Fill in Your Michigan 2796 Form

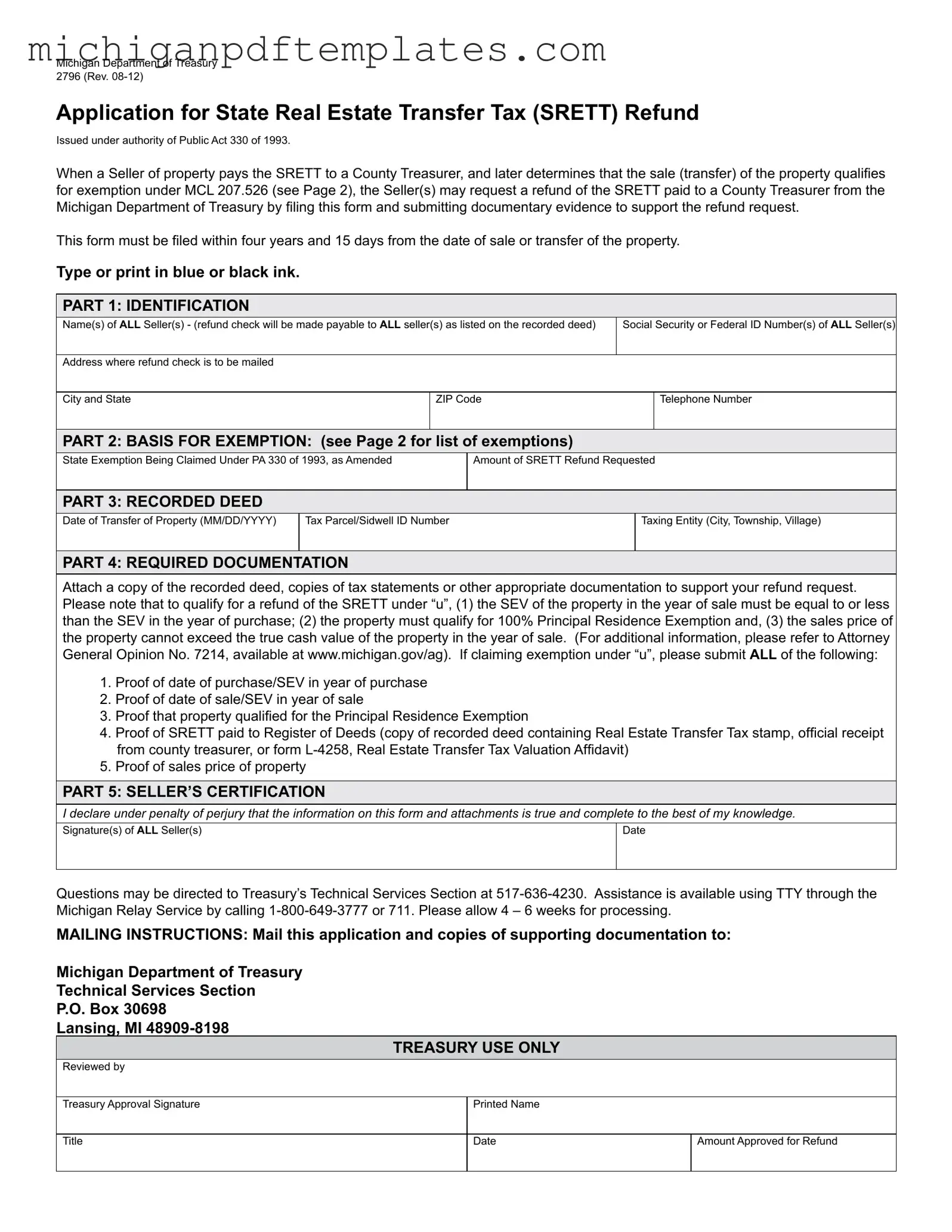

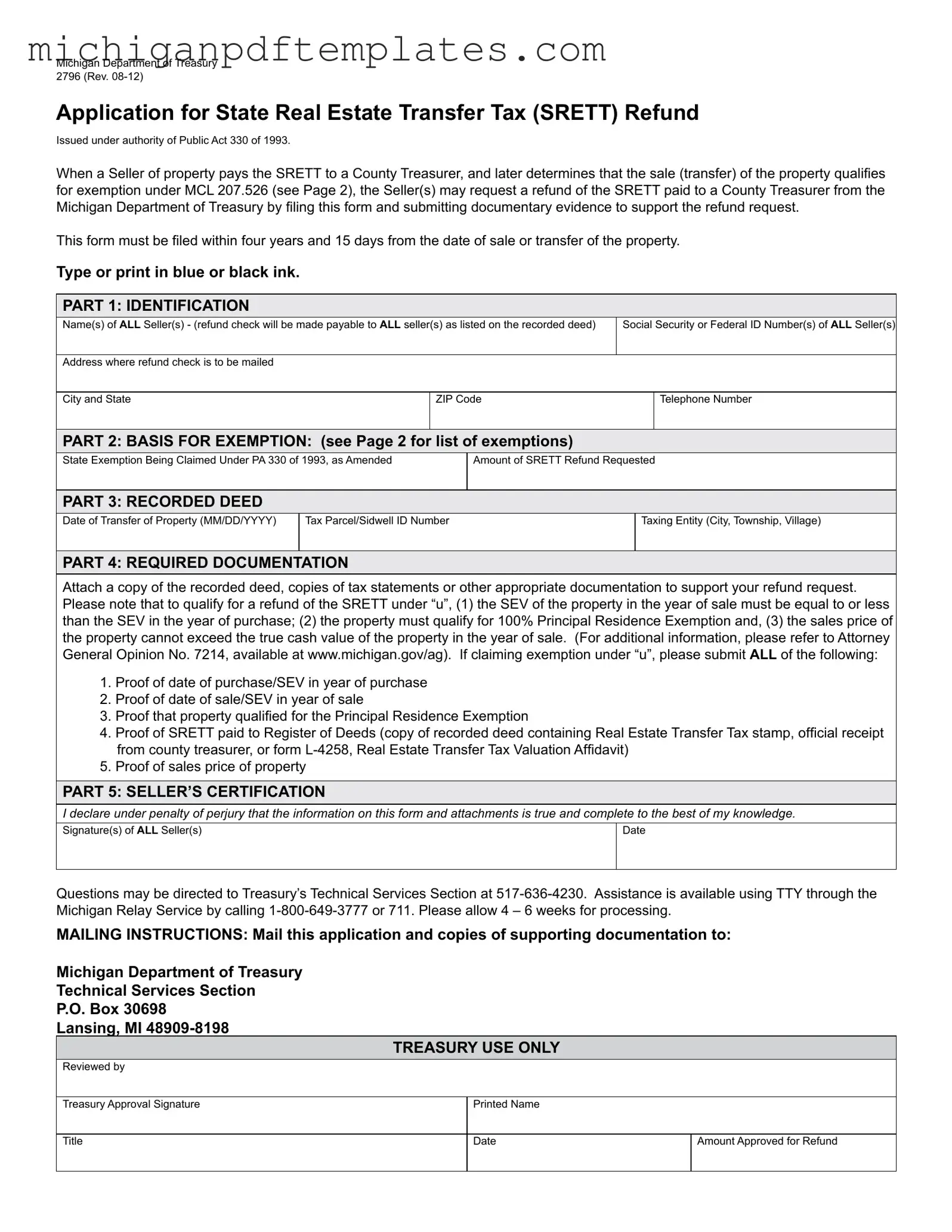

The Michigan Department of Treasury 2796 form is an application used to request a refund of the State Real Estate Transfer Tax (SRETT). If a seller has paid this tax and later finds that their property sale qualifies for an exemption, they can submit this form to the Michigan Department of Treasury. It is important to file the form within four years and 15 days from the date of the property transfer.

To begin the process, fill out the form and gather the necessary documentation. Click the button below to get started.

Get Your Form Now

Fill in Your Michigan 2796 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2796 online quickly.