Fill in Your Michigan 2248 Form

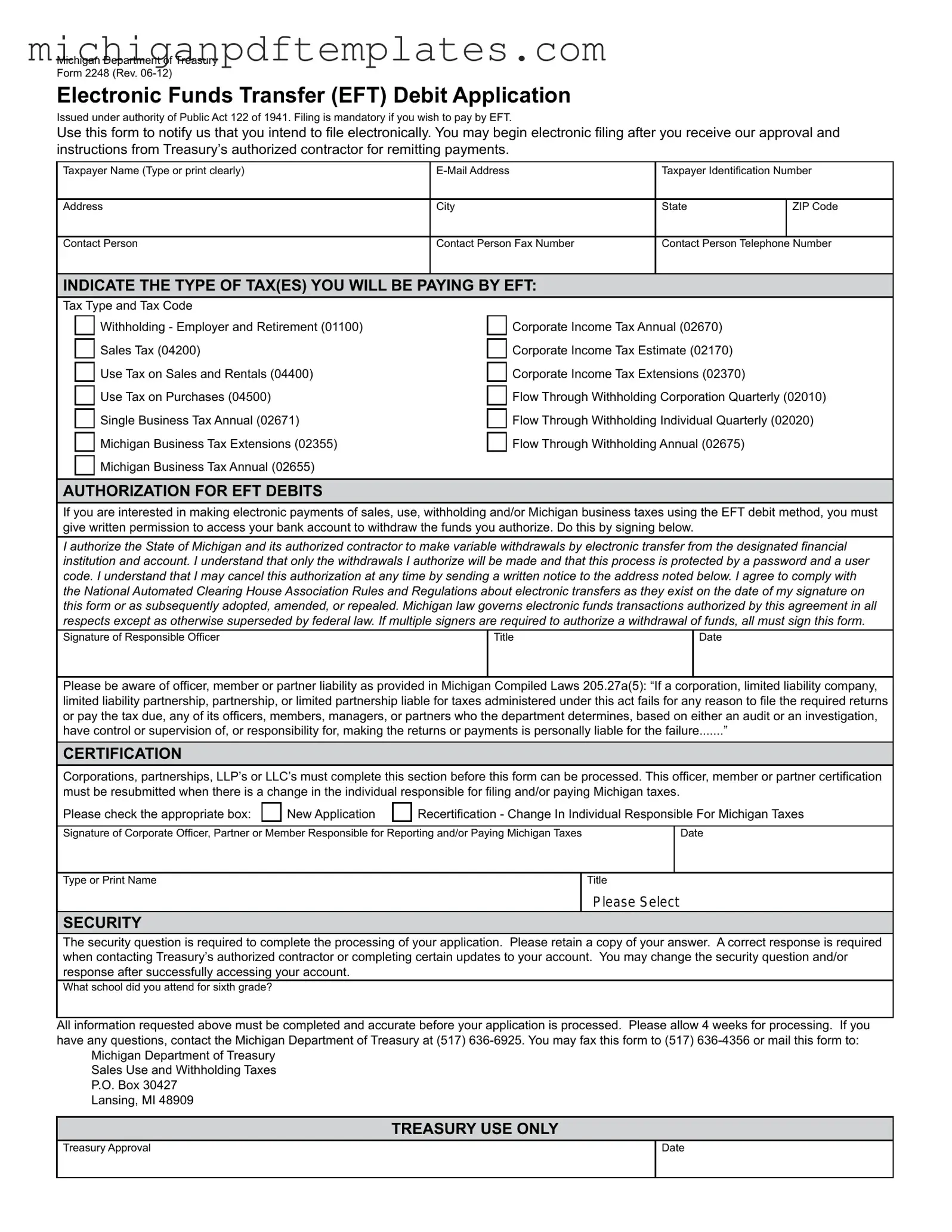

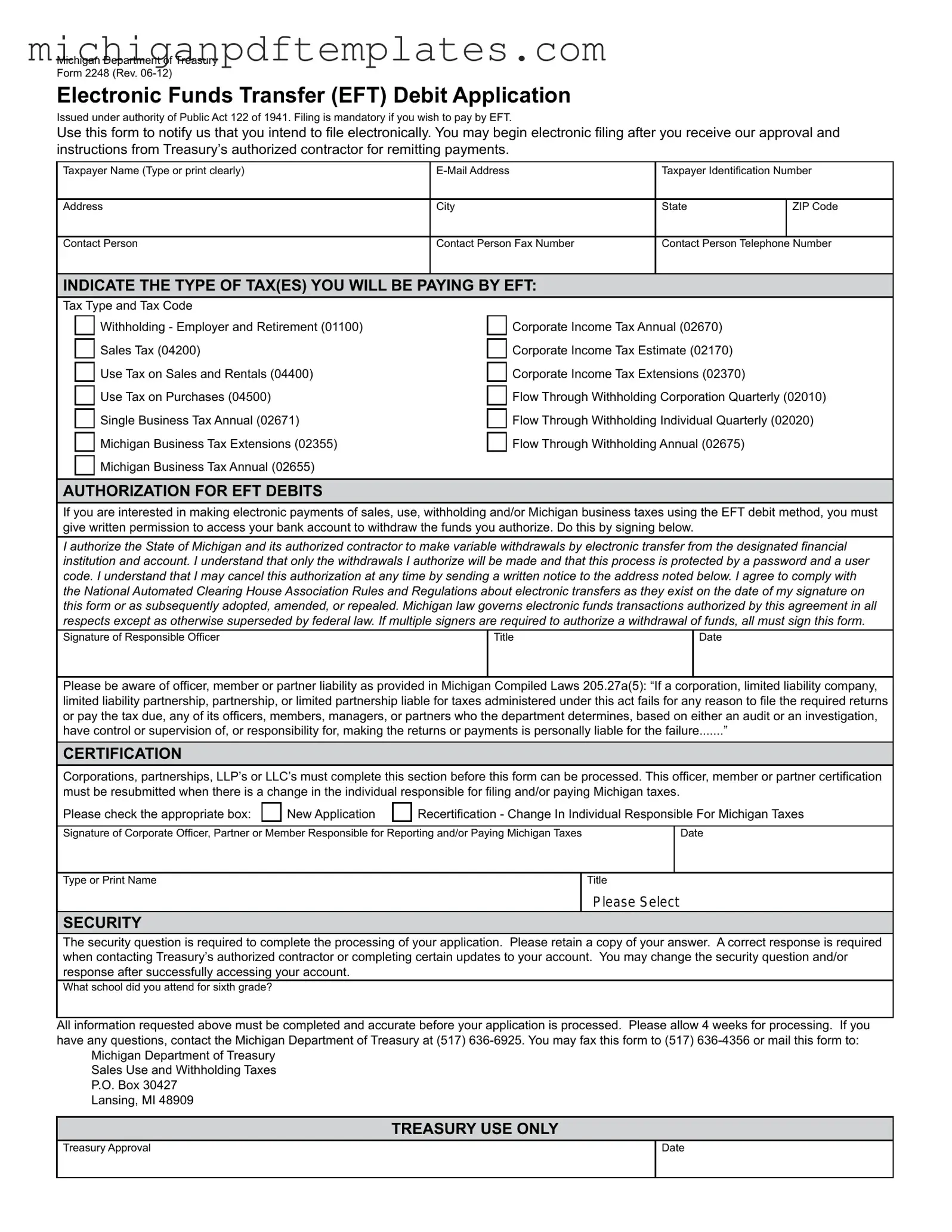

The Michigan Department of Treasury Form 2248 is an essential document for those wishing to make electronic payments through the Electronic Funds Transfer (EFT) debit method. By completing this form, you notify the Treasury of your intent to file electronically and authorize access to your bank account for tax payments. If you're ready to streamline your tax payments, fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 2248 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2248 online quickly.