Fill in Your Michigan 2766 Form

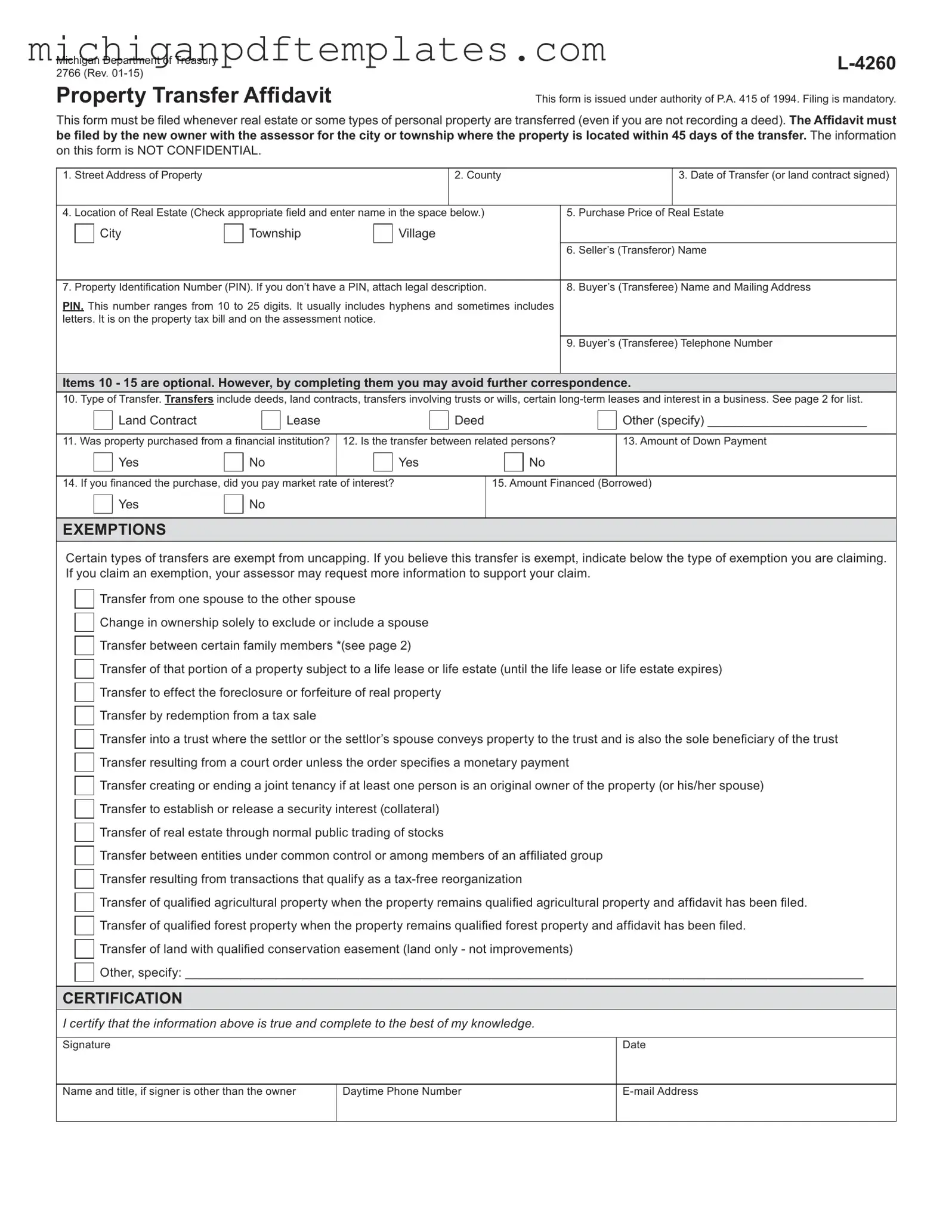

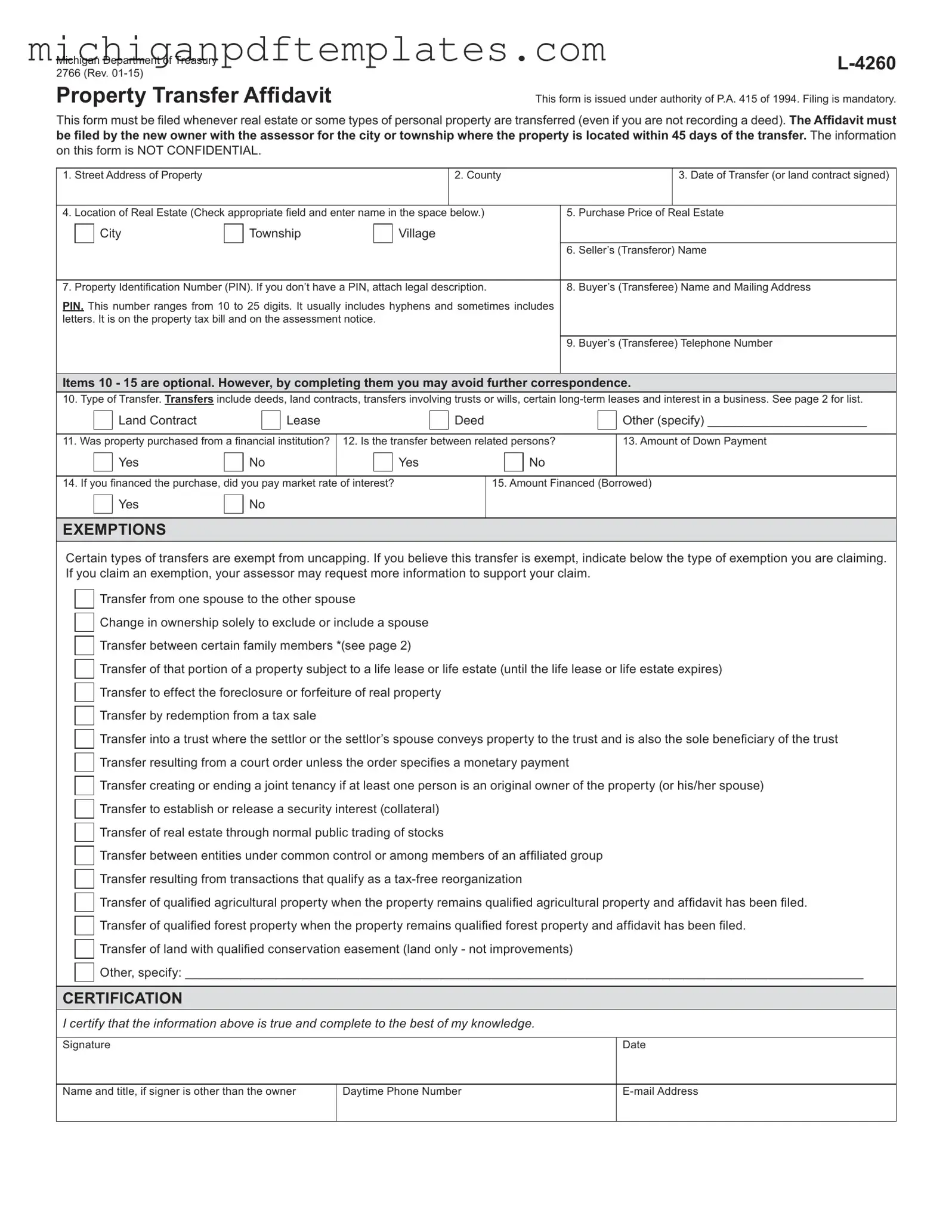

The Michigan 2766 form, officially known as the Property Transfer Affidavit, is a mandatory document required by the Michigan Department of Treasury whenever real estate or certain personal property is transferred. This affidavit must be filed by the new owner with the local assessor within 45 days of the transfer, ensuring that the property’s ownership is properly recorded. Understanding the requirements and implications of this form is crucial for both buyers and sellers in Michigan.

Fill out the Michigan 2766 form today by clicking the button below.

Get Your Form Now

Fill in Your Michigan 2766 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2766 online quickly.