Fill in Your Michigan 2368 Form

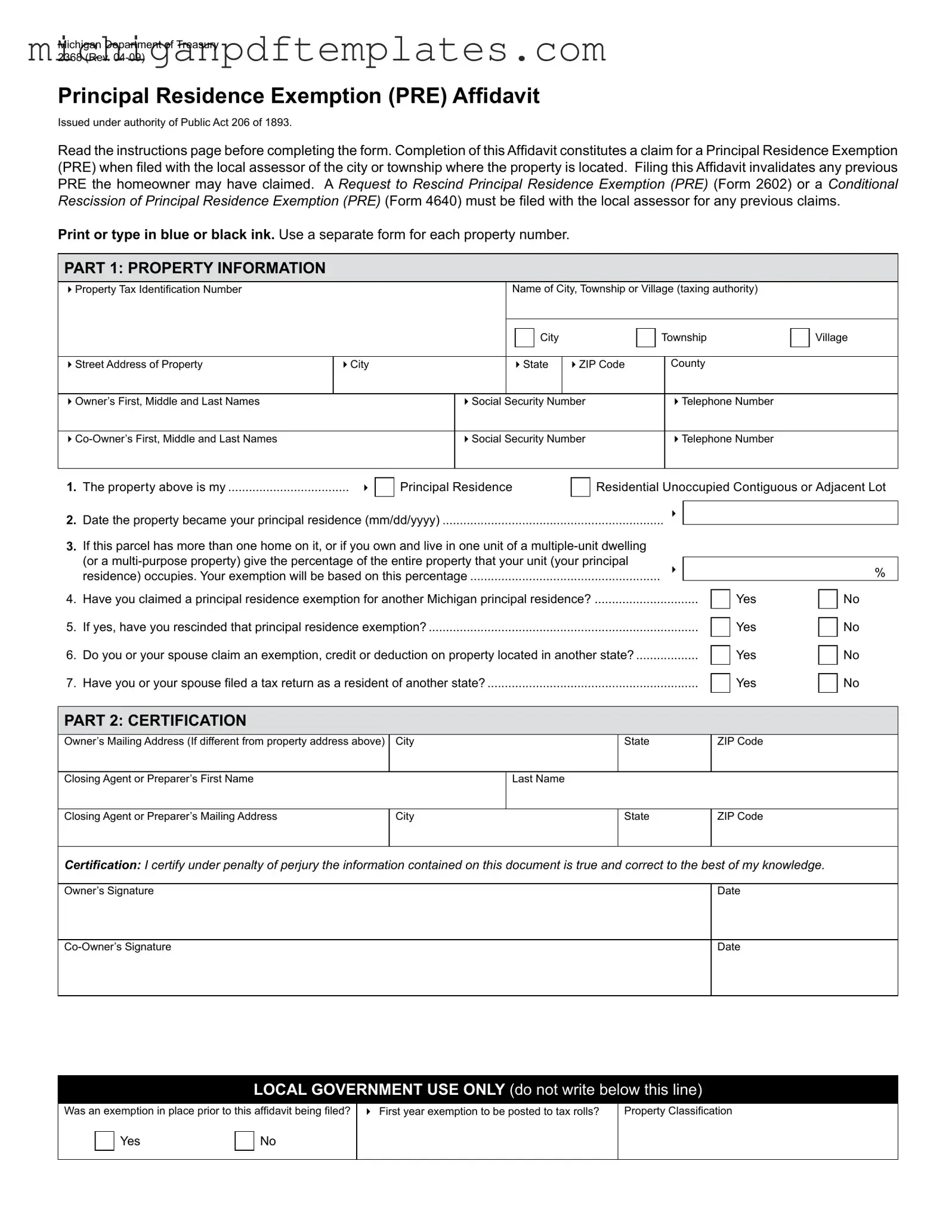

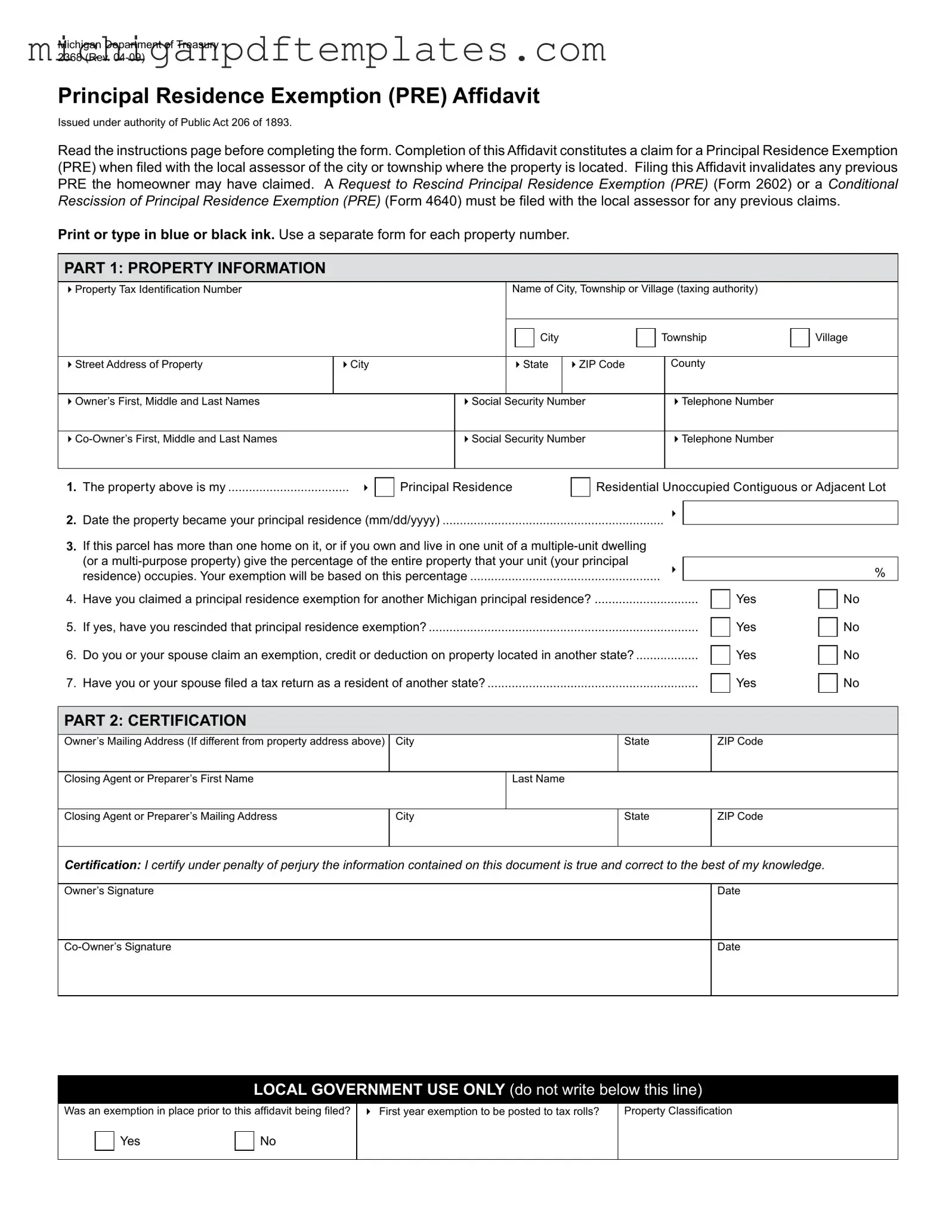

The Michigan Department of Treasury 2368 form is an affidavit used to claim a Principal Residence Exemption (PRE) for property taxes. This exemption allows homeowners to reduce a portion of their local school operating taxes by filing the form with their local assessor. To ensure accurate processing, it is essential to complete the form correctly and submit it by May 1 of the claim year.

For assistance in filling out the form, click the button below.

Get Your Form Now

Fill in Your Michigan 2368 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2368 online quickly.