Fill in Your Michigan 2196 Form

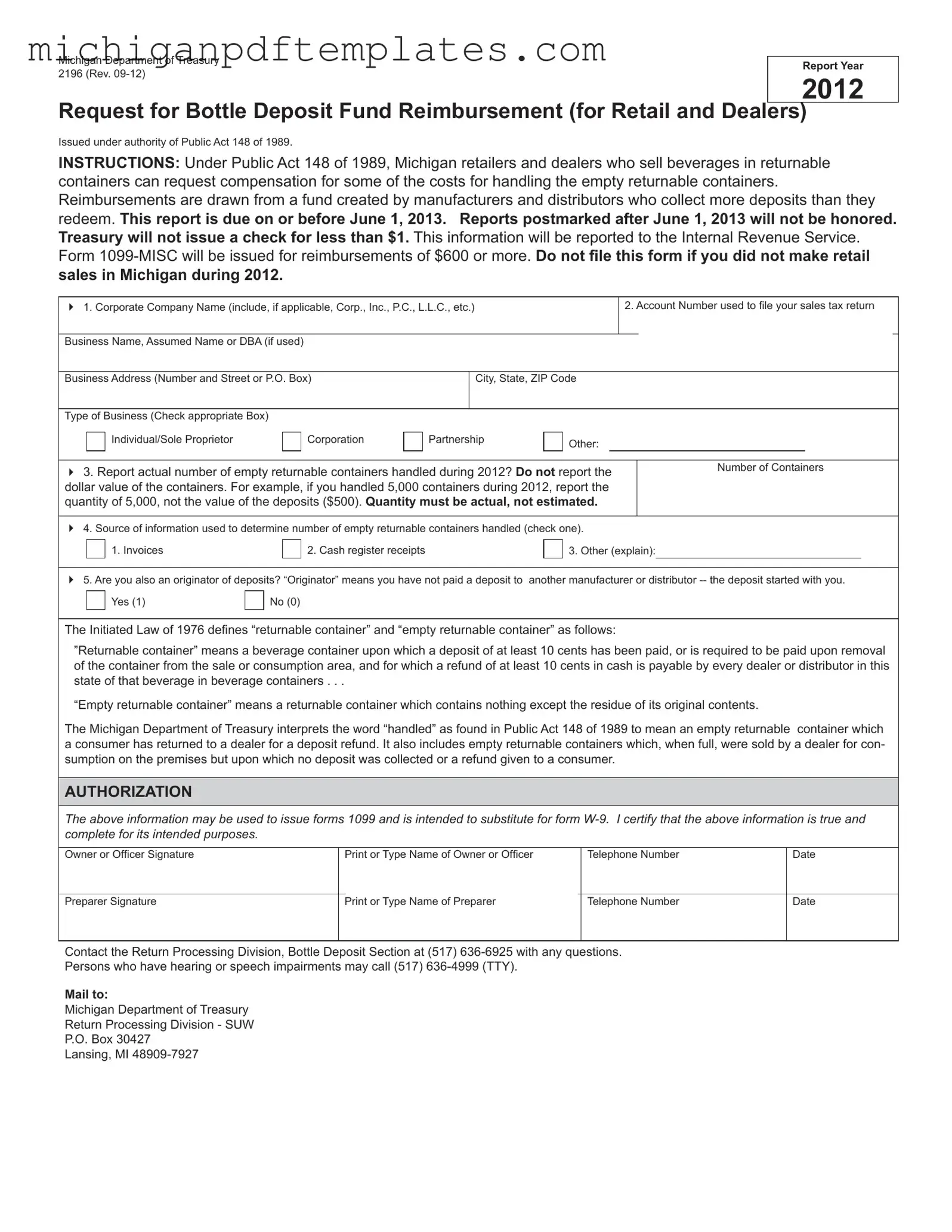

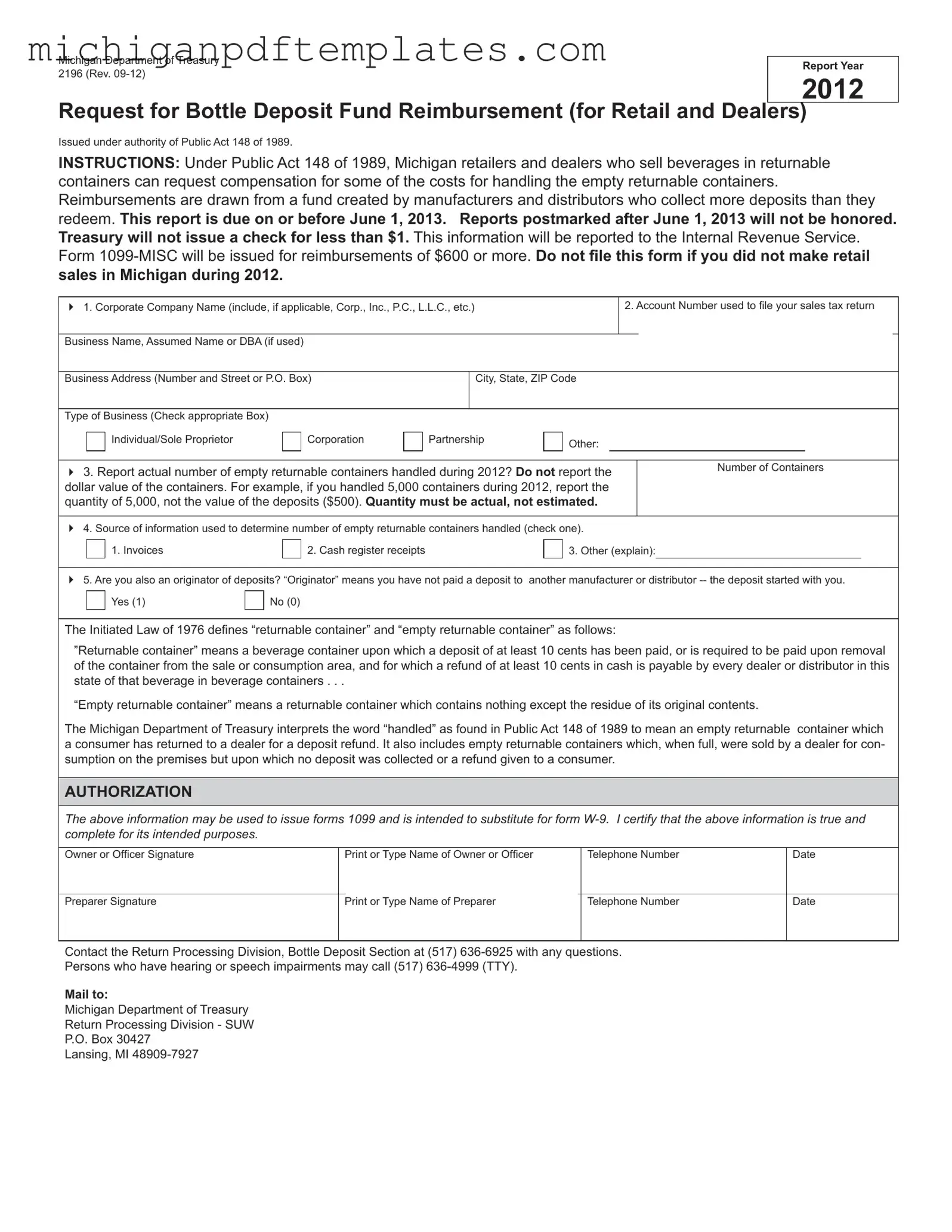

The Michigan 2196 form is a request for reimbursement from the Bottle Deposit Fund, designed for retailers and dealers who sell beverages in returnable containers. Under Public Act 148 of 1989, these businesses can seek compensation for the costs associated with handling empty returnable containers. To ensure eligibility, it is crucial to complete the form accurately and submit it by the deadline.

For those ready to apply, please fill out the form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 2196 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 2196 online quickly.