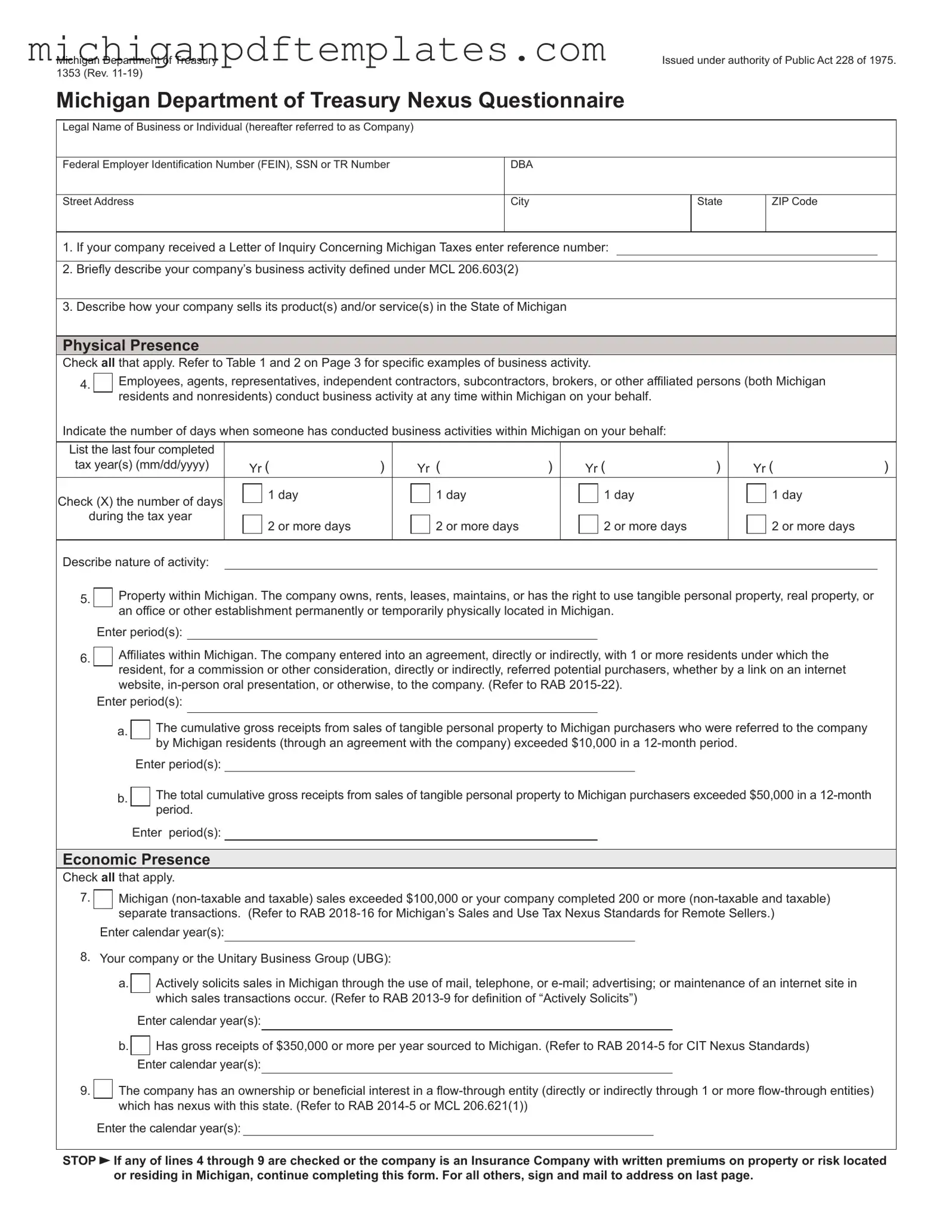

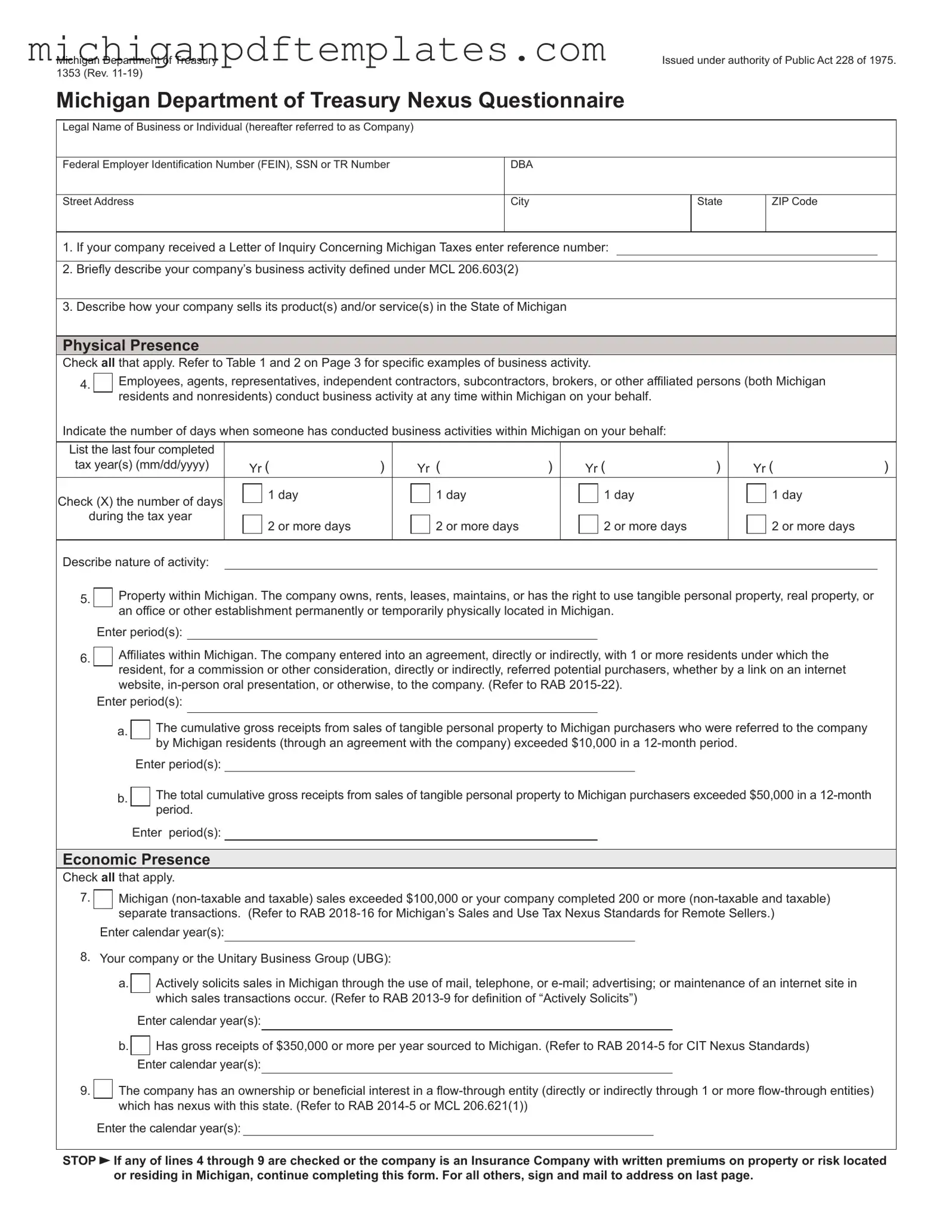

Fill in Your Michigan 1353 Form

The Michigan 1353 form is a Nexus Questionnaire issued by the Michigan Department of Treasury. It is designed to gather information about a business's activities in Michigan to determine tax obligations. Completing this form is essential for businesses that have conducted activities within the state.

For assistance in filling out the Michigan 1353 form, please click the button below.

Get Your Form Now

Fill in Your Michigan 1353 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 1353 online quickly.