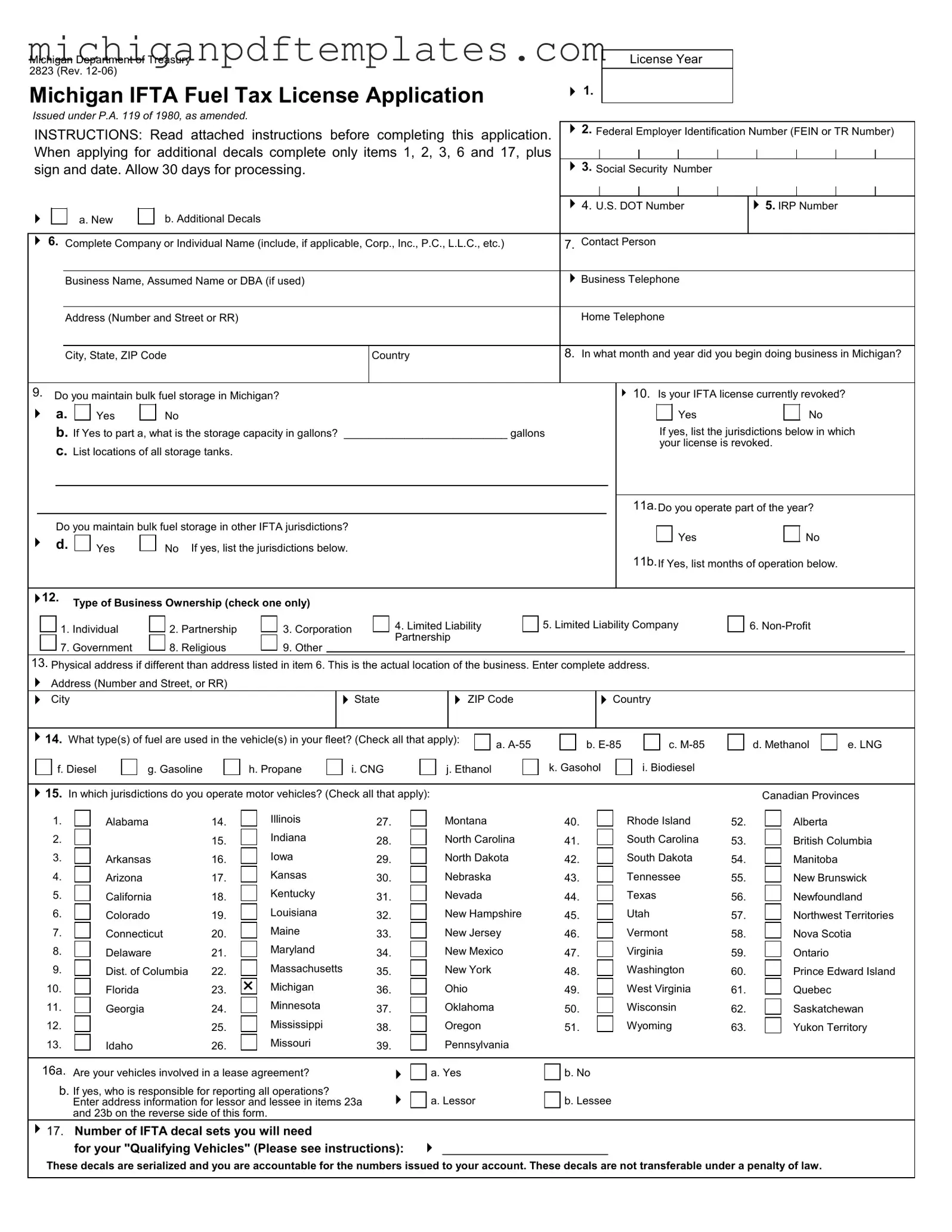

Fill in Your Michigan 2823 Form

The Michigan Department of Treasury 2823 form is the application for the International Fuel Tax Agreement (IFTA) Fuel Tax License. This form is essential for motor carriers operating qualifying vehicles in Michigan and at least one other IFTA jurisdiction. Completing this form accurately ensures compliance with state regulations and facilitates the tax reporting process.

Ready to get started? Fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 2823 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2823 online quickly.