Fill in Your Michigan 165 Form

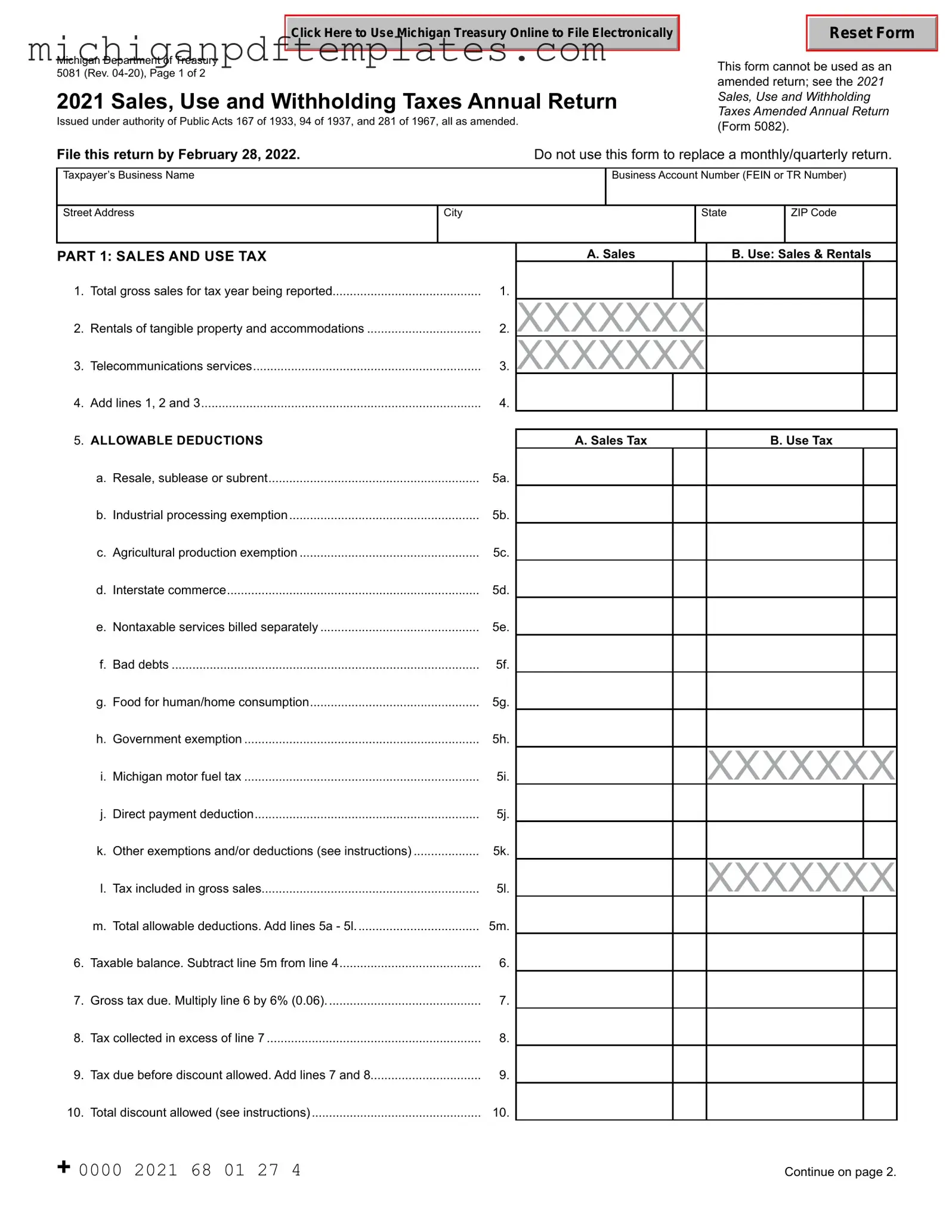

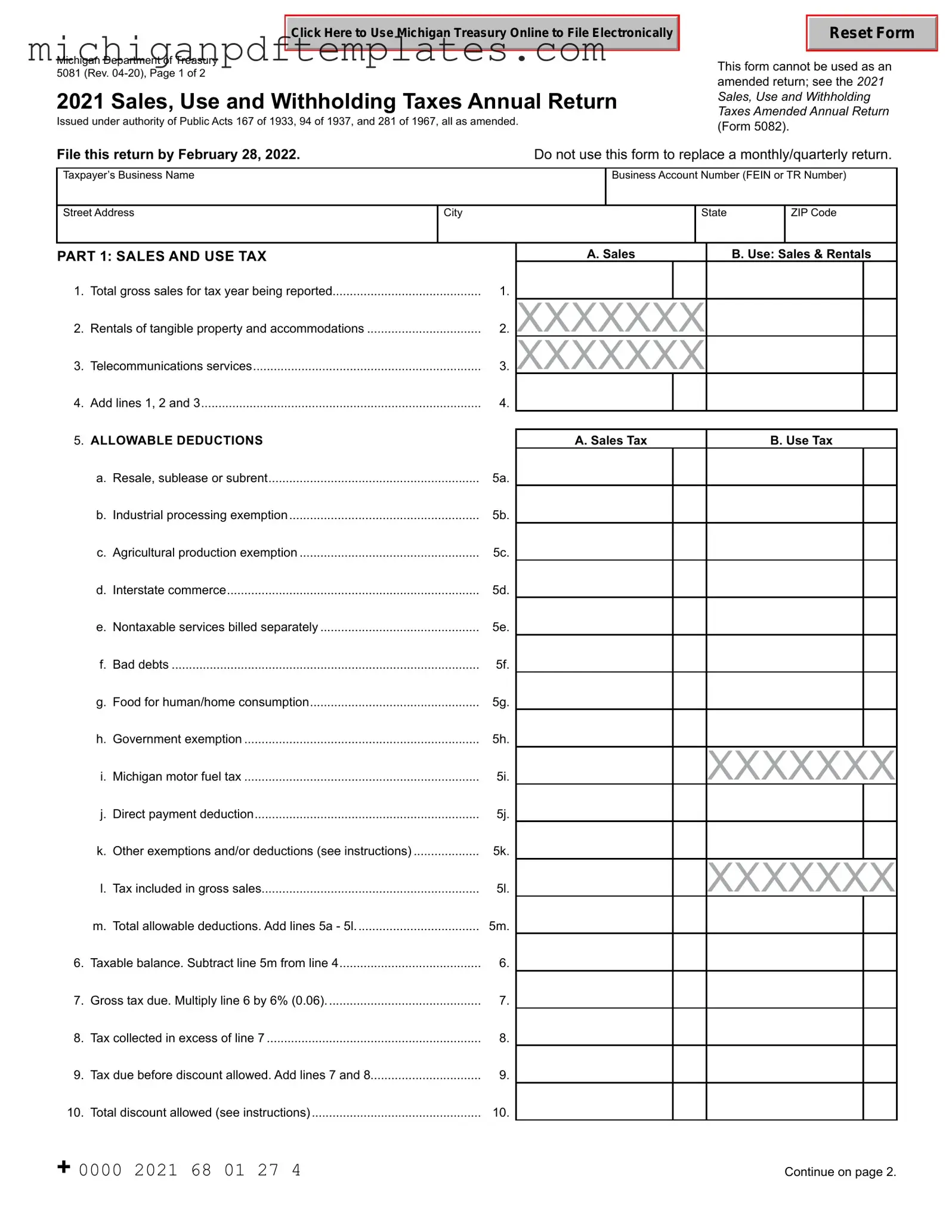

The Michigan 165 form, officially known as the 2021 Sales, Use and Withholding Taxes Annual Return (Form 5081), is a document that businesses in Michigan must file to report their sales, use, and withholding taxes for the year. This form must be completed accurately and submitted by the designated deadline, which is typically February 28 of the following year. It is essential for businesses to understand the requirements and details outlined in the form to ensure compliance with state tax regulations.

To fill out the Michigan 165 form, click the button below.

Get Your Form Now

Fill in Your Michigan 165 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 165 online quickly.