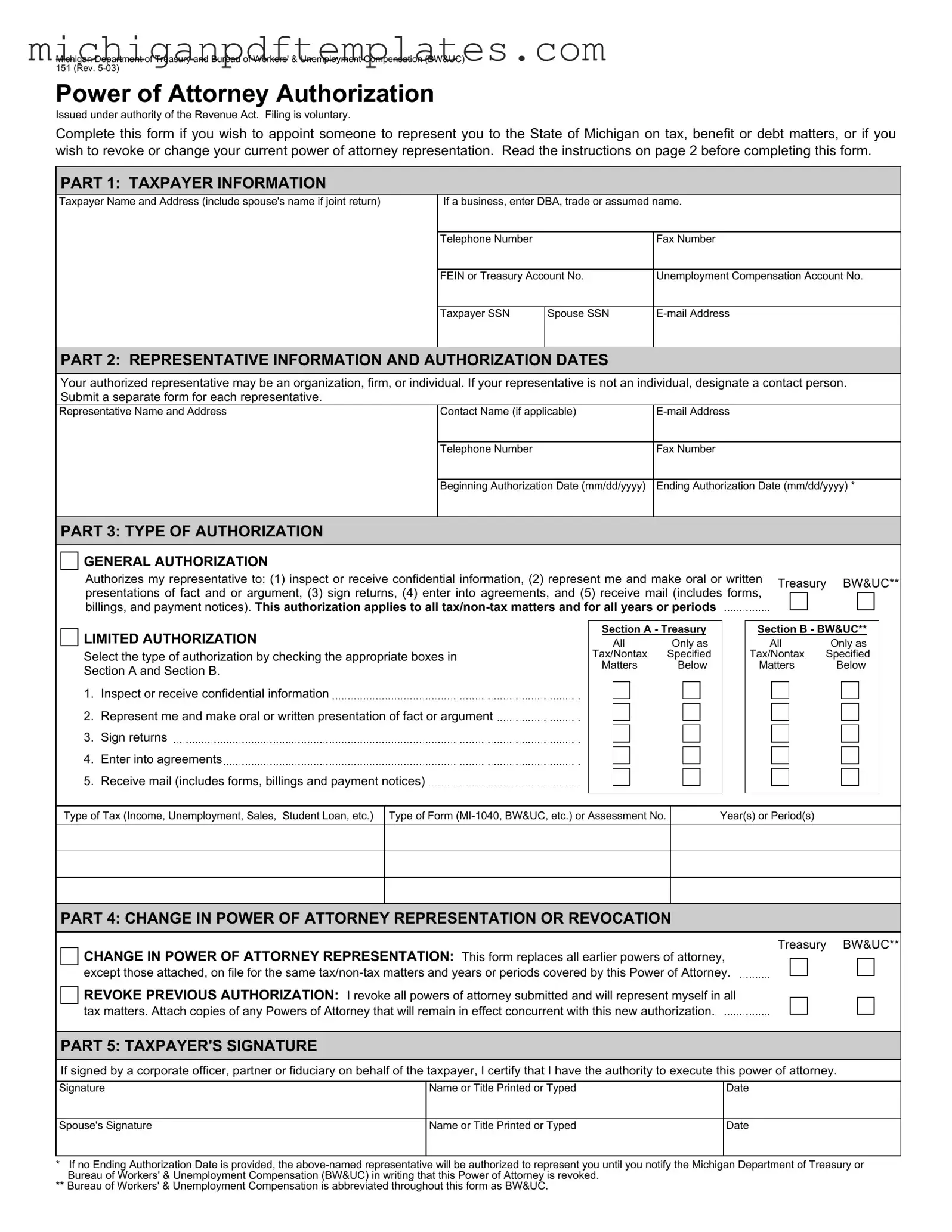

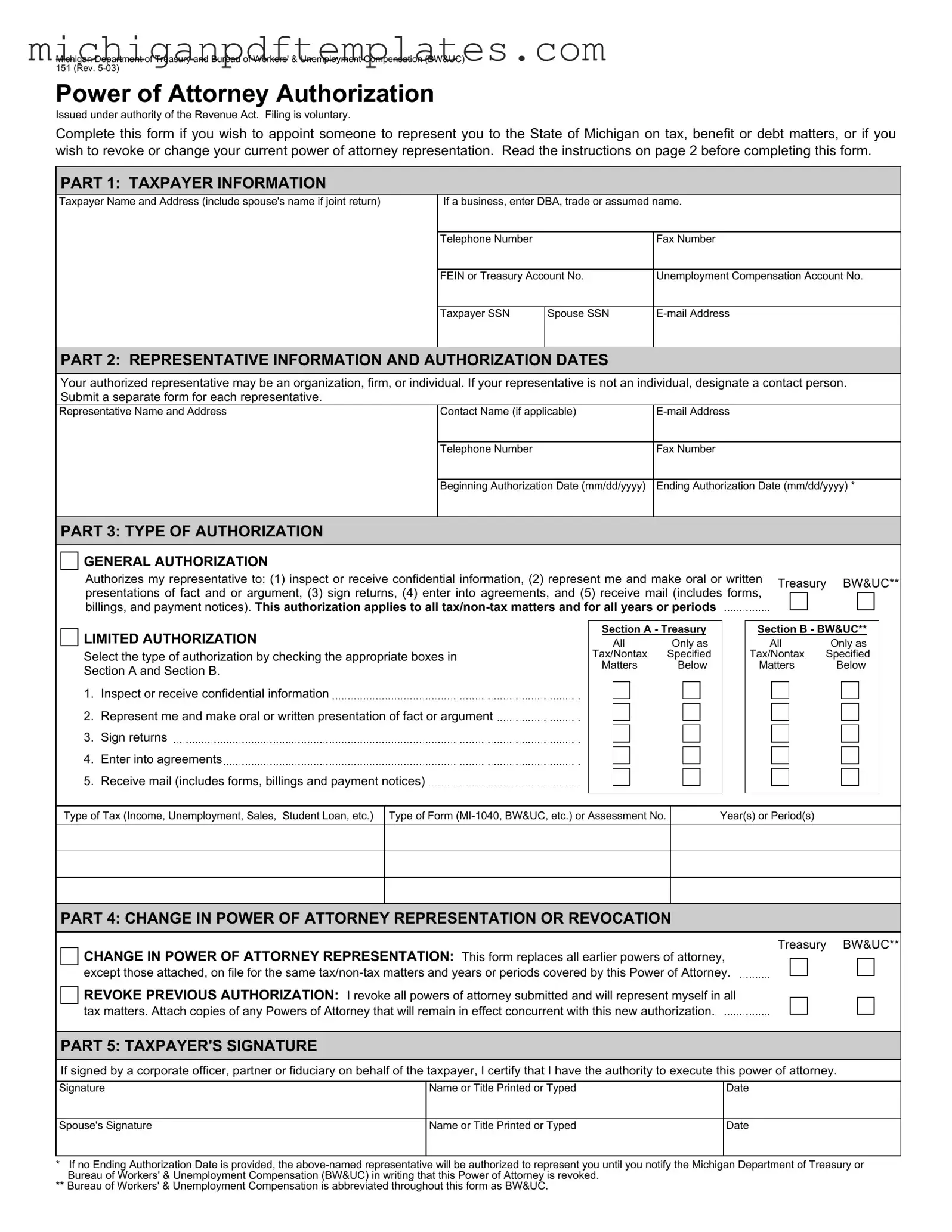

Fill in Your Michigan 151 Form

The Michigan 151 form is a Power of Attorney Authorization issued by the Michigan Department of Treasury and the Bureau of Workers' & Unemployment Compensation. This form allows individuals to appoint a representative for tax, benefit, or debt matters with the State of Michigan. Completing this form is voluntary, but it is essential for ensuring that your representative can act on your behalf.

Ready to appoint your representative? Fill out the Michigan 151 form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 151 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 151 online quickly.