Fill in Your Michigan 2271 Form

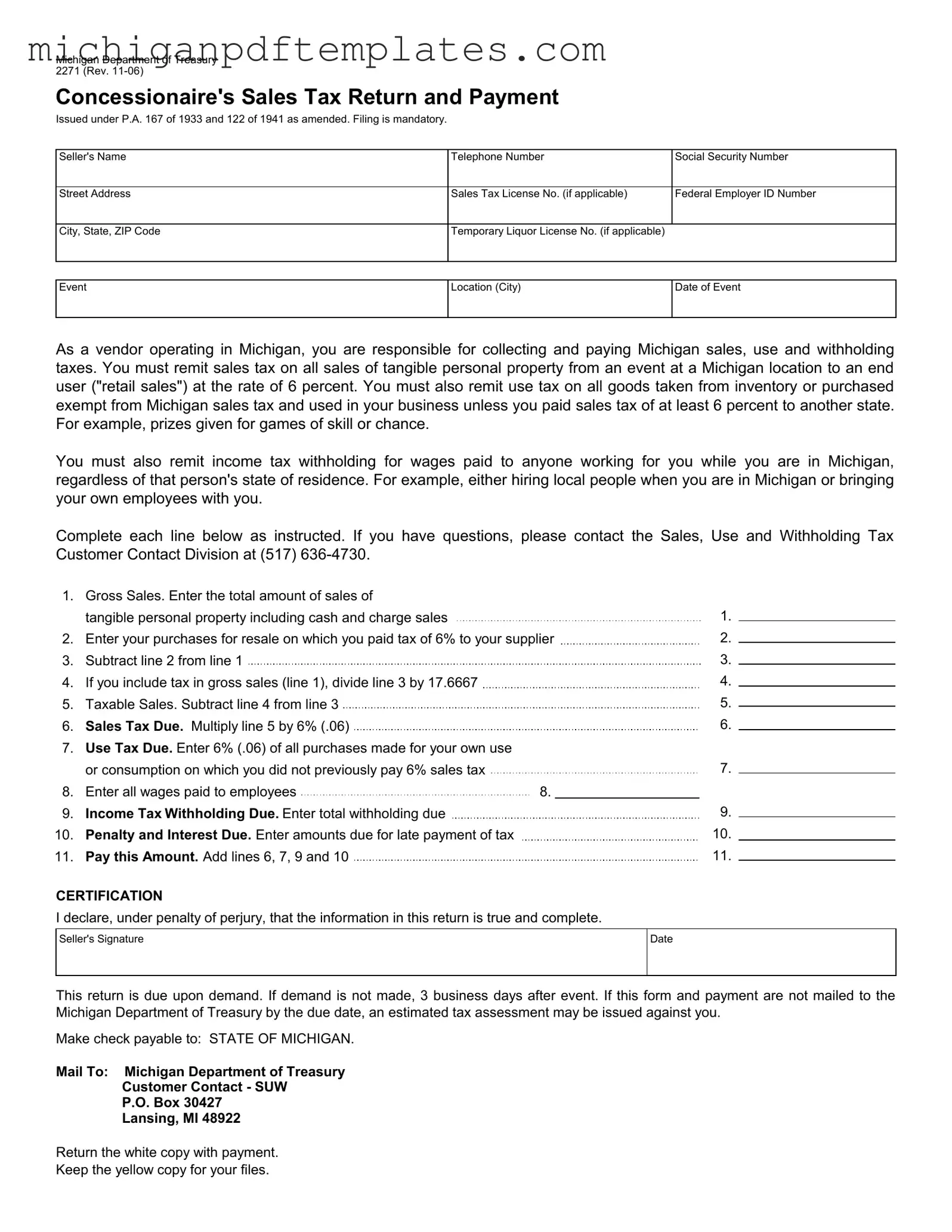

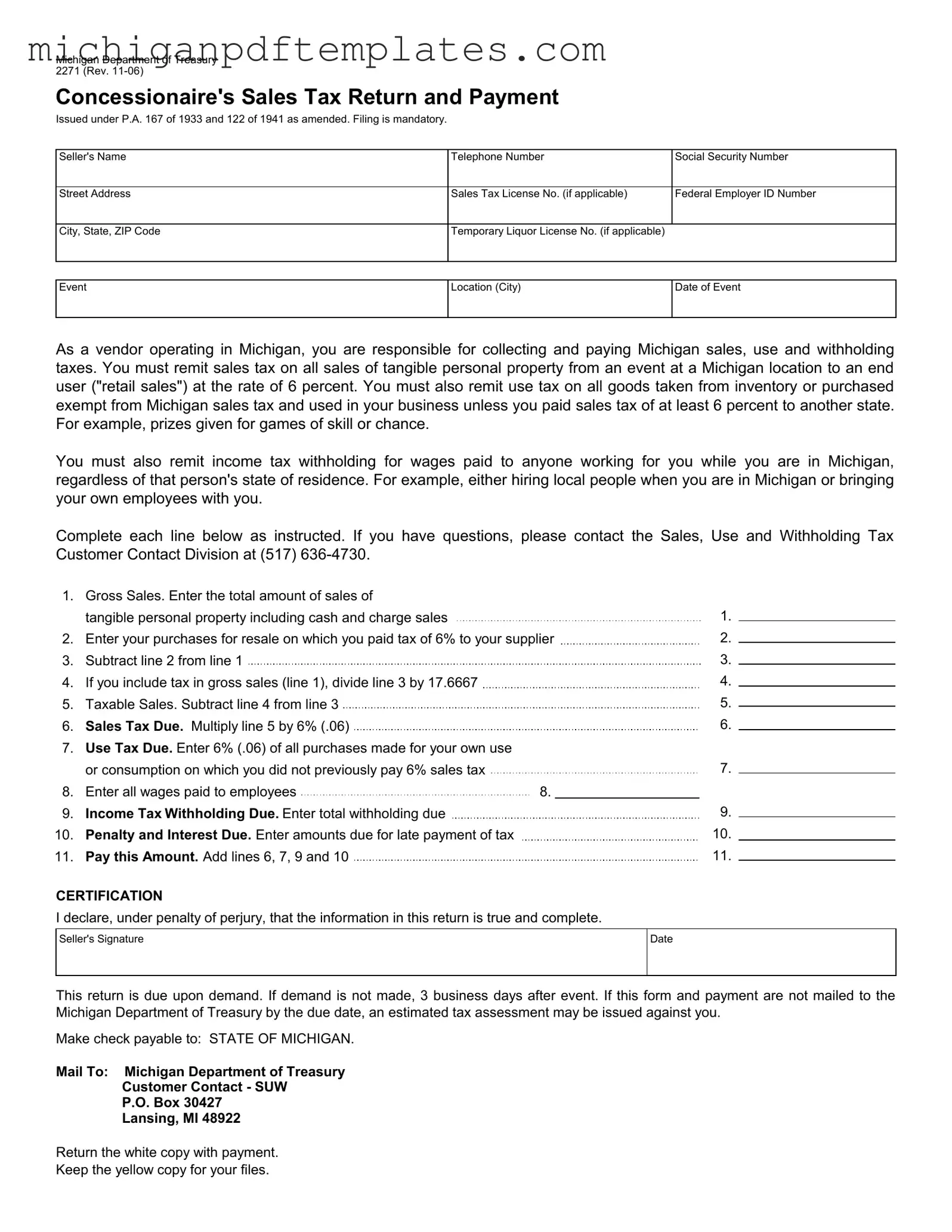

The Michigan Department of Treasury 2271 form is a crucial document known as the Concessionaire's Sales Tax Return and Payment. This form is mandatory for vendors operating in Michigan, ensuring compliance with state sales, use, and withholding tax regulations. Completing this form accurately is essential for avoiding penalties and ensuring smooth business operations.

If you're ready to tackle the Michigan 2271 form, click the button below to get started!

Get Your Form Now

Fill in Your Michigan 2271 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2271 online quickly.